As global leaders and innovators convene, the conversation around digital finance has decisively shifted from theoretical potential to practical implementation, making the integration of cryptocurrency into mainstream business operations a central theme of economic strategy. For small and medium-sized enterprises (SMEs), this transition represents both a formidable challenge and an unprecedented opportunity. The rapidly evolving landscape of digital assets, coupled with an increasing demand for regulatory clarity, requires businesses to adapt with agility and foresight. Navigating this new frontier involves more than just adopting new technology; it necessitates a deep understanding of practical strategies for incorporating crypto solutions, leveraging blockchain for streamlined payroll systems, and viewing regulatory compliance not as a barrier, but as a powerful catalyst for innovation and growth. The decisions made now will determine which businesses are poised to lead in the reshaping of the global economy.

1. The Critical Role of Compliance in Crypto Payroll

In the fast-paced and ever-evolving world of digital assets, compliance has transcended its traditional role as a mere regulatory hurdle to become a fundamental driver of sustainable innovation. For SMEs considering the adoption of cryptocurrency for payroll and other financial operations, a thorough grasp of the regulatory landscape is not just advisable; it is absolutely crucial. The current discourse underscores the necessity of building a strong compliance framework as the cornerstone of any crypto strategy. This proactive approach ensures that businesses can successfully navigate the intricate web of global regulations while simultaneously unlocking the significant advantages offered by blockchain technology. By treating compliance as a strategic imperative, SMEs can build a resilient operational model that fosters trust among employees, investors, and regulatory bodies, positioning themselves as responsible pioneers in a new financial era.

The emergence of comprehensive regulatory frameworks, such as the European Union’s Markets in Crypto-Assets (MiCA) regulation and the United States’ clarifying legislation, is providing a more structured and predictable environment for the use of digital currencies in business. These regulations offer much-needed legal clarity and are actively encouraging the use of stablecoins for payroll, thereby mitigating the substantial risks associated with the price volatility of traditional cryptocurrencies. By leveraging stablecoins, which are pegged to stable assets like the U.S. dollar, SMEs can provide employees with the benefits of crypto—such as faster transaction speeds and lower fees—without exposing their compensation to market fluctuations. Placing compliance at the forefront of their strategy allows SMEs to not only adhere to legal requirements but also to build profound stakeholder trust and solidify their reputation as forward-thinking leaders in the digital economy.

2. Actionable Strategies for SME Crypto Adoption

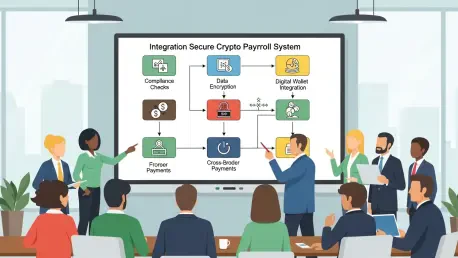

To effectively integrate crypto solutions, SMEs must begin by investing in the education and training of their staff, as a foundational understanding of blockchain technology and cryptocurrency is non-negotiable for successful implementation. Comprehensive training programs empower teams across all departments, from finance to human resources, to navigate this new financial landscape with confidence and competence. Simultaneously, the adoption of blockchain for payroll operations can revolutionize internal processes by significantly reducing transaction costs, shortening payment cycles, and enhancing transparency through an immutable ledger. This dual approach not only boosts operational efficiency but also cultivates an image of the business as a progressive and technologically advanced employer, which is a powerful asset in attracting and retaining top-tier talent in a competitive global market. A well-informed team is the first line of defense against risks and the primary driver of innovation from within.

Beyond internal readiness, SMEs must develop robust external strategies centered on compliance and collaboration to ensure a smooth and secure transition into the crypto space. This involves actively partnering with legal and tax experts who specialize in digital assets to establish clear and effective compliance protocols. These protocols are essential for navigating complex regulations, particularly those concerning Anti-Money Laundering (AML) and Know Your Customer (KYC) requirements, which are critical for preventing illicit activities. Furthermore, selecting a reliable and highly secure crypto payment platform is paramount for simplifying transactions and facilitating seamless cross-border payments. For businesses with international teams, this capability is transformative. Finally, continuous engagement with industry leaders and peers through participation in key events and forums provides SMEs with invaluable opportunities to gather insights, learn best practices, and build a network of support for their crypto adoption journey.

3. The Future of Global Payroll and Remote Work

As businesses continue to expand their operations globally, the demand for efficient, secure, and cost-effective cross-border payroll solutions has become more pressing than ever. Traditional financial systems, such as SWIFT, have long been the standard, but they are increasingly showing their age, often hampered by slow processing times, high transaction fees, and a reliance on multiple intermediaries. These limitations make them poorly suited for the dynamic, fast-paced nature of modern digital finance. In stark contrast, blockchain technology has emerged as a superior alternative, offering the capability for real-time, peer-to-peer transactions at a fraction of the cost. By leveraging blockchain for payroll, SMEs can eliminate intermediaries, dramatically accelerate payment processing, and enhance security through decentralized verification, all while maintaining compliance with international regulations.

The paradigm shift toward remote work has fundamentally altered the global employment landscape, granting companies unprecedented access to a diverse and geographically distributed talent pool. In this new reality, crypto salaries are rapidly gaining popularity as an innovative and practical solution for managing a global workforce. Offering compensation in cryptocurrency not only simplifies the complex logistics of cross-border payments but also serves as a powerful recruitment tool, attracting top talent who value flexibility and cutting-edge technology. This approach positions SMEs as forward-thinking and adaptable employers, capable of meeting the demands of the modern workforce. However, this innovation must be balanced with a diligent approach to regulatory compliance, as navigating the diverse and often complex tapestry of international tax laws and labor regulations is essential to ensure that both the company and its employees remain fully compliant in their respective jurisdictions.

4. A Concluding Look at Financial Evolution

The extensive discussions and strategic planning that took place underscored a fundamental shift in the global financial system. It was evident that the integration of cryptocurrency into the economy was no longer a speculative future but a present-day reality demanding immediate attention and action. For small and medium-sized enterprises, the path forward was clarified: proactive adoption of practical digital asset strategies, combined with an unwavering commitment to navigating the complex compliance landscape, emerged as the definitive formula for success. The insights shared revealed that those businesses willing to embrace this transformation were not merely adapting to change but were actively positioning themselves to become leaders. This strategic approach provided a clear and actionable roadmap for thriving in an ever-evolving financial world, ensuring that innovation and responsibility went hand in hand.