Unveiling a Critical Challenge in BNPL Growth

The buy now, pay later (BNPL) sector has exploded in popularity, reshaping consumer spending with its promise of flexibility and instant gratification, but a shadowy threat looms large over this fintech success story, threatening its long-term stability. Self-pay fraud, a sophisticated scam where fraudsters impersonate both merchants and consumers to exploit platforms like Afterpay, is emerging as a significant barrier to sustained growth. With losses mounting and the industry expanding into high-value transactions, understanding and mitigating this risk has never been more urgent. This market analysis delves into current trends, data insights, and future projections surrounding self-pay fraud in the BNPL landscape, offering a roadmap for stakeholders to navigate an increasingly complex environment.

Market Dynamics: Dissecting Self-Pay Fraud Trends in BNPL

Rising Incidence of Collusive Scams

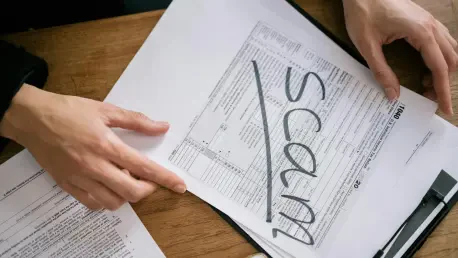

The BNPL market, valued for its accessibility and speed, is facing a surge in self-pay fraud, a scheme where bad actors create fictitious merchant and consumer identities to execute sham transactions. These fraudsters leverage stolen personal data to craft synthetic profiles, processing payments through platforms like Afterpay before vanishing without repayment. Industry reports suggest that such scams are becoming more frequent as BNPL adoption grows, particularly in urban markets with high transaction volumes. The financial toll on providers is substantial, as they absorb losses from unpaid balances, raising concerns about profitability in a competitive sector.

Technology’s Dual Impact on Fraud Evolution

Advancements in technology, particularly generative artificial intelligence (AI), are amplifying the scale and sophistication of self-pay fraud within the BNPL space. AI tools enable criminals to generate hundreds of fake identities rapidly, overwhelming traditional detection systems and exploiting the streamlined approval processes that define BNPL services. On the flip side, AI also holds potential for providers to enhance fraud prevention through pattern recognition and anomaly detection. The challenge lies in staying ahead of tech-savvy fraudsters, as the market witnesses a technological arms race between perpetrators and defenders.

Shift to High-Value Transactions Fuels Greater Risks

As BNPL platforms expand into big-ticket purchases like concert tickets, luxury goods, and medical services, the stakes for self-pay fraud escalate dramatically. Transactions in these categories often yield four-figure gains for fraudsters, making them prime targets for collusive scams. Variations of the fraud, such as claims of non-delivery to secure refunds, further complicate the landscape, especially in sectors with less tangible deliverables. Data remains scarce on the exact scope of these incidents, but anecdotal evidence points to a correlation between transaction value and fraud prevalence, signaling a need for tailored risk management strategies.

Data Insights: Quantifying the Threat and Market Vulnerabilities

Underreported Losses and Data Gaps

Despite the growing concern over self-pay fraud, the BNPL industry lacks comprehensive data to fully gauge its impact, creating a blind spot for market participants. Estimates suggest that losses from collusive scams could account for a significant portion of operational costs for providers like Afterpay, yet the absence of standardized reporting obscures the true scale. This gap in transparency hinders the development of effective countermeasures and raises questions about the long-term sustainability of current business models. Without robust metrics, stakeholders risk underestimating a threat that could erode consumer trust.

Regional and Sectoral Exposure Patterns

Market analysis reveals that self-pay fraud exposure varies across regions and industries, with densely populated urban centers showing higher vulnerability due to transaction density. Sectors like entertainment and healthcare, where BNPL is increasingly used for expensive purchases, face elevated risks compared to traditional retail. These disparities highlight the need for localized fraud prevention strategies, as a one-size-fits-all approach may fail to address specific market dynamics. Providers must prioritize data collection and analysis to map these patterns more accurately and allocate resources effectively.

Future Projections: Navigating the BNPL Fraud Landscape

Technological Innovations as a Defense Mechanism

Looking ahead, the BNPL market is poised to leverage cutting-edge technologies like machine learning and biometric verification to combat self-pay fraud over the next few years, from 2025 to 2027. Predictive analytics could identify suspicious transaction behaviors in real time, while blockchain-based systems might offer tamper-proof identity verification. However, adoption of such solutions faces hurdles related to cost and scalability, particularly for smaller providers. The balance between innovation and affordability will shape how effectively the industry can fortify itself against evolving threats.

Regulatory and Collaborative Horizons

Economic and regulatory shifts are expected to influence the BNPL sector’s response to fraud in the near term. As losses mount, governments may impose stricter oversight, mandating enhanced vetting processes or fraud reporting standards. Simultaneously, industry collaboration could emerge as a powerful tool, with platforms sharing intelligence on fraud patterns to build a collective defense. Such partnerships, while promising, require trust and coordination among competitors, presenting a unique challenge in a rapidly evolving market.

Market Expansion and Rising Stakes

The continued expansion of BNPL into new demographics and high-value sectors is likely to intensify fraud risks, as fraudsters adapt to exploit emerging opportunities. Projections indicate that without proactive measures, financial losses could escalate, potentially impacting investor confidence and slowing market growth. Providers must anticipate these challenges by integrating fraud prevention into their expansion strategies, ensuring that scalability does not come at the expense of security. The trajectory of the BNPL market will depend heavily on how well it balances accessibility with robust safeguards.

Reflecting on the Path Forward

This analysis of self-pay fraud in the BNPL sector uncovers critical vulnerabilities that threaten platforms like Afterpay, driven by collusive scams, technological advancements, and market expansion into high-value transactions. The lack of comprehensive data compounds the challenge, leaving the industry grappling with an underreported yet persistent issue. Moving forward, stakeholders need to prioritize investment in AI-driven fraud detection and foster cross-industry collaboration to share insights on emerging threats. Additionally, advocating for regulatory frameworks that support innovation while enforcing accountability proves essential. By taking these steps, the BNPL market can fortify its defenses, ensuring that growth and trust go hand in hand in the evolving fintech landscape.