In a decisive move that reverberates through the digital asset community, social media giant Reddit is officially dismantling its Web3 infrastructure by announcing the permanent closure of its in-app digital wallet, the “Reddit Vault,” effective January 1, 2026. This action represents the final chapter in the company’s strategic retreat from the volatile world of digital collectibles, a pivot that gained significant momentum following its public offering in March 2024. The shutdown is not an abrupt decision but the culmination of a carefully phased withdrawal, which included signaling its intentions four months prior and ceasing all sales in its Avatar Shop on November 11, 2025. For the millions of users who engaged with the platform’s digital assets, this announcement serves as a critical and time-sensitive call to action, forcing a reckoning with the true ownership and portability of their collections as the platform that birthed them steps away for good. The move raises profound questions about the viability of digital collectibles when a mainstream platform withdraws its support.

The End of an Era for Reddit’s Digital Collectibles

The termination of the Reddit Vault places a direct and urgent responsibility on its users, who must now navigate the technical process of preserving their assets independently. Before the January 1, 2026, deadline, every Vault holder is required to export their private keys or recovery phrases to a compatible third-party wallet, such as MetaMask or Phantom. This is the only method to ensure they retain custody and control over their digital avatars and any associated community points. After this date, all transfer capabilities within the Reddit app will be permanently disabled, effectively locking any remaining assets within a defunct system. This transition from a simplified, integrated user experience to a more complex, self-custody model marks a significant shift, highlighting the inherent risks of relying on centralized platforms for decentralized asset management. The company’s decision underscores a fundamental tenet of the Web3 space: “not your keys, not your crypto,” a lesson that many casual users are now being forced to learn under a strict deadline.

Despite the finality of the Vault’s closure, Reddit is not entirely erasing the presence of these digital collectibles from its platform, offering a small concession to the community that embraced them. The company will maintain a simplified import function that allows users to connect an external wallet and continue displaying their owned collectibles as their profile avatars. This feature ensures that the visual identity and status associated with these digital items can persist, albeit without the integrated management and trading infrastructure the Vault once provided. In a parallel move that solidifies the end of this chapter, the official r/CollectibleAvatars subreddit will be archived. This means that while existing posts and discussions will remain readable, no new official content, announcements, or community initiatives will be launched. The archival effectively freezes the community in time, transforming it from a vibrant hub of activity into a digital museum of what was once a promising corporate foray into the world of Web3.

A Bellwether for a Market in Crisis

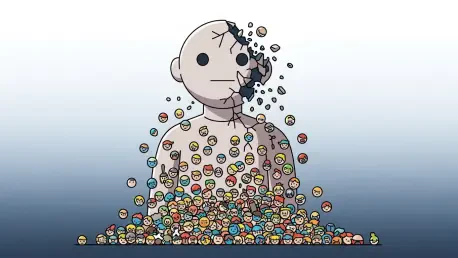

Reddit’s departure is far more than an isolated corporate strategy shift; it serves as a powerful and highly visible indicator of a systemic crisis within the broader digital collectible market. The decision reflects a landscape plagued by persistently low demand, waning speculative interest, and a significant failure to gain meaningful traction among mainstream institutions. The initial euphoria that surrounded non-fungible tokens has given way to a stark reality, a trend supported by overwhelming data. A comprehensive 2024 report that analyzed a vast number of NFT collections delivered a sobering verdict, finding that a staggering 96% of them were essentially “dead,” holding zero trading volume and no discernible value. The same study revealed that the average lifespan of an NFT collection was a mere 1.14 years, a figure that paints a bleak picture of long-term viability and suggests that the vast majority of projects were transient fads rather than sustainable assets. Reddit, with its vast user base, was seen by many as a potential bridge to mass adoption, making its exit a particularly damning piece of evidence for the market’s overall health.

The qualitative downturn is mirrored by a catastrophic quantitative collapse in financial value across the entire NFT ecosystem. At its zenith in 2022, the total market capitalization for NFTs reached an astonishing $15.5 billion, fueled by celebrity endorsements and rampant speculation. Today, that figure has plummeted to approximately $2.6 billion, representing a massive erosion of wealth and confidence. This market-wide depreciation is starkly illustrated by the fate of what was once the industry’s crown jewel, the Bored Ape Yacht Club (BAYC) project. The floor price for a BAYC avatar, a key metric for a collection’s value, fell from a peak of 153 ETH to a current value of around $4.99. This constitutes a staggering 96% drop, transforming what were once high-status digital assets, trading for hundreds of thousands of dollars, into little more than cautionary tales. The precipitous fall of such blue-chip projects demonstrates that no corner of the market was immune to the crash, providing a clear rationale for why a publicly traded company like Reddit would choose to distance itself from such profound volatility.

A Turning Point for Digital Asset Utility

In retrospect, Reddit’s complete withdrawal from the digital collectibles space was seen as the most significant departure of a major platform that had attempted to provide real utility for such assets. This event severely shook an already fragile investor confidence, sending a clear message that the initial model of corporate-backed collectibles struggled to find a sustainable footing beyond speculative hype. The closure of the Vault and the archival of its community underscored a critical lesson for the entire Web3 industry: for digital assets to have lasting value, they needed to be integrated with tangible, real-world utility or a truly decentralized ecosystem, a test that this particular corporate experiment had ultimately failed. The market was forced to confront the fundamental question of what these tokens represented without the support of the platform that created them, pushing the conversation toward a necessary evolution beyond simple digital status symbols and toward more robust and resilient applications.