Imagine a financial system where the rapid integration of cutting-edge digital assets with century-old banking frameworks creates a volatile mix, ready to detonate at the slightest misstep, reshaping global economics at an unprecedented pace. The convergence of cryptocurrency markets and traditional finance, often referred to as TradFi, carries profound dangers, as outdated risk models fail to grasp the unique, high-speed dynamics of crypto ecosystems. Institutional investments in digital currencies are soaring, amplifying exposure to systemic vulnerabilities. Liquidity mismatches, unchecked leverage, and the inability of conventional tools to adapt to real-time market shifts are brewing a potential crisis. The stakes couldn’t be higher, as a single shock could ripple across both sectors, threatening widespread instability. This exploration delves into the critical gaps in current financial systems and the urgent need for reform to avert disaster.

Bridging Two Worlds: The Growing Interconnection

The intertwining of crypto markets with traditional finance marks a transformative era, but it also lays bare significant structural flaws. As institutional players pour capital into digital assets, the bridges connecting these two realms are becoming increasingly strained. Conventional financial systems, built on slower settlement times and inherent liquidity buffers, are not equipped to handle the 24/7 trading frenzy of cryptocurrencies. This disconnect poses a severe threat, especially as market events demonstrate direct correlations between liquidity withdrawals in traditional systems and sharp declines in crypto indices. For instance, a projected $400 billion drain from key government accounts has already been linked to notable downturns in major crypto benchmarks. Without updated frameworks, these bridges risk collapsing under pressure, pulling both sectors into a downward spiral of volatility and loss that could reverberate globally.

Beyond the structural mismatch, the sheer scale of investment flowing between these domains heightens the potential for systemic failure. Billions in institutional funds are now tied to digital assets, creating a web of dependencies that traditional risk models cannot adequately assess. The rapid pace of crypto transactions, coupled with instantaneous liquidations, leaves little room for error or recovery. Industry experts have sounded alarms over Wall Street’s unpreparedness for the next market downturn, pointing to a dangerous overreliance on tools designed for a bygone era. The fragility of this integration is evident in recent market stress tests, where even minor liquidity shocks have triggered outsized reactions in crypto valuations. If left unaddressed, this growing interconnection could transform isolated disruptions into full-blown crises, underscoring the need for adaptive strategies that account for the unique challenges of digital finance.

Leverage: A Double-Edged Sword in Crypto Markets

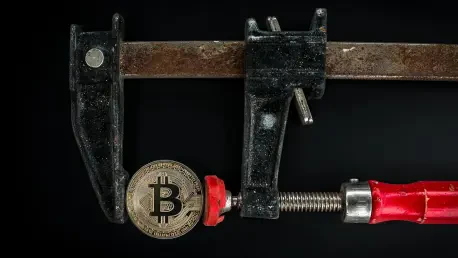

One of the most alarming aspects of the crypto landscape is the pervasive use of leverage, which amplifies both gains and losses with devastating potential. Institutional crypto treasuries have taken on staggering debt, with collateralized loans reaching tens of billions in recent quarters. Borrowing rates for popular assets like Ethereum have spiked to unsustainable levels, triggering deleveraging events that destabilize markets. Such high-stakes borrowing, often without the grace periods common in traditional finance, sets the stage for forced liquidations that can cascade into broader sell-offs. The risks are compounded by significant debt maturities looming over digital asset treasury companies, where rising interest costs could push vulnerable entities to the brink. This precarious balance threatens not just individual investors but the stability of the entire financial ecosystem.

Further intensifying the danger is the lack of robust safeguards to manage leveraged positions in times of crisis. Unlike traditional markets, where circuit breakers and regulatory oversight provide a buffer, the crypto space operates with minimal guardrails. Recent data highlights how quickly overleveraged positions can unravel, as seen in congestion issues within blockchain networks during high-stress periods. These events reveal a critical vulnerability: the speed at which liquidations occur leaves no time for corrective action, potentially igniting panic selling. The interconnected nature of crypto and TradFi means that such a spiral could drag traditional institutions into the fray, amplifying the damage. Addressing this issue demands a shift away from reckless borrowing practices and toward stricter risk management protocols tailored to the volatile nature of digital assets.

Liquidity Challenges and Market Fragility

Liquidity, or the lack thereof, stands as a central pillar of risk in the merging of crypto and traditional finance. Massive withdrawals from key financial reserves, orchestrated by central banks tightening monetary policies, have direct and immediate impacts on digital asset markets. With diminished tools to absorb shocks—such as shrinking reverse repo facilities—the broader system is left exposed to sudden volatility. Crypto markets, already prone to rapid price swings, bear the brunt of these liquidity crunches, as evidenced by sharp declines in major indices following government account drawdowns. The absence of adequate buffers means that even small disruptions can escalate into significant market events, highlighting a fragility that traditional models fail to predict or mitigate.

Compounding this challenge is the uncertainty surrounding how markets will react under intensified stress. While some large-scale asset sales have been absorbed without catastrophic outcomes, experts caution that a similar event during a panic could trigger a destructive selling spiral. The potential for a $10 billion liquidation to destabilize both crypto and TradFi underscores the urgent need for resilience in liquidity management. Investors are advised to prioritize assets with strong on-chain liquidity and avoid overleveraged entities with opaque funding structures. Hedging strategies and diversification through futures markets offer additional layers of protection against inherent volatility. Without proactive steps to bolster liquidity and update risk assessment tools, the financial system remains perilously close to a breaking point, where a single miscalculation could unleash widespread turmoil.

Path Forward: Building a Resilient Future

Reflecting on the mounting risks, it becomes clear that the financial landscape has been navigating uncharted territory with outdated maps. The warnings from industry leaders, coupled with stark data on leverage and liquidity, paint a sobering picture of a system teetering on the edge. Recent market movements have exposed the cracks in the integration of digital assets with traditional frameworks, revealing how swiftly isolated issues can escalate. The staggering scale of institutional debt and the fragility of liquidity buffers have underscored the urgency of reform, as past events demonstrate the devastating potential of unchecked vulnerabilities. Each tremor in the market serves as a reminder that time is not on the side of complacency.

Looking ahead, the focus must shift to actionable solutions that safeguard stability. Investors should prioritize assets backed by deep reserves, such as certain stablecoins and exchange-traded funds, while steering clear of overleveraged entities. Regulators and institutions need to collaborate on developing risk models that capture the real-time dynamics of crypto markets, abandoning obsolete 20th-century tools. Enhancing transparency in digital asset treasuries and enforcing stricter leverage limits could prevent cascading failures. Moreover, building robust liquidity mechanisms to weather sudden shocks will be critical in averting crises. The path to resilience lies in embracing innovation while respecting the lessons of financial history, ensuring that the transformative power of cryptocurrencies strengthens rather than undermines global markets.