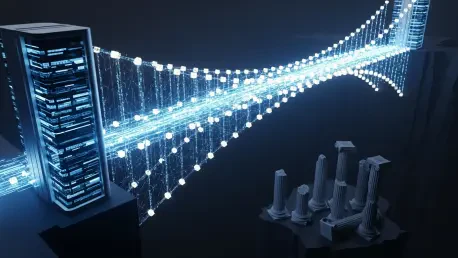

Faced with crippling economic sanctions that severed its ties to the global financial system, Iran has pioneered a sophisticated digital alternative by weaponizing cryptocurrency to conduct trade and stabilize its beleaguered economy. This strategy involves the creation of a parallel financial infrastructure, or a “shadow bank,” built upon the Tether stablecoin (USDT). This system is meticulously designed to operate beyond the reach of international regulators, allowing the state to amass a significant dollar-pegged reserve and exert control over its national currency in an unprecedented fashion.

The development of this digital shadow economy represents a strategic pivot for the Islamic Republic, transforming a tool of speculative finance into an instrument of statecraft. By leveraging the borderless nature of cryptocurrency, the Central Bank of Iran (CBI) aims to achieve two primary objectives. First, it seeks to circumvent the sanctions that have effectively locked it out of the conventional banking world, creating new channels for international trade and financial transactions. Second, it uses its crypto reserves to directly intervene in its domestic market, propping up the value of the Iranian rial and injecting much-needed dollar-equivalent liquidity to quell economic instability.

The Geopolitical Context of Economic Isolation

The turn toward a crypto-based financial system is not a choice made in a vacuum but a direct response to years of relentless economic pressure. International sanctions, primarily led by the United States, have inflicted severe damage on Iran’s economy by restricting its oil exports and cutting off its access to the SWIFT banking network. This economic isolation has fueled rampant inflation and currency devaluation, compelling the Iranian state to seek innovative and unconventional methods to maintain economic sovereignty and continue engaging with the global market.

This strategy places Iran among a growing number of state actors exploring cryptocurrencies as a means of geopolitical resistance. Nations like Venezuela have similarly turned to dollar-pegged stablecoins to navigate U.S. sanctions and a scarcity of physical dollars. Research into Iran’s activities is therefore crucial, as it illuminates a broader trend where digital assets are being co-opted by governments to challenge the existing international financial order and create sanctions-resistant economic pathways.

Research Methodology, Findings, and Implications

Methodology

The investigation into Iran’s crypto operations was anchored in meticulous on-chain analysis conducted by the blockchain intelligence firm Elliptic. The inquiry began with a critical lead: leaked documents that detailed specific USDT purchases made by Iranian entities in the spring of 2023. These documents provided the initial wallet addresses and transaction details needed to start unraveling a much larger network.

Working from this starting point, analysts traced the flow of funds across both the TRON and Ethereum blockchains, two of the primary networks on which USDT circulates. By mapping the intricate web of transactions, investigators identified a cluster of wallets whose activity patterns were consistent with a coordinated, state-level operation. This digital forensic work allowed them to confidently attribute a significant portion of the activity directly to the CBI, providing a clear window into the mechanics of its digital shadow bank.

Findings

The analysis revealed that the CBI successfully acquired a minimum of $507 million in USDT to establish its sanctions-proof reserve. This figure represents a conservative estimate based only on the wallets directly linked to the state. The operational strategy unfolded in two distinct phases, demonstrating a capacity for adaptation in the face of emerging threats. Initially, the CBI channeled its USDT holdings through Nobitex, Iran’s largest cryptocurrency exchange. This allowed the central bank to perform what were essentially open-market operations, selling USDT to buy and support the local rial.

However, a debilitating hack on the Nobitex exchange in June 2023, perpetrated by a pro-Israel hacking group, forced a strategic pivot. Following this security breach, the CBI shifted its methodology away from the vulnerable centralized exchange. Instead, it began using decentralized cross-chain bridges to move funds between the TRON and Ethereum networks, subsequently dispersing them through a variety of decentralized exchanges (DEXs). This marked a clear evolution toward enhancing operational security and reducing reliance on single points of failure.

Implications

These findings uncover a sophisticated and highly adaptable model for state-sponsored sanctions evasion that poses a significant challenge to traditional enforcement mechanisms. The use of a dollar-pegged stablecoin allows a sanctioned state to access the benefits of the U.S. dollar without ever touching the U.S. banking system. This creates a functional financial layer that is resilient, decentralized, and difficult to disrupt through conventional means.

Simultaneously, the strategy exposes a critical paradox. While this digital system bypasses banks, its reliance on public blockchains creates a permanent and auditable record of every transaction. This inherent transparency offers a powerful new tool for regulators and law enforcement, creating a “visible shadow” that can be monitored in real time. Furthermore, it creates a new chokepoint for enforcement, as stablecoin issuers like Tether have the ability to freeze assets and blacklist wallets associated with sanctioned entities, demonstrating that even this new frontier is not without its own forms of control.

Reflection and Future Directions

Reflection

The study of Iran’s crypto strategy offers a sobering reflection on the vulnerabilities inherent in such a system. The successful hack of the Nobitex exchange served as a stark reminder that even well-funded state operations are susceptible to cyber threats, which can result in the catastrophic loss of assets. This event highlighted the operational risks associated with relying on centralized domestic infrastructure, prompting the shift toward more decentralized protocols.

Moreover, the “visible shadow” paradox remains a central theme. The very technology that enables sanctions evasion also provides an immutable ledger for international authorities to scrutinize. This has created a complex and ongoing cat-and-mouse dynamic, where sanctioned states develop increasingly sophisticated methods of obfuscation, while regulators and blockchain analytics firms develop more advanced tools for tracking and identification. This dynamic underscores the dual nature of blockchain as a technology of both liberation and surveillance.

Future Directions

Looking ahead, future research must continue to monitor the evolution of these state-sponsored crypto tactics. A key area of focus should be the increasing use of decentralized finance (DeFi) protocols, such as privacy mixers and non-custodial exchanges, which are employed to further obscure the flow of funds and make attribution more difficult. Understanding how states leverage these advanced tools is critical for anticipating the next phase of sanctions evasion.

Further investigation is also needed to assess the effectiveness of emerging countermeasures. This includes analyzing the impact of wallet blacklisting by stablecoin issuers and evaluating the capacity of international bodies to use advanced blockchain monitoring to disrupt these financial networks. The long-term efficacy of sanctions in the digital age will depend on the ability of enforcement agencies to adapt to these rapidly changing technological landscapes.

Conclusion: A New Paradigm in Sanctions and Sovereignty

In conclusion, the investigation revealed that Iran successfully engineered a functional, crypto-based financial layer to counteract the severe impact of international economic sanctions. This digital shadow banking system represented a formidable challenge to traditional enforcement frameworks, allowing the state to access dollar-equivalent liquidity and conduct trade outside the established global order. While this model demonstrated significant ingenuity and adaptability, it was not without its own inherent weaknesses and paradoxes.

The public and immutable nature of blockchain technology ultimately ensured that these clandestine activities were not invisible. Instead, they left behind a permanent digital trail that provided new avenues for monitoring and intervention by international regulators and private-sector actors like stablecoin issuers. This development marked a new and complex chapter in the interplay between technology, geopolitics, and international finance, where digital currencies served as a double-edged sword, offering powerful new tools for both sanctions evasion and enforcement.