The simple plastic ID card carried by millions of students and employees is on the cusp of a significant transformation, evolving from a mere proof of identity into a sophisticated financial tool. This shift is being driven by companies that are reimagining the intersection of identity and

A landmark collaboration between payment infrastructure innovator Wirex and the TRON DAO has initiated a profound shift in decentralized finance by launching a novel, TRON-native payment system engineered to support "agentic on-chain payments." This strategic initiative is not merely an incremental

As investor anticipation reaches a fever pitch, the global financial community is intensely focused on the potential public debut of Ant International, the formidable international division of Ant Group. The company's recent financial disclosures, revealing a remarkable 20-25% revenue surge to

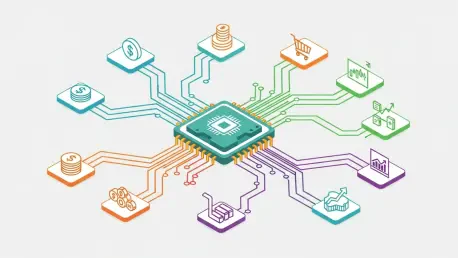

The Modern Paradox of Payments: More Tools, More Complexity The proliferation of specialized financial technology has created a labyrinth of operational complexity. While new fintech solutions offer unprecedented capabilities, they present a paradox for banks: more tools mean more convoluted

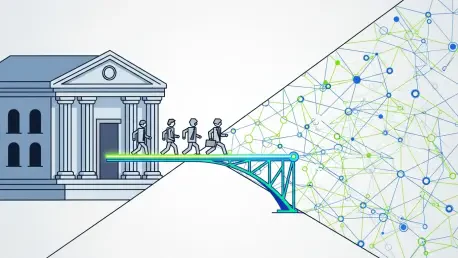

A profound and accelerating tectonic shift is reshaping the global financial system, presenting traditional banking institutions with an existential threat from which there may be no recovery without immediate and decisive action. The rapid expansion of the digital asset and tokenization ecosystem

The digital dollar, once envisioned as a universal and interchangeable asset, is undergoing a dramatic Balkanization as individual applications begin to mint their own bespoke currencies, fundamentally altering the financial landscape of the web. This roundup examines the strategic motivations and

In a bold strategic move underscoring significant confidence in Ukraine’s economic resilience and rapid digital evolution, Estonian fintech firm Iute Group is set to establish a fully digital bank within the country. This expansion follows the company’s successful bid in a state tender organized by

In a decisive pivot from its long-standing economic model, Kuwait has initiated a comprehensive and strategic modernization of its entire legislative framework, a foundational move designed to secure a prosperous and diversified future. This ambitious national plan is far more than a simple update

A Landmark Deal Reshaping African FinTech In a move that signals a seismic shift in Africa's digital finance landscape, payments giant Flutterwave has strategically acquired Mono, a leading open banking infrastructure company. This landmark transaction is more than a simple business deal; it

The Reserve Bank of India’s latest assessment of the nation's financial system paints a compelling picture of a banking sector that has not only recovered from past challenges but has emerged with unprecedented strength and confidence. The 'Trends and Progress of Banking in India, 2024–25' report

ITCurated uses cookies to personalize your experience on our website. By continuing to use this site, you agree to our Cookie Policy