A Fragile Rally: Why Experts Are Predicting a Deeper Bitcoin Downturn The cryptocurrency market is once again at a critical juncture as Bitcoin's recent upward momentum has stalled following a period of apparent strength, leaving investors and traders questioning its sustainability. While casual

The long-anticipated convergence of traditional finance and decentralized digital assets is no longer a future projection but a present reality, as Morgan Stanley launches a comprehensive digital asset strategy. This initiative goes far beyond simple investment offerings, aiming to build an

The once-impenetrable wall between cryptocurrency and the federally regulated American banking system is now being methodically dismantled by firms with direct lines to the White House. A high-profile cryptocurrency firm with deep ties to U.S. President Donald Trump has applied for a national bank

After a period of tight consolidation that has tested the patience of even the most seasoned investors, Bitcoin appears to be coiling for a significant move as underlying market dynamics have shifted dramatically in its favor. While the price has remained in a relatively narrow range, a confluence

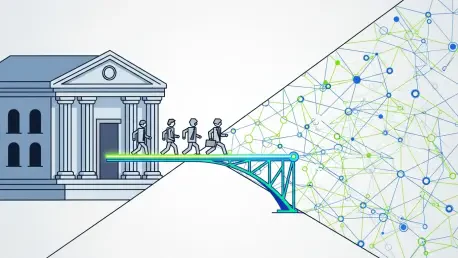

A profound and accelerating tectonic shift is reshaping the global financial system, presenting traditional banking institutions with an existential threat from which there may be no recovery without immediate and decisive action. The rapid expansion of the digital asset and tokenization ecosystem

The quiet replacement of leather wallets with their digital counterparts represents one of the most significant and swift technological shifts in modern consumer behavior, fundamentally altering how we interact with money, commerce, and entertainment. Once viewed as a niche convenience with