The narrative surrounding financial technology has decisively shifted from a story of pure disruption to one of enduring resilience, where the primary conversation in executive boardrooms now centers on system stability, comprehensive audit trails, and regulatory survivability. A decade ago, the

The tremors on Wall Street began subtly but have since escalated into a full-blown seismic event for the software sector, sending shockwaves through portfolios and boardrooms alike. A pervasive anxiety has taken hold, fueled by the conviction that the very foundations of the established software

With a keen eye on the dynamic world of FinTech, Kofi Ndaikate has navigated the intricate landscapes of corporate M&A, from the complexities of blockchain to the nuances of regulatory policy. Today, he joins us to dissect the recent acquisition of Firstance by Harvest, a move that is sending

The explosive growth that once defined the US WealthTech sector has given way to a profound recalibration, as 2025 marked a dramatic market correction that is compelling startups and investors to navigate an entirely new landscape. After years of unprecedented expansion, the industry has hit a

In the complex and often volatile world of cryptocurrency, certain price levels become battlegrounds that define market cycles. For Bitcoin, $69,000 is one such territory. We're joined by Kofi Ndaikate, a seasoned fintech expert with deep knowledge of blockchain and market dynamics, to dissect this

For millions of renters, the path to owning a home is blocked by more than just the down payment; the most significant hurdle is often the slow, complex, and opaque approval process itself. This traditional system, laden with manual checks and bureaucratic delays, frequently stands between aspiring

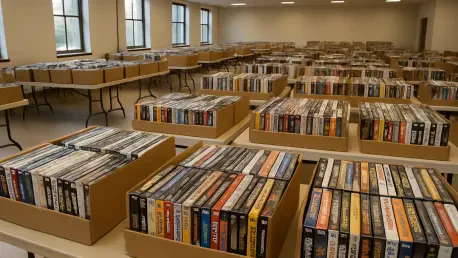

In a business landscape increasingly saturated with unstructured data, the strategic imperative for organizations to find scalable and intelligent information management solutions has never been more acute. Recognizing this market-wide demand, document management specialist M-Files is making a

In the complex and often turbulent world of global finance, few areas are as dynamic as cross-border payments. We're joined by an expert in the field to unravel the strategies that top fintech players are using to navigate today's landscape of geopolitical shifts, regulatory changes, and

In a significant move to restore its international financial standing, Kenya's Directorate of Criminal Investigations has initiated a comprehensive training program aimed at senior law enforcement officials, a direct response to the nation's placement on the Financial Action Task Force's grey list.

The long-promised convergence of traditional stock markets and decentralized finance is now moving from theoretical discussions to functional reality, with established assets like equities beginning to serve as the backbone for a new generation of on-chain derivatives. This evolution marks a

ITCurated uses cookies to personalize your experience on our website. By continuing to use this site, you agree to our Cookie Policy