In a landscape where financial regulators often face intense scrutiny, the Securities and Exchange Commission of Pakistan (SECP) finds itself at the center of a contentious debate with the Auditor General of Pakistan (AGP) over the latest Consolidated Audit Report for the current fiscal year.

In the ever-evolving landscape of auto finance, fraud remains a persistent threat that challenges even the most established players in the industry, demanding innovative strategies and collaborative efforts to stay ahead of sophisticated schemes. As financial institutions grapple with emerging

In a financial landscape where balancing income and growth remains a persistent challenge for many Canadian investors, a notable development has emerged to address these needs with innovative solutions. CIBC Asset Management Inc., a subsidiary of one of Canada’s leading financial institutions, has

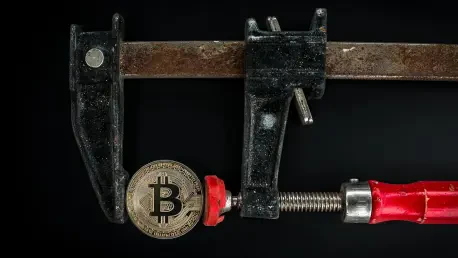

Imagine a financial system where the rapid integration of cutting-edge digital assets with century-old banking frameworks creates a volatile mix, ready to detonate at the slightest misstep, reshaping global economics at an unprecedented pace. The convergence of cryptocurrency markets and

As the U.S. economy navigates through the early months of 2025, a palpable sense of anticipation surrounds the Federal Reserve’s potential decision to cut interest rates, a move that could fundamentally alter the financial terrain for businesses and consumers alike. Fed Chair Jerome Powell’s recent

The intersection of cryptocurrency and traditional finance has reached a pivotal moment, where the rapid evolution of digital assets is exposing critical vulnerabilities in long-standing banking systems, and as more mainstream financial institutions dip their toes into the crypto market, the risks