The cryptocurrency market is no stranger to dramatic swings, but few assets have captured attention quite like Chainlink (LINK), which currently hovers at a critical price point of around $15.14 after a staggering 32% monthly decline, raising a pressing question for investors and enthusiasts alike.

The cryptocurrency market is witnessing an extraordinary rally in 2025, with XRP, Solana (SOL), and Ethereum (ETH) emerging as the undeniable frontrunners in this bullish wave. These digital assets have not only captured the imagination of retail investors but have also drawn significant attention

In the ever-evolving landscape of financial technology, peer-to-peer (P2P) lending has emerged as a powerful alternative to traditional banking, captivating investors with its promise of high returns and direct engagement between lenders and borrowers, reflecting a broader shift toward

As the fintech landscape continues to evolve, few companies are making as significant an impact on independent workers as Lettuce Financial. Today, I’m thrilled to speak with Kofi Ndaikate, a renowned expert in fintech, blockchain, cryptocurrency, and regulatory policy. With his deep understanding

In a world where businesses grapple with spiraling financial inefficiencies, a staggering statistic emerges: the global spend management market, already valued at over $19 billion, is projected to soar to $46 billion by 2030, signaling a desperate need for smarter, streamlined solutions in

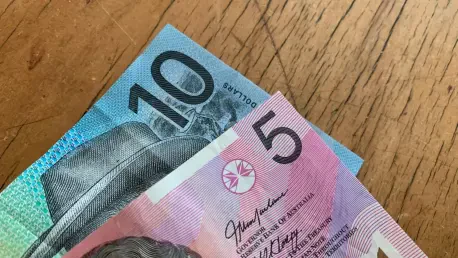

In the heart of Australia’s financial landscape, Artificial Intelligence (AI) is no longer a distant vision but a powerful force driving transformation across the banking sector, with major ASX-listed institutions like Commonwealth Bank and ANZ embedding AI into their core operations. They are

Imagine a world where managing finances is as seamless as streaming a favorite show, where financial data flows securely between banks and apps at the tap of a button, and where personalized money management tools are no longer a luxury but a standard offering. This isn’t a distant dream but the

Unpacking the AI Crypto Surge: Why Blazpay Matters Now In 2025, the cryptocurrency market is witnessing an unprecedented boom in AI-driven projects, with billions in capital flowing into tokens that promise to blend artificial intelligence with blockchain innovation, and amid this fervor, Blazpay

I'm thrilled to sit down with Kofi Ndaikate, a seasoned expert in the fintech space with deep knowledge of blockchain, cryptocurrency, and the evolving landscape of digital innovation. Today, we’re diving into the buzz surrounding LivLive, a groundbreaking project that’s blending augmented reality

In an era where financial technology evolves at breakneck speed, one platform consistently stands out as a beacon for groundbreaking advancements, drawing attention from across the globe. FinovateEurope, an annual gathering of over 1,000 participants including industry leaders, investors, and

ITCurated uses cookies to personalize your experience on our website. By continuing to use this site, you agree to our Cookie Policy