In today’s constantly evolving financial landscape, advanced technologies are fundamentally reshaping the way financial services operate. These innovations are not just enhancing services but are also creating new opportunities for growth and transformation. From artificial intelligence (AI) and machine learning (ML) to blockchain, cloud computing, and robotic process automation (RPA), the financial services sector is undergoing a dramatic metamorphosis. The financial sector has been a traditional stronghold of innovation, consistently adopting new technologies to streamline operations and provide better services to its customers. The impact of these technologies is pervasive, influencing everything from trading platforms to customer service and data security. As these technologies continue to evolve, their integration is expected to drive further changes, not just in how financial services are delivered, but also in how they are perceived by consumers and regulators alike.

Technological Innovations in Financial Trading

The financial trading sector has always been a frontrunner in adopting new technologies to improve access to markets. Financial trading platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader provide sophisticated tools that significantly enhance market analysis and asset price tracking. These platforms are well-known for their security, transparency, and efficiency, making trading more accessible to retail traders. Their user-friendly interfaces and advanced functionalities make them indispensable tools for anyone involved in financial trading. Their robust feature sets allow traders of all experience levels to gain insights and make more informed decisions, thus enhancing their trading strategies and success rates.

Integrating AI and ML into these platforms is transforming the trading experience by simplifying market analysis and improving trading effectiveness. These technologies can analyze large datasets to identify trends and patterns that humans might easily miss. As a result, traders can make more informed decisions, enhancing their trading strategies and success rates. These advancements are also democratizing trading by providing equal access to high-quality tools and data analytics, irrespective of a trader’s scale or expertise. As financial trading platforms continue to evolve, they will likely become even more sophisticated, offering features that further simplify trading while increasing transparency and security.

Artificial Intelligence and Machine Learning

AI and ML technologies are driving transformative change across the financial services industry. The integration of machine learning algorithms into financial services is making a substantial impact on customer experience and service efficiency. These algorithms can analyze massive amounts of data to find patterns and provide personalized financial advice, offering customers tailored solutions to their financial needs. The use of AI extends beyond customer service; it includes improving loan underwriting processes by assessing risk more accurately and efficiently. Financial companies are investing heavily in AI to not only enhance service but also to innovate solutions that meet ever-changing consumer demands.

AI-powered chatbots are another significant advancement, revolutionizing customer service by providing almost instant responses to queries. These chatbots learn from interactions and data, offering better answers over time without needing explicit programming. This enhancement not only improves customer satisfaction but also frees up human resources for more complex tasks. Furthermore, the implementation of AI and ML solutions helps financial institutions detect fraudulent activities and predict market movements more accurately. By analyzing transaction data and identifying suspicious patterns, ML algorithms help financial institutions prevent fraud and ensure security. These predictive capabilities offer firms valuable insights, helping them stay ahead in a competitive market landscape.

Blockchain and Distributed Ledger Technology (DLT)

Blockchain technology is revolutionizing how financial transactions are conducted. The core advantage of blockchain lies in its ability to record transactions transparently and securely without intermediaries. This feature makes cross-border transactions faster, more secure, and cost-effective, significantly altering the dynamics of international finance. Blockchain’s inherent transparency and immutability make it an ideal solution for various financial applications, including asset management, payments, and smart contracts. It not only enhances the operational efficiency of financial transactions but also reduces costs and mitigates risks associated with errors and fraud.

Cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH) utilize blockchain technology to provide secure ways for users to store and transfer value. This decentralized approach reduces the need for traditional banking systems, offering more autonomy to users. Beyond simple transactions, blockchain also enhances service transparency and minimizes fraud risks. Financial services are increasingly adopting blockchain to develop decentralized finance (DeFi) solutions, thus expanding the scope and reach of their services. However, the decentralized nature of blockchain introduces new security challenges. Personal devices holding private keys become prime targets for cyberattacks, necessitating advanced security measures to protect users’ assets. Despite these challenges, the potential benefits of blockchain in creating a transparent, efficient, and secure financial environment are immense.

Cloud Computing

Cloud computing is another game-changer in the financial services sector. By migrating data storage and processing to the cloud, financial institutions can significantly reduce operational costs while gaining access to powerful computational resources. This capability allows firms to manage and analyze large datasets effectively, drawing insights from social media, market data, and transaction records. The cloud’s advantage isn’t just in cost savings; it’s about scalability and agility. Financial institutions can quickly scale their operations up or down based on demand, which is crucial for maintaining a competitive edge in a rapidly changing environment.

The scalability and flexibility offered by cloud computing enable financial companies to adapt quickly to market changes and detect potential risks in real-time. This agility is crucial for maintaining a competitive edge in the fast-paced financial landscape. Moreover, cloud services facilitate collaboration across different departments, improving overall organizational efficiency. Cloud-based solutions also support the development and deployment of advanced applications, enhancing customer experiences and streamlining operations. As more financial services migrate to the cloud, the benefits of this technology will become increasingly evident, offering a robust and cost-effective solution for data management and analysis.

Robotic Process Automation (RPA)

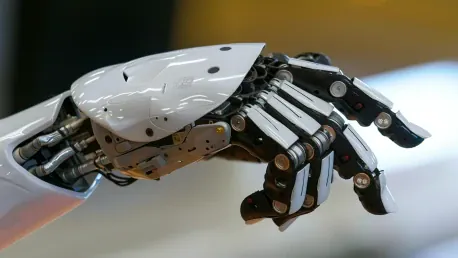

Robotic Process Automation (RPA) is streamlining business processes in the financial services industry by automating repetitive, rule-based tasks. RPA solutions can handle high-volume transactions, data entry, and compliance reporting with speed and accuracy, significantly reducing the likelihood of human error. This automation enables financial institutions to focus on more strategic initiatives, thereby improving efficiency and productivity. RPA also ensures compliance with regulatory requirements by maintaining complete and accurate records of transactions and processes.

Additionally, RPA can work alongside AI and ML technologies to further enhance financial service operations. For example, RPA can trigger AI algorithms to perform complex analyses or generate reports based on predefined criteria, combining the strengths of both technologies. As RPA continues to evolve, it is expected to take on more sophisticated roles, driving further efficiencies and innovations in the financial services sector. The implementation of RPA solutions is proving to be a critical factor in helping financial institutions remain competitive and responsive to the dynamic needs of their clients and the market.