A New Blueprint for Emerging Market Investment?

For decades, institutional investors have viewed emerging markets as a double-edged sword: a source of high potential growth hamstrung by equally high perceived risk. A groundbreaking new financial structure, however, may be poised to change that calculus. Global payments finance firm BlackOpal recently announced a $200 million anchor facility to launch GemStone, an institutional product designed to unlock Brazil’s vast pool of credit card receivables. This initiative isn’t just another emerging market play; it represents a potential paradigm shift in how to isolate and mitigate risk. This article will dissect the innovative mechanics behind this model, explore its context within broader financial trends, and evaluate whether this approach offers a truly scalable blueprint for de-risking emerging market assets for global capital.

The Perennial Challenge of Emerging Market Credit

Investing in emerging market credit has traditionally been a complex endeavor. Beyond macroeconomic and currency risks, the primary hurdle for investors has always been counterparty credit risk—the danger that the underlying borrowers or merchants will default on their obligations. This has left massive, otherwise stable asset classes, like Brazil’s approximately $100 billion credit card receivables market, largely inaccessible to global institutions. While sustained by a deeply entrenched consumer culture of installment payments, the risk was tied to the financial health of countless individual merchants. This historical backdrop shaped a cautious investment landscape where the operational and credit risks of local businesses were seen as an unavoidable part of the package, deterring large-scale institutional allocation.

Unpacking the GemStone Model A New Approach to Risk

Bypassing the Merchant A Structural Shift in Risk

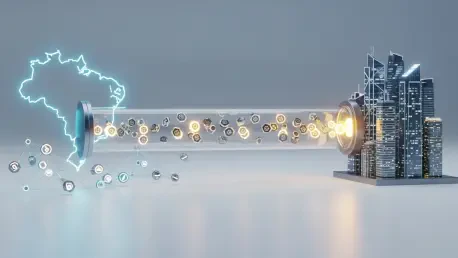

The core innovation of the GemStone product lies not in sophisticated credit underwriting but in fundamentally re-architecting the flow of funds to bypass merchant risk entirely. BlackOpal achieves this by purchasing the credit card receivables as a “True Sale,” securing legal ownership and registering it on Brazil’s Central Bank C3 Registry. The crucial step follows: collections are automatically routed directly from the card networks, Visa and Mastercard, into BlackOpal-controlled accounts. This simple yet profound structural change means repayment is no longer dependent on the merchant’s solvency or operational discipline. The risk profile shifts from the creditworthiness of thousands of small businesses to the operational integrity of the global payment settlement infrastructure itself. This model’s effectiveness was previously validated by BlackOpal’s predecessor product, LiquidStone, which operated with a zero-default track record.

Tokenization as the Gateway for Institutional Capital

This structurally sound asset is then brought to global markets through tokenization, facilitated by BlackOpal’s partner, Plume. By converting the ownership of these receivables into digital tokens on a blockchain, GemStone offers institutional investors unprecedented transparency, efficiency, and liquidity. This approach directly addresses the growing institutional appetite for alternative sources of yield, particularly assets that are not correlated with traditional public markets. The tokenization of real-world assets (RWAs) is a powerful trend, and GemStone serves as a prime case study. It demonstrates how blockchain technology can act as a bridge, connecting a de-risked, high-yield emerging market asset class with the trillions of dollars in institutional capital seeking new opportunities for deployment.

A Replicable Model for Global South Finance?

The immediate question is whether this innovative structure is a one-off solution tailored to Brazil’s unique regulatory environment or a replicable model for other emerging markets. While Brazil’s C3 Registry provides a robust legal framework, the underlying principle—leveraging payment infrastructure to secure cash flows—is broadly applicable. The sentiment from the firm’s leadership suggests that collection becomes a question of “when, not if,” highlighting a universal appeal. Similarly, the facility’s structurer, Mars Capital Advisors, praised the model for its foundation in “real assets, real cash flows, and structural protections.” With an existing asset capacity exceeding $1 billion, BlackOpal is already planning for scale, suggesting a strong belief that this methodology can be adapted to unlock similar asset classes across Latin America and other regions.

The Future of Payments Finance and Real-World Assets

The BlackOpal model signals a significant evolution in both payments finance and the RWA landscape. It represents a convergence of traditional structured finance, modern payment technology, and blockchain-based asset management. The future trend points away from simply analyzing country-level risk and toward a more granular analysis of specific infrastructures within those countries. We can expect to see similar models applied to other types of predictable cash flows, such as supply chain financing, subscription revenues, and other forms of consumer credit. This shift enables investors to gain exposure to the economic vitality of a region without being fully exposed to its traditional credit weaknesses, a powerful proposition that could reshape global capital flows.

Key Takeaways for the Institutional Investor

The launch of GemStone offers several critical insights for today’s institutional allocator. First, it underscores that significant value can be unlocked by focusing on structural risk mitigation rather than relying solely on traditional underwriting. The main takeaway is that the most effective de-risking strategies are often embedded in the plumbing of a transaction. Second, investors should actively seek opportunities at the intersection of FinTech and blockchain, where tokenization is making previously illiquid and inaccessible asset classes available. The actionable strategy is to move beyond broad emerging market labels and conduct due diligence on the specific mechanics of an investment product. For asset originators, the lesson is clear: innovation in financial engineering can create entirely new markets for existing assets.

Reframing Risk and Unlocking Global Opportunity

Ultimately, the BlackOpal and GemStone initiative was more than just a new financial product; it was a compelling proof of concept for a new way of thinking about emerging market risk. By isolating and leveraging the inherent stability of global payment networks, it offered a pathway to transform high-risk assets into institution-grade investments. This model reframed the investment proposition, shifting the focus from the creditworthiness of the individual to the reliability of the system. In doing so, this approach showed how it could become a vital tool in bridging the gap between the vast reserves of institutional capital and the massive, untapped economic potential of the Global South, fundamentally changing how the world invested in emerging markets.