The long-held corporate playbook for surviving market shocks has been rendered obsolete, replaced by a strategic framework where organizations are not just weathering storms but actively harnessing their energy for growth. In the current business landscape, success is no longer measured by the

In a landscape saturated with one-click purchasing and instant credit offers promising immediate gratification, a surprisingly traditional and deliberate payment method has been quietly re-emerging from the retail archives. This resurgence is not driven by a sense of nostalgia but by a calculated

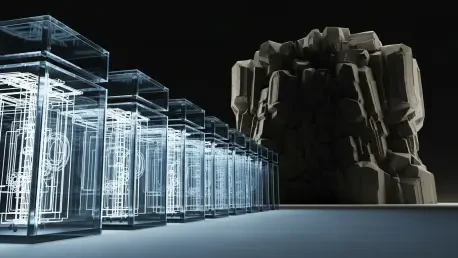

The successful digital transformation of trade finance operations hinges on replacing fragmented legacy infrastructure with unified, intelligent platforms that can support global business at scale. This review explores the evolution of PT. Bank Negara Indonesia's (BNI) trade finance operations

The era of one-size-fits-all financial roadmaps is rapidly drawing to a close, replaced by a new paradigm of predictive, real-time advice that anticipates a client's needs before they even arise. As the wealth management industry undergoes this radical transformation, hyper-personalization is

Beneath the calm surface of the global financial system lies a delicate equilibrium, with the world's banking sector navigating a landscape defined by a forecast of conditional stability. The prevailing consensus among major credit-rating agencies points to a year of resilience, anchored by robust

The intricate and often turbulent world of global finance is currently undergoing a profound technological transformation, with the market for Financial Risk Management (FRM) software standing at the epicenter of this shift. This critical sector is on a remarkable growth trajectory, projected to