For the nearly 17 million Nigerians living abroad, the act of sending money home is a vital thread connecting them to family, community, and opportunity, yet this process has often been fraught with delays, high fees, and uncertainty. Recognizing this critical need for a more streamlined financial

The silent migration of capital from traditional checking and savings accounts into third-party investment applications has presented one of the most significant challenges to the banking sector in the modern digital era. For years, financial institutions watched as their members siphoned funds to

The stability of a nation's financial system rests heavily on the unwavering confidence of its depositors, a trust that is directly underpinned by the capacity of its deposit insurance agency to act decisively in times of crisis. A critical discussion has emerged in Nigeria, where a fundamental

The Nordic online gaming landscape is currently undergoing a profound transformation, driven not by a new type of game but by a fundamental shift in how money moves between players and platforms. In a region defined by its advanced digital infrastructure and sky-high consumer expectations, the

The fundamental relationship between individuals and their financial institutions is being redefined at an unprecedented pace, moving far beyond the simple act of depositing a check or visiting a teller. This transformation is driven by the rise of neobanks, digital-native entities that exist

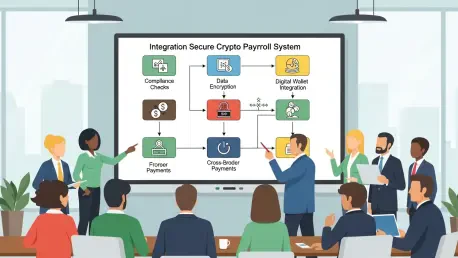

As global leaders and innovators convene, the conversation around digital finance has decisively shifted from theoretical potential to practical implementation, making the integration of cryptocurrency into mainstream business operations a central theme of economic strategy. For small and

South Korea's rigorous regulatory framework for digital assets has once again demonstrated its teeth, as the nation's fourth-largest cryptocurrency exchange, Korbit, faces a substantial fine of approximately $1.9 million for extensive violations of anti-money laundering laws. The Financial

The Reserve Bank of India’s latest "Trends and Progress of Banking in India, 2024–25" report offers a compelling and optimistic narrative, revealing a financial sector that has achieved an unparalleled state of strength and confidence. This historic resilience is not an accident but the result of a

A Rift in Retail Why Walmart is Fighting a Landmark Settlement A landmark class-action settlement designed to cap a decades-long war over credit card "swipe fees" is facing a formidable rebellion from within its own ranks. At the forefront is Walmart, the nation's largest retailer, which has

For countless Indian small and medium-sized enterprises venturing into global markets, the final hurdle to success has often been not finding a buyer but navigating the treacherous and often opaque world of international financial transactions. This long-standing challenge is now at the heart of a

ITCurated uses cookies to personalize your experience on our website. By continuing to use this site, you agree to our Cookie Policy