The Nordic online gaming landscape is currently undergoing a profound transformation, driven not by a new type of game but by a fundamental shift in how money moves between players and platforms. In a region defined by its advanced digital infrastructure and sky-high consumer expectations, the

The American mortgage industry, a foundational pillar of the national economy, is now confronting an insidious and rapidly escalating threat where sophisticated artificial intelligence is being weaponized to exploit systemic vulnerabilities in its cyber defenses. This is not a distant, theoretical

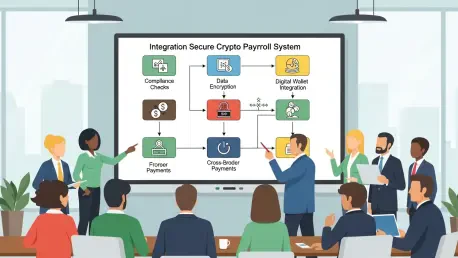

As global leaders and innovators convene, the conversation around digital finance has decisively shifted from theoretical potential to practical implementation, making the integration of cryptocurrency into mainstream business operations a central theme of economic strategy. For small and

South Korea's rigorous regulatory framework for digital assets has once again demonstrated its teeth, as the nation's fourth-largest cryptocurrency exchange, Korbit, faces a substantial fine of approximately $1.9 million for extensive violations of anti-money laundering laws. The Financial

Financial institutions are navigating an increasingly complex regulatory landscape where the sheer volume of compliance obligations can strain resources and hinder customer onboarding. The traditional, one-size-fits-all approach to customer due diligence often proves both inefficient and

A substantial €2.6 million fine levied by De Nederlandsche Bank (DNB) has ignited a high-stakes confrontation with the Dutch fintech Bunq, moving beyond a simple penalty to establish a crucial test case for the role of Artificial Intelligence in the fiercely regulated world of Anti-Money Laundering