Market Context: Navigating a Digital Imperative in Asset Management In the dynamic realm of asset management, a staggering 46% of industry leaders pinpoint legacy systems as the foremost obstacle to operational efficiency, highlighting a critical juncture for the sector in 2025. This statistic

Imagine a small business owner, juggling inventory costs and marketing expenses, struggling to secure the capital needed to grow on a major online marketplace like eBay. For many sellers, this scenario is all too real, as access to financing remains a significant hurdle, with a staggering 77% of

In the fast-paced world of decentralized finance, where innovation and opportunity collide, Mutuum Finance (MUTM) has emerged as a compelling contender with its token price sitting at a modest $0.035 during its presale phase, prompting the burning question on many investors’ minds about whether

In the ever-evolving landscape of global finance, the Asia-Pacific region stands out as a powerhouse of wealth creation, with high-net-worth individuals seeking sophisticated financial solutions to match their growing portfolios. Amid this dynamic environment, a prominent Swiss banking institution

In a landscape where decentralized finance (DeFi) continues to reshape the financial sector with its promise of autonomy and innovation, a significant regulatory development has emerged from the U.S. Treasury. Under the leadership of Secretary Janet Yellen, a bold proposal has been introduced to

Introduction Imagine completing an online purchase with just a few clicks, effortlessly selecting a payment plan that fits your budget, all without leaving the browser. This seamless experience is now a reality for millions of U.S. consumers, thanks to an innovative partnership between a leading

What happens when millions of people worldwide face an uncertain financial future due to outdated pension systems, and how can innovative solutions address this crisis? The stakes couldn’t be higher as retirement planning becomes a pressing global challenge, but Smart, a British FinTech powerhouse,

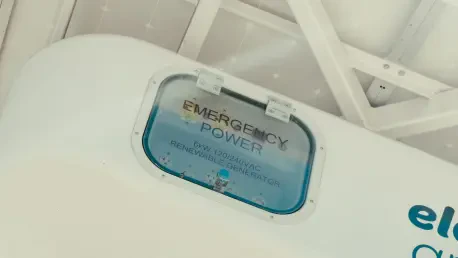

Imagine a world where the hum of electric vehicle (EV) fleets dominates the roads, slashing carbon emissions and driving businesses toward sustainability, yet the backbone of this transformation—reliable infrastructure—remains a stubborn bottleneck for many. This is the reality facing countless

In the fast-evolving world of digital payments, Paysafe, a prominent fintech player listed on the NYSE under the ticker PSFE, finds itself at a critical juncture in Q2 2025. The latest earnings report paints a complex picture: a 3% year-over-year revenue decline to $428.2 million, driven largely by

The electric vehicle (EV) industry is accelerating at an unprecedented pace, yet significant hurdles like steep upfront costs and uncertainties around battery lifecycles continue to slow down mass adoption across various sectors. A transformative solution has emerged in the form of

ITCurated uses cookies to personalize your experience on our website. By continuing to use this site, you agree to our Cookie Policy