The rapid evolution of Africa's digital economy has reached a pivotal juncture, marked not by the launch of a new disruptive startup but by the strategic union of two of its most influential technology players. In a move that sends ripples across the continent's burgeoning financial technology

The definitive entry of a global professional services titan like PricewaterhouseCoopers (PwC) into the digital asset space represents far more than a simple expansion of services; it is a profound validation of the cryptocurrency market's evolution from a niche interest into a formidable component

In a defining moment for Africa's burgeoning financial technology sector, the all-stock acquisition of Nigerian open banking startup Mono by payments behemoth Flutterwave has sent ripples across the continent, signaling a new era of strategic consolidation. This transaction, valued between $25

The long-standing partitions separating daily operations from financial management are rapidly dissolving, giving way to a seamlessly integrated ecosystem where intelligent, automated systems are no longer a luxury but a fundamental prerequisite for competitive survival. For small and medium-sized

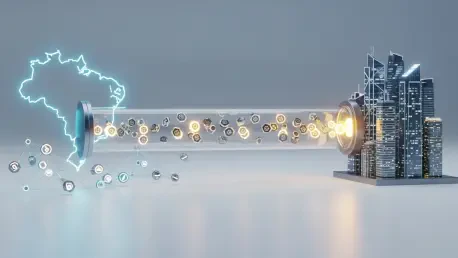

A New Blueprint for Emerging Market Investment? For decades, institutional investors have viewed emerging markets as a double-edged sword: a source of high potential growth hamstrung by equally high perceived risk. A groundbreaking new financial structure, however, may be poised to change that

A recent and perplexing US jobs report has sent ripples through financial markets, simultaneously showing slower-than-expected job creation and a falling unemployment rate, creating a perfect storm of uncertainty that has investors flocking to the historical safety of precious metals. This