As investor anticipation reaches a fever pitch, the global financial community is intensely focused on the potential public debut of Ant International, the formidable international division of Ant Group. The company's recent financial disclosures, revealing a remarkable 20-25% revenue surge to

The Modern Paradox of Payments: More Tools, More Complexity The proliferation of specialized financial technology has created a labyrinth of operational complexity. While new fintech solutions offer unprecedented capabilities, they present a paradox for banks: more tools mean more convoluted

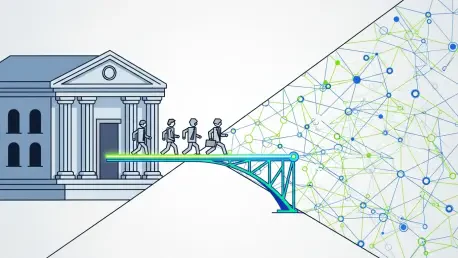

Introduction The digital transformation of the financial sector has rapidly evolved from a convenient alternative to a fundamental pillar of modern banking, reshaping customer expectations and operational efficiency entirely. This evolution is no longer about simply offering online access to

A profound and accelerating tectonic shift is reshaping the global financial system, presenting traditional banking institutions with an existential threat from which there may be no recovery without immediate and decisive action. The rapid expansion of the digital asset and tokenization ecosystem

The quiet replacement of leather wallets with their digital counterparts represents one of the most significant and swift technological shifts in modern consumer behavior, fundamentally altering how we interact with money, commerce, and entertainment. Once viewed as a niche convenience with

For the nearly 17 million Nigerians living abroad, the act of sending money home is a vital thread connecting them to family, community, and opportunity, yet this process has often been fraught with delays, high fees, and uncertainty. Recognizing this critical need for a more streamlined financial