Executing a core banking data migration following a major bank merger is one of the most high-stakes operations in the financial technology landscape, where even the smallest error can trigger cascading operational failures and erode customer trust. When United Bank Limited (UBL) undertook the

In an age dominated by digital transactions and mobile payments, the paper check seems like a relic of a bygone era, yet it has become the focal point for a startling and sophisticated resurgence in financial crime. While the volume of checks written by consumers and businesses has steadily

Once considered the last bastion of relationship-driven, voice-brokered execution, the fixed income market is now undergoing a seismic digital transformation that is fundamentally reshaping its structure and operational dynamics. The conversation has shifted from whether electronification will take

A Strategic Play for the Heart of Latin America's Fastest-Growing Market In the fiercely competitive global smartphone and AI device market, simply having a superior product is no longer enough to ensure success. True market penetration, especially in high-growth emerging economies, demands a deep

A seismic financial shift is underway as Wall Street's technology budgets are not just increasing but fundamentally reallocating toward artificial intelligence at an unprecedented rate. This transformation marks a definitive move away from cautious exploration and into a new era of strategic

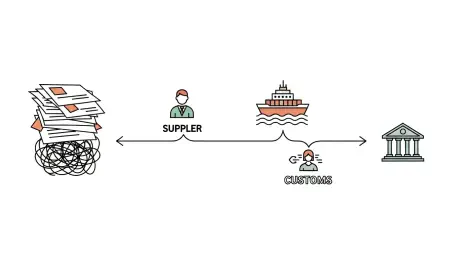

Global trade continues to be heavily reliant on antiquated paper-based processes, a reality that locks away an estimated $2.5 trillion in capital that could otherwise be fueling economic growth, according to a 2024 report from the Asian Development Bank. For years, couriers have shuttled bills of