BlackRock's Bitcoin ETF, $IBIT, has achieved a historic milestone after reaching $40 billion in assets under management (AUM) in a record-breaking 211 days, illustrating the overwhelming confidence that institutional investors have in Bitcoin. This rapid growth has positioned the ETF within the top

With the traditional employment landscape undergoing significant disruptions due to global events and technological advancements, the gig economy has emerged as a viable alternative for many professionals. Focusing on autonomy, adaptability, and project-based work has attracted a growing number of

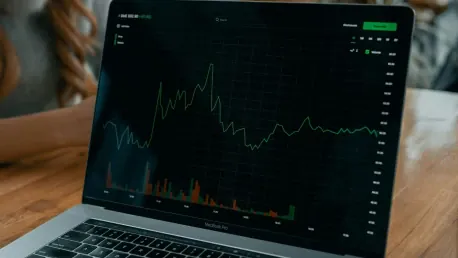

The investment landscape continues to evolve as U.S. investors show a growing interest in exchange-traded funds (ETFs) that hold cryptocurrencies. According to a recent survey conducted by Charles Schwab, 45% of respondents are planning to invest in crypto ETFs over the next year, marking a

PROG Holdings, Inc., a prominent fintech holding company headquartered in Salt Lake City, recently made an important announcement that its Board of Directors has declared a quarterly cash dividend of $0.12 per share of common stock. This dividend underscores the company's robust financial health

In a world where fintech companies are burgeoning, Airwallex’s ambitious drive to remain at the forefront is both bold and commendable. Founded in Melbourne in 2015 and now headquartered in Singapore, the firm has established itself as a key player in the financial technology sector. The company is

As the gaming industry continually evolves, Artificial Intelligence (AI) and blockchain technologies are poised to drive a major transformation in the way players experience games. Traditional gaming paradigms are on the cusp of a revolutionary change, propelled by the convergence of these two

The Consumer Financial Protection Bureau (CFPB) has recently announced its Final Rule on "Personal Financial Data Rights," marking a significant shift in the financial landscape. This rule, which implements Section 1033 of the Dodd-Frank Act, aims to empower consumers by granting them greater

Fireblocks, a leading digital asset custody and settlement platform, and Borderless, a blockchain-based cross-border payments provider, recently announced a significant expansion of their partnership. By leveraging Fireblocks’ advanced Payments Engine and Wallet as a Service (WaaS) technologies,

Trustly, an innovator in open banking payments since 2008, has taken a significant step in its ambitious growth trajectory by appointing Henrik Wallström as its Chief Technology Officer (CTO) for European operations. With this strategic decision, Trustly aims to further solidify its position and

Coinbase, a leading cryptocurrency exchange, has recently announced a significant strategic shift towards enhancing its role within the fintech sector, with a broader vision of converting every fintech company into a crypto-adopting entity. The third-quarter earnings report for 2024 highlighted a

ITCurated uses cookies to personalize your experience on our website. By continuing to use this site, you agree to our Cookie Policy