An overwhelming majority of banking executives recognize their outdated technology as an existential threat, yet an astonishingly small fraction are actively undertaking the necessary transformation to address it. This profound disconnect highlights a central paradox in modern finance: while the need for digital evolution is universally acknowledged, the perceived risks of overhauling legacy core systems have created a state of industry-wide paralysis. Addressing this challenge head-on, a strategic partnership between cloud-native core banking provider 10x Banking and digital solutions expert audax Financial Technology is set to provide a new, de-risked roadmap for modernization, enabling banks to innovate at speed without betting the entire institution on a single, massive project.

The Multi Trillion Dollar Question Why Are So Many Banks Avoiding an Existential Threat

The chasm between awareness and action within the global banking sector is stark. Industry analysis reveals that while 93% of banking leaders view the failure to modernize as a direct threat to their survival, and 67% openly admit to falling behind on digital transformation, a mere 8% are actively prioritizing the upgrade of their core banking infrastructure. This hesitation is not born from ignorance but from a deeply ingrained fear of the complexities and dangers associated with large-scale system migrations, which have historically been fraught with budget overruns, operational disruptions, and catastrophic failures.

This widespread reluctance is anchored in the high-stakes nature of core banking itself. These legacy systems are the central nervous systems of financial institutions, processing millions of transactions and holding sensitive customer data. The prospect of a “rip and replace” project, which can span multiple years and cost tens of millions of dollars, presents an unacceptable level of risk for many boards and executive teams. Consequently, institutions often opt for tentative, piecemeal updates that fail to address the fundamental limitations of their aging technology, allowing technical debt to compound and competitive disadvantages to grow.

The Modernization Paradox The High Cost of Inaction in a Digital First World

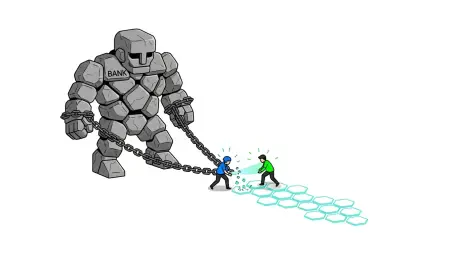

The decision to delay core modernization, while seemingly a prudent risk-mitigation strategy, creates a paradox where the cost of inaction eventually outweighs the risk of action. In a digital-first world, customer expectations are shaped by seamless experiences offered by fintech challengers and big tech firms. Banks shackled by legacy systems are fundamentally unable to compete on this new battleground. They struggle to launch innovative products, personalize services, or integrate with third-party ecosystems, leading to customer attrition and a steady erosion of market share.

Moreover, maintaining these decades-old systems is a significant and ever-increasing operational burden. Technical debt accumulates as developers create complex workarounds to make brittle infrastructure perform modern tasks, making each subsequent update slower and more expensive. This operational drag diverts critical resources away from innovation and toward simple maintenance, trapping banks in a vicious cycle of technological stagnation. The inability to deploy new capabilities like Banking-as-a-Service (BaaS) or build integrated super apps means missing out on entire new revenue streams, further widening the gap with more agile competitors.

A Two Pronged Solution Combining Front End Agility with Back End Resilience

To break this cycle of paralysis, 10x Banking and audax have formed a strategic alliance designed to offer a two-pronged solution that marries front-end agility with back-end resilience. The partnership leverages 10x’s robust, cloud-native core banking meta-platform, SuperCore, with audax’s proven expertise in rapidly deploying digital banking solutions. This collaboration provides a comprehensive framework for banks across the Asia Pacific, Europe, and the Middle East to accelerate their digital transformation journey safely and effectively.

Central to this approach is the principle of incremental modernization, which methodically avoids the “rip and replace” trap. Instead of a single, high-risk overhaul, banks can launch new digital products and services on the modern 10x platform while their legacy core continues to manage existing operations. This strategy allows institutions to systematically erase technical debt while simultaneously capturing new market share with innovative offerings like digital wallets, BaaS platforms, and super apps. New revenue generated from these modern services can then fund the gradual migration of the remaining legacy functions, creating a self-sustaining and de-risked transformation process.

Built on Trust The Proven Track Records of 10x and audax

The credibility of this joint offering is built upon the solid, real-world track records of both partners. 10x Banking’s platform is not a theoretical solution but a battle-tested engine trusted by some of the world’s leading tier-one financial institutions, including Chase UK, Westpac, and Old Mutual. The platform’s resilience and scalability are demonstrated by its performance metrics: it processes over a billion real-time transactions annually with 99.99% uptime, supports peak loads of 100,000 transactions per second, and has managed the onboarding of up to 60,000 customers in a single day.

Complementing this powerful back-end technology is audax’s deep in-market and regulatory expertise. Backed by industry giant Standard Chartered, audax brings an implicit understanding of the complex financial landscape. This is further evidenced by its recent selection by Maybank Islamic to spearhead its digital transformation initiative and its extensive experience delivering solutions for platforms that serve over 150 million users. This combination of a scalable core and seasoned deployment capability gives banks the confidence to embark on modernization with proven partners.

The New Playbook A Faster Smarter Path to Core Banking Transformation

This partnership fundamentally rewrites the playbook for core banking transformation. The traditional model of multi-year projects with massive upfront investment is replaced by a faster, more agile approach capable of delivering new digital banking capabilities in as little as six months. This dramatic acceleration in time-to-market changes the entire business case for modernization, turning it from a costly, long-term necessity into a near-term strategic advantage that can drive immediate growth and competitive differentiation.

By enabling this accelerated path, 10x and audax empower banks to effectively pursue high-growth markets and reach previously underserved customer segments with tailored digital products. The complexity of navigating diverse international regulatory environments is also addressed through a built-in “compliance-as-code” framework, which embeds regulatory requirements directly into the platform. This streamlined approach offers financial institutions a clear, lower-risk, and more cost-effective blueprint for achieving a digital future, ensuring they are equipped not just to survive but to lead in the evolving financial landscape.

The collaboration between 10x and audax redefined the roadmap for bank modernization. By offering a pragmatic, incremental pathway, it effectively dismantled the long-standing barriers of risk and cost that had stalled progress for so many institutions. This model provided a tangible solution to the industry’s modernization paradox, demonstrating that transforming a bank’s core was no longer an insurmountable obstacle but a strategic opportunity. The partnership ultimately established a new standard, proving that a future of digital agility and resilience was well within reach for banks willing to adopt a smarter, more strategic approach to their technological evolution.