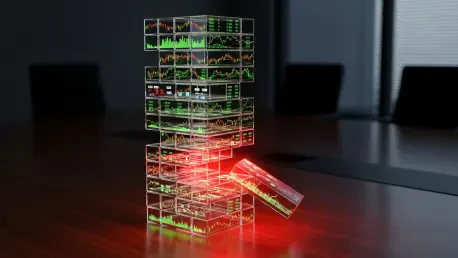

As the 2026 holiday season approaches, a current of unease is running beneath the surface of an otherwise bullish cryptocurrency market, with recent analysis indicating that several prominent altcoins are teetering on the edge of significant liquidation events. A dangerous cocktail of surging open interest and a profoundly imbalanced market structure has created a precarious situation, particularly for traders with long positions. This widespread optimism, while fueling recent gains, has also built a fragile house of cards where even minor negative catalysts or a wave of profit-taking could trigger a domino effect of forced selling. The disparity is stark across the board, with liquidation heatmaps revealing a landscape where those betting on price increases are far more exposed than their bearish counterparts, setting the stage for potentially dramatic price corrections during the Christmas week. This over-leveraged upside exposure represents a critical vulnerability that could unwind rapidly, catching many market participants off guard.

An Imbalance Tipping the Scales

A closer look at the market dynamics reveals a common thread of overextended bullish sentiment across multiple digital assets, creating a lopsided risk profile that heavily penalizes downward price movements. This imbalance is not subtle; liquidation data clearly shows that the potential financial damage from a price drop far outweighs that of a price increase for short sellers. For traders holding long positions, this means their stops are clustered in dense zones just below current prices, forming a liquidity pool that could be targeted. When prices hit these levels, the resulting automated selling can create a cascade, pushing prices down further and triggering even more liquidations in a vicious cycle. The current environment is a textbook example of how excessive optimism can lead to systemic fragility, where the collective weight of leveraged bets to the upside makes the entire structure vulnerable to a sudden and sharp collapse if key support levels are breached. This vulnerability is a direct consequence of market participants chasing gains without adequately pricing in the downside risk.

The situation is particularly acute for Ethereum (ETH), the market’s leading altcoin, where a pronounced imbalance has become a focal point of concern. A relatively modest price decline to the $2,660 zone would be sufficient to trigger a staggering $4 billion in long liquidations, a figure that dwarfs the $1.65 billion in short positions that would be liquidated if the price were to rally to $3,370. This risk is compounded by a convergence of bearish signals that suggest selling pressure is mounting. Notably, a significant transfer of ETH to an exchange by a prominent investor has fueled speculation of profit-taking at the institutional level. Furthermore, the Ethereum Coinbase Premium Index has slipped into negative territory, indicating stronger selling pressure from a major U.S. exchange. This sentiment is echoed in the broader investment landscape, with Ethereum exchange-traded funds (ETFs) recording substantial outflows of nearly $644 million in the preceding week, painting a clear picture of waning confidence among larger market players.

Emerging Tokens and Heightened Volatility

The liquidation risk extends beyond established assets, with newer tokens exhibiting even more dramatic signs of instability due to speculative fervor. Midnight (NIGHT), for instance, has experienced an explosive surge in trader activity, with its open interest ballooning from a modest $15 million to over $90 million in just two weeks. This rapid influx of capital is overwhelmingly biased toward continued price appreciation, creating an environment ripe for a sharp reversal. After a sustained seven-day winning streak, the token recently posted its first negative daily candle, a potential early indicator that selling pressure is beginning to challenge the bullish momentum. A particularly alarming factor is the observation that virtually 100% of its current holders are reportedly in profit. This scenario creates a high probability of a widespread rush for the exits to secure gains, and a price decline to just $0.077 could be enough to annihilate $15 million in cumulative long positions, triggering a potential market cascade.

In a more extreme case, Audiera (BEAT) exemplifies the acute dangers of speculative excess and questionable project fundamentals. Following an astronomical 5,000% price increase since its launch in November, the market for BEAT is dangerously skewed toward long positions. Projections indicate that a fall below the $3 price level could erase $10 million in leveraged bets on its continued rise. The token’s situation is made worse by serious concerns of price manipulation, highlighted by its extreme volatility; in one instance, its value plummeted 30% only to rebound 50% within a single hour. Adding to the apprehension are major operational red flags, including an inaccessible official website and a completely dormant social media presence, which call the project’s legitimacy into serious question. Market data platforms have issued specific warnings about BEAT, noting that its erratic price action could easily trigger cascading liquidations that would affect both long and short traders, underscoring the severe risks associated with such thinly traded and volatile assets.

A Sobering Assessment of Market Health

The analysis of these altcoins ultimately painted a cautionary picture of a market where unbridled optimism had fostered significant systemic risk. The confluence of over-leveraged bullish positions in a market leader like Ethereum, combined with the speculative mania and weak fundamentals observed in emerging tokens such as Midnight and Audiera, revealed a widespread vulnerability to sudden downturns. These conditions underscored how rapidly positive sentiment could evaporate, leading to severe, cascading liquidations that would disproportionately affect the over-exposed majority. The situation served as a critical case study on the inherent dangers of imbalanced market structures and the swiftness with which gains built on leverage could be erased, reminding participants of the volatility that remains a core feature of the digital asset landscape.