The story of a single, pseudonymous trader earning an astounding $2.2 million on the prediction platform Polymarket in roughly two months has sent ripples through the financial technology world, illustrating a seismic shift in trading methodologies. Operating under the name "ilovecircle," this

The line separating traditional financial markets from the burgeoning digital asset economy has become increasingly indistinct with the introduction of two highly specialized exchange-traded funds from the asset management firm Amplify. These new financial instruments, which have officially

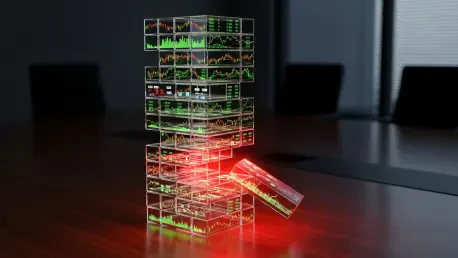

As the 2026 holiday season approaches, a current of unease is running beneath the surface of an otherwise bullish cryptocurrency market, with recent analysis indicating that several prominent altcoins are teetering on the edge of significant liquidation events. A dangerous cocktail of surging open

Canada is embarking on a dramatic overhaul of its anti-money laundering framework, introducing financial penalties of a scale previously unimaginable in the country's regulatory landscape. With new legislation poised to increase fines for non-compliance by a factor of forty, the government is

A Strategic Pivot: Blending Traditional Capital with Digital Ambition Japanese firm Metaplanet is pioneering a new chapter in corporate finance, demonstrating how the time-tested tools of traditional markets can fuel a decidedly futuristic Bitcoin acquisition strategy. Following a significant 4.16%

The European Central Bank has initiated a profound and strategic overhaul of the continent's financial infrastructure, decisively embracing blockchain and distributed ledger technology (DLT) to forge a new path forward. This comprehensive transformation represents a pivotal move away from