In an era where digital transformation often seems to favor financial giants with vast resources, the rise of next-generation core banking platforms is fundamentally reshaping the competitive landscape for institutions of all sizes. These modern systems represent a significant advancement in the

As the digital finance landscape evolves, the competitive edge for core banking providers is shifting from standalone technology to the strategic power of a collaborative global network. In a significant move toward ecosystem-led growth, Tuum has appointed Bhavna Rishi as its new Global Head of

The modern financial landscape presents a frustrating paradox where individuals accumulate diverse assets throughout their lives, yet a single, coherent view of their total wealth remains perpetually out of reach. For decades, personal finance has been managed in a fragmented reality, with

In the highly competitive financial services industry, banking employees spend an average of 2.3 hours every single day navigating a labyrinth of complex internal systems just to find the information needed to serve customers. This staggering inefficiency creates a significant bottleneck, directly

A dramatic cooling has swept through the once-feverish WealthTech sector this year, signaling a fundamental realignment that has not only slashed investment but also redrawn the industry's geographic and strategic maps. As investors pivot from speculative growth to sustainable profitability, the

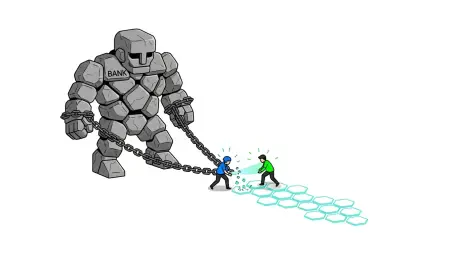

An overwhelming majority of banking executives recognize their outdated technology as an existential threat, yet an astonishingly small fraction are actively undertaking the necessary transformation to address it. This profound disconnect highlights a central paradox in modern finance: while the