A vast and unregulated shadow market, where billions of dollars in locked cryptocurrency tokens are traded daily in encrypted chats and private deals, silently dictates the future of digital assets while leaving most market participants entirely in the dark. This hidden ecosystem, operating between the fanfare of a token’s launch and its eventual listing on a public exchange, represents the single greatest structural impediment to crypto’s maturation. The industry has built world-class infrastructure for a token’s birth and its public life but has critically neglected its adolescence, creating a gap that breeds inefficiency, favors insiders, and stalls the entry of serious institutional capital. Fixing this flaw is not a matter of incremental improvement; it is a prerequisite for crypto to evolve from a speculative arena into a foundational layer of the global financial system.

The Multi-Billion Dollar Problem Hiding in Plain Sight

Beneath the surface of hyper-liquid public exchanges like Binance and Coinbase lies a sprawling, opaque marketplace for tokens that are not yet freely tradable. These are assets held by early investors, team members, and venture funds, subject to vesting schedules or lockup periods. While technically illiquid, they are actively traded through over-the-counter (OTC) brokers in a process that is manual, fragmented, and built on private relationships. Price discovery happens not on an open order book but in whispered negotiations, creating a de facto valuation for assets that the public market cannot see. This unofficial pricing information creates a significant information asymmetry, where insiders understand an asset’s true supply and demand pressures long before the retail market does.

The journey of a token from its initial funding round to its public listing has become a treacherous landscape for the average investor precisely because of this hidden market layer. The sudden price crashes that often follow the unlocking of investor tokens are not random events; they are the predictable result of off-chain deals and pre-negotiated sales finally hitting the public market. This unregulated activity distorts price signals, making it nearly impossible for participants to distinguish between genuine market sentiment and the downstream effects of large, private block sales. Consequently, the market remains vulnerable to manipulation and information shocks, undermining trust and creating an environment where insiders with access to OTC desks hold a decisive and unfair advantage.

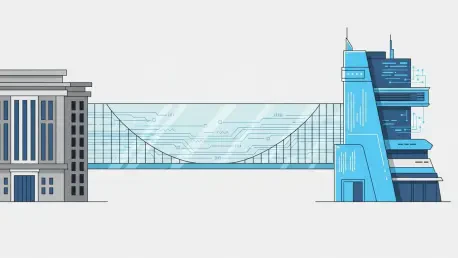

The Great Divide Understanding Crypto’s Missing Market Layer

The digital asset economy operates at two distinct speeds, creating a dangerous and value-destructive gap in the middle. On one end, sophisticated launchpads and fundraising platforms provide world-class infrastructure for projects to issue tokens and raise capital, marking the beginning of an asset’s lifecycle. On the other end, powerful centralized and decentralized exchanges offer near-instantaneous liquidity for publicly traded tokens, representing the final stage of the journey. Between these two highly efficient poles exists a vast chasm where billions of dollars in vested and locked assets become trapped, illiquid, and untradable through any formal, transparent mechanism. This “mid-life” phase of a token’s existence lacks the structured marketplace that is standard in traditional finance.

This structural void has a profound and destabilizing impact on both investors and the projects themselves. For investors, the lack of a transparent secondary market for locked assets means price discovery is happening behind closed doors, creating the information asymmetry that fuels sudden market shocks. A large, discounted sale of locked tokens in a private deal can create downward pressure that only becomes apparent to the public when those tokens are finally unlocked and sold on an open exchange, causing an “unexplained” crash. For projects, this illiquidity makes it difficult for early contributors and team members to manage their holdings responsibly, often forcing them into opaque OTC deals that offer poor pricing and introduce counterparty risk. The entire ecosystem suffers from this missing layer, which prevents the orderly circulation of capital and the stable, long-term maturation of asset valuations.

Deconstructing the Core Flaw Inefficiency Opacity and Stalled Growth

The heart of the problem lies in the opaque world of OTC deals, where transactions for locked assets are negotiated in private Telegram channels and settled through complex, manual legal agreements. This process is the digital equivalent of an old-world, relationship-based trading system, completely at odds with the transparency promised by blockchain technology. These private negotiations establish benchmark prices for locked assets that are invisible to the broader market, creating a phenomenon similar to the infamous “kimchi premium” in Bitcoin’s early days, where price discrepancies across fragmented markets created arbitrage for a select few. Today, retail participants indirectly bear the cost of this inefficiency through heightened volatility and by making decisions based on incomplete public market data.

In its rapid evolution, the crypto market effectively skipped a crucial lesson from traditional finance: the essential, complementary role of primary and secondary markets. In traditional capital markets, platforms like Nasdaq Private Markets provide a regulated, structured venue for pre-IPO liquidity. This allows early employees and investors to sell shares in a controlled environment, fostering price stability and transparent valuation long before a company lists on a public exchange. This critical intermediary step reduces the volatility of an IPO and provides the market with clearer pricing signals. Crypto, by contrast, leaped directly from private fundraising to hyper-liquid, speculative public markets, leaving no formal infrastructure to manage the vast supply of locked tokens that exists in between.

This structural deficiency is now creating a major bottleneck for one of crypto’s most promising frontiers: the tokenization of Real-World Assets (RWAs). The vision of bringing assets like private credit, real estate, and government treasuries on-chain is a multi-trillion-dollar opportunity, but it is hitting a wall. Institutional capital managers, who are the target audience for RWAs, operate under strict mandates that require predictable liquidity and transparent pricing. They are unwilling to invest significant capital into tokenized assets if there is no trustworthy, compliant, and liquid secondary market to exit their positions. Without a formal “mid-life market” for these assets, the entire RWA movement risks remaining a niche experiment rather than the bridge that connects decentralized finance with the global economy. For serious capital to flow, a reliable secondary market is not a feature; it is a non-negotiable requirement.

An Insider’s Diagnosis Replicating Wall Street’s Flaws Not Its Strengths

According to industry veterans like former PIMCO executive Kanny Lee, the crypto ecosystem is unintentionally recreating some of the worst aspects of legacy finance. The central critique is that in its pursuit of radical transparency on-chain, Web3 has ignored the off-chain “shadow” financial system that has emerged to fill a critical market gap. The result is an environment that combines the opacity and insider advantages of pre-regulation Wall Street with a distinct lack of the safeguards, investor protections, and regulatory oversight that were developed over decades to make those traditional markets more resilient and fair. The promise of Web3 was to build a better, more accessible financial system, but in this specific area, it is building a less efficient and less equitable one.

The consequences of failing to address this structural flaw are severe and far-reaching. If the industry continues on its current path, the market will remain defined by periodic information shocks rather than trading based on fundamental value. The sudden impact of large token unlocks will continue to create violent price swings, eroding investor confidence and making it difficult for legitimate projects to build sustainable token economies. This persistent volatility and the clear advantage afforded to insiders create a market that appears rigged, deterring broader adoption and inviting the attention of regulators. Inaction risks not only stunting the market’s growth but also attracting heavy-handed, and potentially innovation-stifling, regulation to solve a problem the industry could have fixed itself.

A Blueprint for a Crypto-Native Nasdaq Building the Missing Infrastructure

The solution lies in building a crypto-native equivalent to the Nasdaq Private Market, engineered from the ground up to leverage the unique capabilities of blockchain technology. The first principle of such a system must be that it is both on-chain and issuer-aware. Every transaction involving locked or vesting tokens should be recorded on a transparent, auditable public ledger. Critically, this platform must empower the original token issuers to programmatically set and enforce the rules governing the secondary sale of their assets, giving them control over their token’s lifecycle and ensuring transfers comply with their strategic objectives and legal requirements.

Secondly, this infrastructure must automate trust by replacing cumbersome legal paperwork and manual spreadsheet tracking with self-executing smart contracts. Vesting schedules, transfer restrictions, and compliance checks like Know Your Customer (KYC) and Anti-Money Laundering (AML) can be embedded directly into the token’s code. This eliminates counterparty risk and dramatically reduces the friction and cost associated with today’s OTC trades. When rules are enforced by immutable on-chain logic rather than by lawyers and intermediaries, the system becomes more efficient, secure, and scalable.

Such a platform would also democratize access to an asset class currently reserved for professional trading desks and well-connected funds. A transparent, on-chain marketplace could create a model where any long-term investor willing to accept lockup conditions could purchase tokens at preferential prices, similar to how institutions participate in private funding rounds. This would broaden participation and align incentives across a wider base of stakeholders, moving beyond a market structure that disproportionately benefits a small circle of insiders. By creating visible, transparent price discovery for historically illiquid assets, this system would forge a continuous liquidity cycle. Locked allocations would transform from a hidden market risk into a visible, tradable inventory, allowing value to circulate efficiently and transparently throughout an asset’s entire lifecycle.

The establishment of a structured secondary market for these mid-life assets was not merely an incremental improvement but a foundational necessity. By creating this missing infrastructure, the digital asset ecosystem addressed a core flaw that had long hindered its progress. It moved the market away from a state of persistent information shocks and toward one driven by fundamentals. This crucial development closed the dangerous gap between opaque insider dealings and the public market, fostering a more stable, transparent, and equitable environment for all participants. The transition ultimately unlocked the full potential of tokenization, paving the way for institutional adoption and cementing crypto’s role as a legitimate and enduring component of the global financial landscape.