Kofi Ndaikate is well-versed in the dynamic world of Fintech. His expertise spans various industry areas, from blockchain and cryptocurrency to regulation and policy. In this interview, Ndaikate shares insights into the newly launched composable banking platform Akkuro by Topicus, its integration capabilities, technical nuances, innovative aspects, and the long-term vision for financial institutions using such advanced technology.

Can you tell us what Akkuro is and why Topicus decided to launch this new platform?

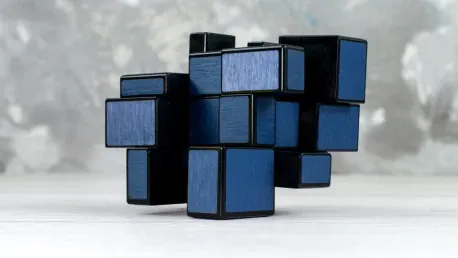

Akkuro is a composable banking platform launched by Topicus, designed to revolutionize how financial institutions innovate, scale, and serve their customers. The launch of Akkuro signifies Topicus’ strategic consolidation of its robust products from Five Degrees, like Matrix CRM and Neo Core Banking, along with finance solutions such as Fyndoo Lending and solutions within the Mortgages, Pension & Wealth, and Connected Finance domains. This new platform aims to present a cohesive, modular, end-to-end financial technology proposition to the global market, emphasizing agility, personalization, and speed in delivering financial services.

What inspired the name “Akkuro” for this platform?

The name “Akkuro” was inspired by the platform’s ambition to act as a strong, cohesive force within the financial technology space. It represents a convergence of advanced technologies unified under one powerful brand, highlighting Topicus’ commitment to delivering innovative and scalable financial solutions that resonate with the evolving needs of the market.

How does Akkuro integrate the capabilities of Five Degrees, such as Matrix CRM and Neo Core Banking products?

Akkuro seamlessly integrates the advanced functionalities of Five Degrees’ offerings, including Matrix CRM and Neo Core Banking products. These comprehensive tools provide robust solutions for managing customer relationships and core banking operations, ensuring financial institutions can leverage a unified platform to address their needs. This integration enhances the platform’s capability to deliver modular and cohesive financial services.

Could you explain how Fyndoo Lending and other Topicus finance solutions are incorporated into Akkuro?

Fyndoo Lending and other Topicus finance solutions are embedded within Akkuro to provide a comprehensive suite of lending services. These solutions cater to different aspects of the financial lifecycle, such as loan origination, documentation, and management, creating a seamless experience for institutions looking to streamline their lending operations while maintaining compliance and efficiency.

What solutions within Mortgages, Pension & Wealth, and Connected Finance domains are integrated into Akkuro?

Akkuro incorporates specialized solutions within the Mortgages, Pension & Wealth, and Connected Finance domains to offer a well-rounded platform. This integration ensures that financial institutions can access a wide array of services, from mortgage management and retirement planning to integrated financial products, all within a single ecosystem, thereby simplifying operations and enhancing service delivery.

How does Akkuro ensure effortless interoperability with existing financial infrastructure?

Effortless interoperability is one of Akkuro’s key strengths. The platform’s composable architecture allows it to integrate smoothly with existing financial systems without disruption. By adopting open standards and flexible technology frameworks, Akkuro can adapt to various legacy systems, ensuring that institutions can enhance their current infrastructure without extensive overhauls.

Can you provide examples of how Akkuro’s composable architecture adapts to changes and integrates with legacy systems?

Akkuro’s composable architecture is designed to be modular, which means that financial institutions can selectively implement different components as needed. For example, a bank can integrate Akkuro’s CRM solution alongside its existing core banking system, gradually adapting other modules like lending or wealth management as necessary. This provides a clear path for incremental upgrades and continuous adaptation to technological advancements.

How does the platform minimize vendor dependency?

The platform minimizes vendor dependency through its modular design, which allows financial institutions to integrate only the components they need while maintaining the flexibility to switch or upgrade individual modules. By leveraging open APIs and standardized interfaces, Akkuro ensures that financial institutions are not locked into a single vendor, providing the freedom to choose the best solutions for their needs.

What does it mean when you say Akkuro supports the full spectrum of financial services?

Supporting the full spectrum of financial services means that Akkuro covers a wide range of banking activities, from lending and payments to wealth and investment management. The platform provides end-to-end services that cater to the entire financial lifecycle, enabling institutions to manage all their operations within a single comprehensive ecosystem.

Can you elaborate on how Akkuro covers the entire banking lifecycle, from investments and core banking to CRM for banks and lending?

Akkuro covers the banking lifecycle by offering integrated modules that address specific areas of financial services. From investment management and core banking functionalities to customer relationship management and lending, Akkuro provides tools designed to handle each phase comprehensively. This includes initial customer acquisition, through CRM tools, to servicing loans, managing investments, and ensuring efficient core banking operations.

In what ways does Akkuro represent a paradigm shift in banking technology?

Akkuro represents a paradigm shift in banking technology by embracing a composable, modular design that emphasizes speed, flexibility, and personalization. Traditional banking platforms often rely on monolithic structures, while Akkuro’s approach allows financial institutions to rapidly develop and deploy innovative customer-centric solutions. This shift empowers banks with greater control and adaptability in an ever-evolving financial landscape.

How does Akkuro empower banks and fintechs to create customer-centric financial solutions quickly?

Akkuro empowers banks and fintechs through its agile, modular architecture, which allows for rapid development and deployment of tailored solutions. This enables institutions to respond quickly to market demands and customer needs, ensuring they can deliver personalized and efficient financial services. The platform’s flexibility also supports iterative development and continuous improvement, fostering innovation.

What makes Akkuro’s technology future-proof in relation to evolving customer expectations and regulatory landscapes?

Akkuro’s technology is future-proof due to its composable design and adherence to industry standards, which facilitate adaptation to new regulations and changing customer expectations. The architecture allows for seamless integration of new technologies and compliance mechanisms, ensuring that financial institutions can evolve and scale their operations without significant disruptions.

What long-term vision does Topicus have for Akkuro in the financial services industry?

The long-term vision for Akkuro is to position it as the leading platform in financial technology, fostering innovation and resilience within the industry. Topicus aims to continuously enhance the platform’s capabilities, ensuring it remains at the forefront of technological advancements and supports financial institutions in delivering superior, future-ready services.

How does Akkuro aim to position financial institutions to lead with resilience, relevance, and purpose?

Akkuro aims to position financial institutions to lead with resilience, relevance, and purpose by providing a robust, adaptable platform that addresses current and future challenges. By ensuring seamless integration, compliance, and customer-centric solutions, Akkuro helps institutions remain relevant and impactful in a competitive market.

In what ways do you see Akkuro acting as a catalyst for meaningful change in financial services?

Akkuro acts as a catalyst for meaningful change by enabling financial institutions to innovate rapidly and efficiently. The platform’s flexibility and comprehensive coverage allow institutions to meet evolving needs and expectations, driving advancements in customer service, operational efficiency, and regulatory compliance.

How has the initial feedback been from financial institutions or early adopters using Akkuro?

The initial feedback from financial institutions and early adopters has been overwhelmingly positive. Many have praised Akkuro for its ease of integration, flexibility, and the ability to quickly deploy tailored solutions. This positive reception underscores the platform’s effectiveness in addressing the dynamic needs of the financial sector.

What kind of customer experiences and benefits do you expect Akkuro to deliver?

We expect Akkuro to deliver enhanced customer experiences by facilitating personalized and efficient financial services. The platform’s modular nature allows financial institutions to tailor solutions to individual needs, improving customer satisfaction. Additionally, the streamlined operations and robust integration capabilities promise to enhance overall service delivery and operational efficiency.

Do you have any advice for our readers?

My advice for readers, especially those in the financial sector, is to embrace technological advancements and the potential they hold for innovation. Staying adaptable and open to new, modular solutions like Akkuro can position your institution to lead and thrive in an evolving market.