The once-staid halls of European wealth management now echo with an urgent digital hum, signifying that the industry has irrevocably crossed a threshold where evolution has become a revolution. A convergence of persistent market instability, stringent regulations, and sophisticated client expectations has forced firms to a defining moment: fundamentally reinvent their value proposition or risk obsolescence.

A Digital Revolution or an Existential Crisis

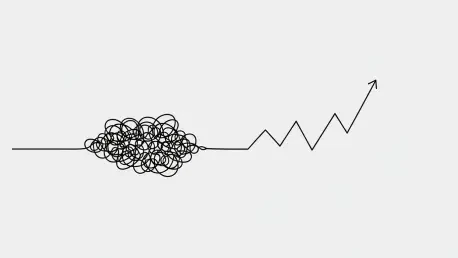

For Europe’s wealth managers, the current landscape represents a critical inflection point. The strategies that secured success for decades, built on personal relationships and periodic reviews, are proving insufficient in an environment demanding real-time data and proactive communication. This is not merely a question of adopting new tools; it is an existential challenge forcing firms to either embrace a digital-first paradigm or face shrinking margins and declining client loyalty.

The Perfect Storm Forcing a Digital Reckoning

Sustained market volatility has been a primary catalyst, eroding client confidence and making the traditional annual review inadequate. Investors now demand clear, ongoing communication that explains market movements, a need best met through digital platforms. At the same time, rising regulatory pressures for greater transparency have accelerated the adoption of modern WealthTech solutions that automate compliance far more efficiently than outdated manual processes.

The most powerful force, however, is the dramatic shift in client expectations. The demand for intuitive digital interfaces and on-demand information, once limited to younger investors, is now the standard across all demographics. The “premium” experience is no longer defined by high-touch gestures but by the quality and seamlessness of a firm’s digital ecosystem.

The Three Pillars of the New Wealth Paradigm

Leading firms are mastering this new environment by translating data overload into digital clarity. They leverage technology to provide curated, understandable insights that empower clients and build confidence. This redefines the premium experience, shifting focus from personal gestures to high-quality digital interactions, from frictionless onboarding to genuinely personalized portfolio construction based on an individual’s evolving goals.

Artificial intelligence has emerged as the essential co-pilot for the modern advisor. Rather than replacing human expertise, AI-driven tools are amplifying it by automating low-value tasks like research and documentation. This frees advisors to focus on high-value, strategic client engagement, enabling them to deliver hyper-relevant advice at a scale previously unimaginable.

A View from the Vanguard on Why Transformation Is No Longer Optional

According to industry experts like Ralf Heim, co-CEO of fincite, mastering these interconnected trends is non-negotiable for survival. A holistic strategy integrating digital clarity, a redefined premium experience, and AI-powered efficiency has become the primary differentiator in the hyper-competitive European market. A piecemeal approach to technology is no longer viable; firms that fail to integrate these pillars will simply be outmaneuvered.

The Playbook for Scalable and Personalized Advisory

The most successful wealth managers have abandoned the outdated model of periodic client interactions for a playbook built on continuous digital engagement. This proactive approach nurtures the client relationship through a constant, value-added digital dialogue. Integrating digital excellence, deep personalization, and an AI-supported model has become the definitive framework for lowering client churn, building loyalty, and meeting the complex demands of the modern investor.

The decisive moment for European wealth management has passed. Firms that acted decisively to build an integrated digital advisory model have already pulled away from the pack. They succeeded by transforming data into trust, redefining service through technology, and empowering advisors with intelligent tools. For the rest, the challenge was no longer about catching up; it was confronting the reality of a new industry standard they were unprepared to meet.