The decentralized finance landscape is littered with projects that promised revolutionary returns but ultimately succumbed to volatile market pressures and fleeting user engagement, leaving many to question if long-term sustainability is even possible. Against this backdrop, a new protocol experiment on the Polygon network, ElevateFi, has launched with the ambitious goal of constructing a durable, community-centric ecosystem from the ground up. Commencing operations on January 9, 2026, the project aims to sidestep the pitfalls of its predecessors by building on a foundation of transparent, open-source, and independently audited smart contracts. Its multifaceted approach combines decentralized staking, a structured multi-tiered rewards system, community governance, and long-term liquidity solutions to align the incentives of users, long-term stakeholders, and active contributors. By focusing on sustainable economic experimentation, ElevateFi is attempting to prove that a DeFi protocol can foster genuine growth and stability.

A New Model for Community Incentives

At the heart of the ElevateFi protocol lies a transparent on-chain staking engine engineered for both accessibility and efficiency, providing the foundational layer for user participation. The mechanism revolves around two core assets: EFI, the primary protocol token, and sEFI, a yield-bearing token representing a user’s staked position. The process is streamlined for simplicity; users stake their EFI tokens directly through the platform’s smart contracts and, in return, receive an equivalent amount of sEFI. This design choice provides a liquid representation of their stake, enabling seamless participation in the protocol’s reward structure. A defining feature of this system is its epoch-based reward model coupled with automatic compounding. Every eight hours, the protocol distributes yields to all sEFI holders, and crucially, these rewards are automatically reinvested into the user’s stake. This eliminates the need for manual claiming and re-staking, maximizing yield generation over time and creating a more passive, user-friendly experience that encourages long-term holding and participation within the ecosystem.

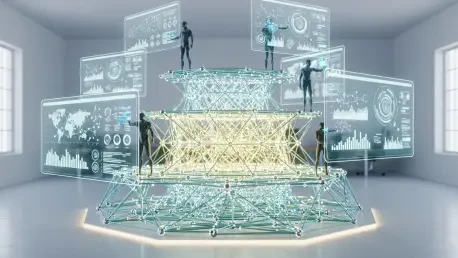

Building upon this foundation, ElevateFi introduced what is arguably its most innovative component: the SpiderWeb Rewards system. This sophisticated, multi-tier incentive structure is specifically designed to catalyze community expansion and reward tangible leadership activity beyond simple capital provision. The framework consists of up to fifteen distinct reward tiers, with a participant’s progression determined by a combination of their individual staking level, broader participation activity, and other community contribution metrics. The reward percentages are structured on a sliding scale, ranging from a maximum of 10% for participants in the highest tiers down to 4% for those at the entry levels. To promote inclusivity, self-stake thresholds begin at an accessible $100 and progressively scale up to $11,000 for top-tier eligibility. This model explicitly moves away from systems that incentivize short-term speculation, instead promoting measurable participation and leadership accountability as the primary drivers of success and reward within the ElevateFi community.

Empowering Stability and Governance

To ensure the long-term viability of its ambitious reward structure, the SpiderWeb system is supported by unique anti-inflationary mechanics. Central to this is the “Energy credits” mechanism, where credits required to claim rewards are generated through the burning of EFI tokens. This process creates a consistent deflationary force that helps sustain the reward pool without resorting to excessive token issuance, directly countering the inflationary pressures that have plagued many other DeFi protocols. Furthermore, to moderate the potential for short-term sell pressure resulting from reward distributions, the protocol implemented a 24-hour lock period on all claimed rewards, which are paid out in the DAI stablecoin. This design encourages a longer-term holding perspective among participants, contributing to greater market stability and aligning the actions of reward earners with the overall health of the ecosystem. These measures collectively demonstrate a thoughtful approach to economic design aimed at fostering a more stable and sustainable environment for all stakeholders.

Complementing its economic incentives, ElevateFi has integrated a Leadership DAO ranking model to formally recognize and reward its most dedicated community contributors. This performance-based framework ensures that advancement through ranks such as Pioneer, Builder, Guardian, and the top-tier Dynasty and Elite is tied to clearly defined activity and contribution metrics. This system ensures recognition is earned through tangible ecosystem involvement rather than purely promotional efforts. These ranks come with corresponding bonus structures, ranging from 20% to 60%, with additional advanced bonuses for the highest tiers. This leadership framework is deeply integrated with the protocol’s governance model. As a Decentralized Autonomous Organization (DAO), ElevateFi empowers its token holders with the ability to participate directly in the protocol’s evolution. This includes the right to submit proposals for changes and to vote on critical protocol-level decisions, ensuring that the platform’s development remains aligned with the collective interests and vision of its user base.

Securing Long-Term Liquidity and Future Growth

To address the pervasive DeFi challenge of liquidity volatility, ElevateFi launched a Long-Term Liquidity Vault, a structured program designed to incentivize and secure liquidity over an extended period. Participants can deposit either EFI or DAI into the vault, and these funds are then programmatically allocated into liquidity pairs and locked for a mandatory 12-month period. This mechanism directly tackles the issue of “mercenary capital” that often flows in and out of protocols seeking short-term gains. In exchange for this significant long-term commitment, participants receive a multi-faceted reward package that includes standard protocol-defined staking rewards, a fixed 7% long-term participation bonus, and the benefit of treasury-supported liquidity pairing. At the conclusion of the 12-month term, participants received their full principal deposit plus all accrued rewards. This strategy was designed to encourage longer participation horizons and enhance the overall stability of the protocol’s liquidity foundation from its inception.

With its foundational mechanics in place, ElevateFi’s future roadmap signaled an intention to bridge the gap between decentralized and traditional finance. A primary focus outlined in its strategic goals was the exploration of Real-World Asset (RWA) tokenization, a move that would significantly expand the protocol’s scope and utility by integrating tangible, off-chain assets into its decentralized infrastructure. Other key initiatives included developing programs to expand global access to DeFi, reinforcing its DAO-governed development systems, and enabling financial participation without the need for traditional intermediaries. The project’s initial vision was summarized as a protocol experiment focused on community participation and transparent infrastructure, and its early actions demonstrated a clear commitment to building a system that could potentially endure the tests of time and market cycles by prioritizing its community and economic stability.