The immense potential of artificial intelligence to revolutionize personal finance has long been shadowed by the critical question of whether it can operate within the stringent legal frameworks designed to protect investors. In South Korea, a groundbreaking partnership between a financial giant and an AI pioneer is providing a definitive answer. Meritz Securities is collaborating with WNSTN to launch a new digital investment service, embedding advanced, compliant AI to bridge the gap between technological innovation and unwavering regulatory adherence.

The Digital Finance Dilemma of Innovation vs Protection

Across the globe, financial institutions are in a race to integrate AI for automating services and providing personalized investment advice. However, this push for innovation often collides with a formidable regulatory roadblock. Financial laws, meticulously crafted to safeguard consumers from risk and misinformation, can inadvertently slow the adoption of new technologies that do not have built-in compliance checks.

This challenge is particularly pronounced in South Korea, a market characterized by its highly tech-savvy population and a robust regulatory environment. The nation’s investors are eager for digital-first solutions, yet its financial authorities demand the highest standards of protection. This unique dynamic makes it the ideal environment to develop and launch an AI solution engineered from its core to respect and uphold complex financial rules.

Forging a New Path with the Meritz WNSTN Alliance

The alliance pairs Meritz Securities, a dominant force in South Korea’s retail trading and investment landscape, with WNSTN, a global leader in providing infrastructure-grade, AI-powered financial intelligence. The collaboration centers on embedding WNSTN’s sophisticated AI directly into a new digital investment platform from Meritz, which launches this year.

This next-generation service is designed to deliver a superior user experience through several key features. It will provide real-time, intelligent responses to client inquiries, deliver complex investment knowledge at scale, and create hyper-personalized interactions across all digital touchpoints. The platform adapts to an individual’s goals and risk tolerance, offering tailored insights rather than generic advice. For Meritz, this marks a strategic move, positioning it as the first major Korean financial institution to adopt such a pioneering compliant AI solution.

A Shared Vision for the Future of AI Driven Finance

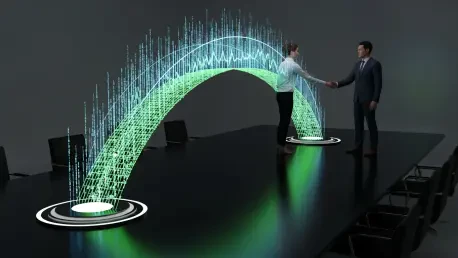

Leadership from both Meritz and WNSTN have expressed a unified perspective: the future of digital finance depends not just on smarter technology, but on safer, more trustworthy technology. The core belief driving the partnership is that combining advanced AI capabilities with steadfast compliance is the only sustainable path forward for the industry.

This shared mission is to deliver an exceptional and deeply personalized digital experience that actively builds investor confidence. By ensuring the AI operates within regulatory boundaries, the service aims to demystify financial markets and empower users. The goal is to transform the client relationship from a transactional one to a trusted partnership grounded in transparency and intelligent guidance.

Tangible Benefits for the Everyday Investor

For the average investor, this service translates into achieving unprecedented market clarity. The platform’s AI is engineered to distill vast amounts of market data and complex financial concepts into accessible, actionable insights. This empowers users to move beyond simple buy-and-sell transactions and begin making strategically sound decisions aligned with their long-term objectives.

Furthermore, the power of hyper-personalization unlocks a distinct competitive edge for each user. The service learns and adapts to an individual’s financial behavior, risk appetite, and stated goals, providing proactive alerts and opportunities. Instead of merely reacting to market events, investors gain the tools to anticipate potential shifts and act with greater confidence and precision.

The New Standard for Compliant AI in Finance

The successful launch of this AI-driven platform by Meritz and WNSTN established a critical benchmark for the financial industry. It demonstrated conclusively that advanced technological innovation does not have to exist in opposition to stringent regulatory oversight. This initiative provided a working blueprint for integrating AI with compliance at its core, rather than treating it as an afterthought. This venture addressed the foundational dilemma of modern digital finance and set a new standard for how technology can responsibly empower the next generation of investors.