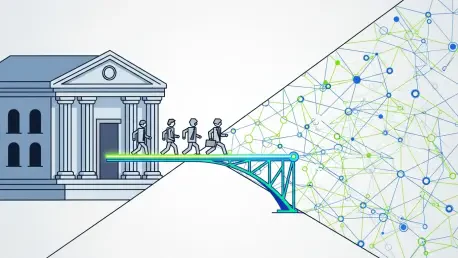

A profound and accelerating tectonic shift is reshaping the global financial system, presenting traditional banking institutions with an existential threat from which there may be no recovery without immediate and decisive action. The rapid expansion of the digital asset and tokenization ecosystem is not merely a peripheral development but a foundational rewiring of how value is created, stored, and transferred. For banks, the long-held strategy of cautious observation and incremental adoption is no longer viable. The ground is moving beneath their feet, and the choice has become starkly clear: undergo a fundamental transformation to embrace this new paradigm or risk being rendered obsolete by a more agile, efficient, and decentralized financial future. Inaction is now the most perilous course, as a new wave of innovation threatens to leave legacy institutions entirely excluded from the next chapter of finance.

The Unstoppable Rise of a Parallel Financial System

The sheer scale and velocity of the tokenization market’s evolution are nothing short of breathtaking, underscoring the urgency for incumbent financial players to formulate a response. Industry research projects that the market for tokenized real-world assets (RWAs)—encompassing everything from commercial real estate and private equity to supply-chain receivables—will explode into a $16 trillion industry by 2030. This is not a distant, speculative future; the essential infrastructure is already operational and scaling at an unprecedented rate. For instance, stablecoins have already facilitated the settlement of over $46 trillion in transaction volume, a significant portion of which has been processed entirely outside the conventional banking framework. This activity highlights a critical migration of value transfer away from legacy rails. The transition from a niche experiment to a formidable parallel ecosystem is further solidified by forecasts predicting that digital asset turnover will constitute nearly 10% of all global financial activity within the next five years, signaling a permanent change in market structure.

This burgeoning ecosystem represents far more than just a new asset class; it is an entirely new financial infrastructure operating in parallel to the traditional system. The market has decisively moved beyond the control and influence of incumbent banks, which now find themselves playing catch-up in a race they have yet to fully enter. A dynamic cohort of competitors, including decentralized finance (DeFi) platforms, agile FinTech innovators, and specialized crypto-native custodians, are actively building and capturing financial flows that were historically the exclusive domain of regulated institutions. As these new players become more entrenched, they are not just offering alternative products but are fundamentally redefining the rules of engagement. The longer banks hesitate, the more permanent this shift becomes, solidifying new market dynamics that marginalize traditional intermediaries and place them at a significant competitive disadvantage from which it may be impossible to recover.

Reimagining Trust and the Erosion of Traditional Advantages

For generations, traditional banks have been protected by a formidable competitive moat, built upon pillars of stringent regulatory oversight, established fiduciary responsibility, and robust governance frameworks. These advantages created a high barrier to entry and cemented their central role in the global economy. However, the advent of blockchain technology is systematically dismantling this long-standing defense. Emerging decentralized architectures are demonstrating an impressive capacity to embed these critical safeguards directly “on-chain.” Principles of trust, compliance, and transparent governance, once cited as weaknesses of decentralized systems, can now be replicated and, in some cases, even enhanced within blockchain environments through smart contracts and distributed consensus mechanisms. This technological leap directly weakens the core argument that institutional trust and security can only be guaranteed within the confines of legacy financial structures, challenging the very value proposition that has sustained banks for centuries.

While the complexities of integrating permissioned banking products with the inherently open nature of public blockchains are significant, the most critical “strategic bottleneck” for incumbent institutions is undoubtedly compliance. This challenge has created a significant paradox: while many banks are inclined to wait for comprehensive regulatory clarity before committing significant resources, this very delay has become their greatest risk. The history of financial innovation, particularly the rapid and largely unregulated scaling of the stablecoin market, provides a powerful precedent. It shows that technological adoption and market development often outpace the ability of regulators to create comprehensive frameworks. Consequently, regulation is frequently forced to follow innovation rather than lead it. Institutions that remain on the sidelines, waiting for a perfect set of rules, risk conceding irreversible market share and strategic positioning to more nimble competitors willing to navigate ambiguity and shape the future of finance.

The Inevitable Future and a Final Call to Action

The evidence overwhelmingly suggests that tokenization is not a fleeting trend or a niche instrument but a fundamental, structural shift in the operational mechanics of capital markets. The ongoing transition towards on-chain issuance, trading, and near-instant settlement for a vast array of financial instruments, including mortgages, corporate bonds, and trade finance, is already well underway. This evolution promises to unlock unprecedented efficiencies, reduce counterparty risk, and democratize access to previously illiquid asset classes. For incumbent banks, the cost of non-participation is rising exponentially with each passing quarter. The suggested path forward is no longer to wait for a perfect, fully-formed solution but to engage in proactive and structured experimentation. Through focused workshops, carefully designed pilot programs, and strategic partnerships with native technology providers, banks can begin to build critical institutional knowledge, develop necessary skills, and preserve strategic flexibility in a fluid and rapidly evolving environment.

Ultimately, the window of opportunity for traditional banks to define their role in this new financial landscape was rapidly closing. The $16 trillion tokenized asset market was not a hypothetical construct but a tangible reality being actively built, traded, and scaled by a new generation of players operating outside the traditional banking perimeter. Financial institutions were confronted with a clear choice: either continue to treat digital assets as a peripheral concern and accept the high probability of obsolescence, or recognize them as a core component of the future financial system and commit to a deep and immediate transformation. It became evident that compliance could be reframed as a competitive differentiator, that governance models were transferable to new technological paradigms, and that tokenization represented a foundational shift that could not be ignored. The institutions that began their integration journey understood that transformation was no longer an option but a critical necessity for survival, ensuring they would not be relegated to the periphery as the future of finance was constructed without them at its center.