Imagine a world where managing personal investments is as intuitive as streaming a favorite show, accessible to anyone with a smartphone and a dollar to spare. This is no longer a distant vision but a reality shaped by self-service investment tools, a transformative force in wealth management. These digital platforms have empowered millions of retail investors to take control of their financial destinies, bypassing traditional barriers like high fees and complex advisory processes. With retail investors now accounting for a significant portion of daily equity trading, the impact of these tools is undeniable. This review delves into the capabilities, trends, and challenges of self-service investment platforms, offering a comprehensive look at how they are reshaping the financial landscape for both individuals and firms.

The Emergence of Self-Service Investment Platforms

Self-service investment tools have risen as a response to a growing demand for autonomy and accessibility in personal finance. These platforms, often dubbed do-it-yourself (DIY) or self-directed investing solutions, enable users to manage portfolios without relying on traditional financial advisors. Historically, wealth management was an exclusive domain, reserved for the affluent and guided by human intermediaries. Today, technology has shifted this paradigm, making investing available to a broader audience through digital interfaces that prioritize ease and affordability.

The relevance of these tools cannot be overstated in a digitally driven era. A notable trend shows that a substantial percentage of investors, particularly younger demographics, prefer managing at least part of their investments independently. This shift reflects not just a technological advancement but a cultural change toward empowerment and transparency. As digital natives continue to dominate the investor pool, self-service tools are becoming a cornerstone of modern financial strategies, challenging industry norms and setting new expectations for convenience.

Key Features That Define the Technology

Intuitive and Accessible Interfaces

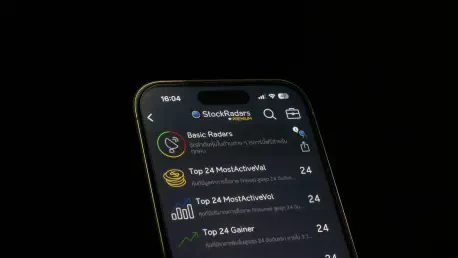

One of the standout attributes of self-service investment platforms is their user-friendly design, tailored to reduce intimidation for newcomers. Platforms like Robinhood and Wealthsimple exemplify this with mobile-first applications that boast seamless navigation and minimal entry requirements, allowing investments to start with as little as a single dollar. Such accessibility breaks down long-standing barriers, inviting users from varied economic backgrounds to engage with financial markets confidently.

Beyond just simplicity, these interfaces are engineered to enhance user interaction. Real-time updates, clear visual dashboards, and straightforward transaction processes ensure that even those with limited financial knowledge can participate. This democratization of access is a game-changer, fostering a sense of inclusion and encouraging consistent engagement with personal investments.

Cost Efficiency as a Core Advantage

Another defining feature is the cost-effectiveness that self-service tools bring to the table. By eliminating or drastically reducing fees associated with traditional advisory services, these platforms make investing financially viable for a wider audience. The absence of commissions and low operational costs appeal to budget-conscious individuals who might otherwise be deterred by high entry costs.

This affordability also benefits wealth management firms by enabling scalability. With digital tools handling routine transactions, firms can reach a larger client base without proportional increases in overhead. The result is a mutually beneficial model where investors save on costs while firms expand their market presence efficiently, proving that technology can align individual and corporate interests.

Trends Fueling the Adoption Surge

The popularity of self-service investment tools is driven by several converging trends that reflect changing investor behaviors. A significant portion of investors, especially in regions like Canada, now manage some form of self-directed investments, showcasing a clear preference for control over financial decisions. This trend is amplified by a demand for transparency, where users seek to understand every aspect of their investment journey without the filter of an advisor.

Digital expectations play a crucial role as well, with younger generations accustomed to instant, on-demand services expecting the same from their financial tools. The desire for real-time access to portfolios and market data has pushed platforms to prioritize speed and responsiveness. Additionally, the emergence of hybrid models—combining self-service with optional advisory support—indicates a nuanced evolution, catering to those who value independence but occasionally need expert input.

A deeper look reveals that societal shifts toward financial education and experimentation are also key drivers. Many users view these platforms as safe spaces to learn and test strategies without high stakes or external pressure. This educational aspect, often integrated into the tools themselves, underscores their role not just as transactional hubs but as learning environments that foster long-term financial literacy.

Real-World Impact Across Demographics

The practical applications of self-service investment tools span a wide range of users and scenarios, demonstrating their versatility. Retail investors, now a formidable force in daily US equity trading, use these platforms to build portfolios that reflect personal goals and values, whether prioritizing sustainable investments or high-growth opportunities. This alignment with individual priorities marks a significant departure from the one-size-fits-all approach of traditional models.

Beyond personal use, these tools have found unique applications in educational settings, where they serve as resources for teaching financial concepts. Interactive features allow novice investors to simulate trades and understand market dynamics without risking substantial capital. Such initiatives highlight the broader societal benefit of these platforms, equipping future generations with essential skills for economic independence.

Their impact on wealth management firms is equally profound, enabling a shift in focus from manual client handling to strategic growth. By automating routine tasks, firms can allocate resources to high-value advisory services while maintaining engagement with a diverse clientele. This dual benefit illustrates how self-service tools are not just empowering individuals but also redefining operational efficiencies in the industry.

Challenges and Limitations to Address

Despite their advantages, self-service investment platforms are not without drawbacks that warrant careful consideration. A primary concern is the risk of emotional or impulsive decisions, where users, lacking professional guidance, may chase trends or react poorly to market volatility. Such behaviors can lead to suboptimal outcomes, undermining the very autonomy these tools aim to provide.

Information overload poses another challenge, particularly for beginners overwhelmed by the sheer volume of data and options available. Without structured support, navigating complex financial products or long-term planning—like tax strategies or retirement goals—can be daunting. This gap highlights a critical need for better design and integrated resources to guide users through intricate decisions.

Technical and usability issues also persist, with some platforms failing to balance simplicity with depth. Efforts to address these limitations are underway, including enhanced user education modules and the integration of advisory support within digital frameworks. While progress is evident, ensuring that self-service tools cater to both novice and experienced investors remains a pressing priority for developers and firms alike.

The Future Role of Artificial Intelligence

Looking ahead, artificial intelligence (AI) stands poised to elevate self-service investment tools to new heights of personalization and efficiency. By analyzing vast datasets, AI can offer tailored market insights and predictive analytics, helping users make informed choices without the burden of extensive research. Natural language processing further enhances this by enabling chat assistants to provide instant, conversational guidance.

The potential for AI extends to adaptive user experiences, where platforms evolve based on individual behaviors and preferences. This dynamic customization can mitigate risks like decision fatigue or misinformed choices, offering suggestions that align with long-term goals. As AI technology matures, its integration promises to transform these tools from mere transactional aids into comprehensive financial companions.

For wealth management firms, AI-driven self-service tools represent an opportunity to deepen client relationships while maintaining scalability. The ability to deliver continuous, personalized engagement without human intervention could redefine customer expectations, pushing firms to innovate relentlessly. This technological frontier suggests a future where autonomy and expertise coexist seamlessly within digital ecosystems.

Final Thoughts and Next Steps

Reflecting on this exploration, it becomes clear that self-service investment tools have carved a significant niche in wealth management, driven by their accessibility and cost efficiency. Their ability to empower retail investors while offering scalability to firms marks a pivotal shift in how financial services are delivered and perceived. Yet, the journey reveals challenges, from emotional decision-making to the need for robust user education, that temper unchecked enthusiasm.

Moving forward, stakeholders should prioritize integrating educational resources and AI-driven personalization to address existing gaps. Wealth management firms must consider hybrid models that blend self-service with advisory support, ensuring users have access to guidance when needed. Developers, on the other hand, should focus on refining interfaces to balance simplicity with comprehensive functionality, preventing information overload.

Ultimately, the path ahead involves a collaborative effort to harness technology for greater financial inclusion. By investing in user-centric design and innovative features, the industry can ensure these tools not only democratize investing but also sustain trust and long-term engagement among diverse investor groups. This balanced approach emerges as the key to unlocking the full potential of self-service platforms in reshaping wealth management.