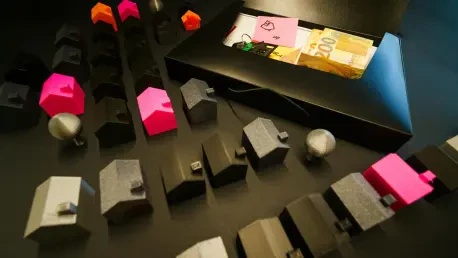

Imagine a world where a single software platform not only streamlines business operations but also handles payments, offers loans, and manages payroll—all without forcing users to switch apps or navigate external systems. This transformative vision is at the heart of embedded finance, a trend gaining remarkable traction within the Software-as-a-Service (SaaS) ecosystem. Far beyond a mere add-on, embedded finance integrates a spectrum of financial services—think bank accounts, debit cards, and insurance—directly into non-financial platforms, creating a seamless user experience. For SaaS companies, this isn’t just about keeping up with technology; it’s a strategic pivot that can redefine customer engagement, unlock fresh revenue streams, and solidify market dominance. As competition intensifies, understanding how embedded finance works and its implications is crucial for staying relevant. This concept promises to turn SaaS platforms into comprehensive hubs where operational and financial needs converge effortlessly, making it a topic no forward-thinking business can ignore.

Tracing the Path of SaaS to Embedded Finance

The journey of SaaS platforms has been one of constant reinvention, evolving from simple subscription-based models to complex ecosystems that now embrace embedded finance. In its earliest form, often dubbed SaaS 1.0, the focus was on delivering core software solutions through recurring payments. This progressed to SaaS 2.0, where payment processing became a natural extension, facilitating transactions via third-party tools. Now, with SaaS 3.0, the integration of full-fledged financial services marks a bold leap forward. Embedded finance enables platforms to address specific user challenges—like providing instant payouts for gig workers or accessible credit for small enterprises—directly within their interface. Vertical SaaS players, such as those catering to restaurants or e-commerce, have been early adopters, leveraging deep customer data to craft financial offerings that resonate. This shift isn’t merely technological; it reflects a broader realization that intertwining financial tools with core services can significantly enhance user value and platform relevance.

Horizontal SaaS platforms and marketplaces, including HR software and gig economy apps, are also catching on to this trend, recognizing the potential to engage vast user bases with tailored financial products. Unlike earlier iterations of SaaS that relied on external fintech solutions, embedded finance embeds these capabilities natively, creating a frictionless experience. The result is a deeper bond between users and platforms, as financial transactions become an organic part of daily workflows. This evolution positions SaaS companies not just as software providers but as holistic partners in their customers’ success. The transition to SaaS 3.0 through embedded finance also opens doors to differentiation in crowded markets, allowing platforms to stand out by solving pain points that competitors might overlook. As this model gains ground, it’s clear that embedding financial services isn’t a passing fad but a fundamental redefinition of what SaaS can offer in a digital-first economy.

Unpacking the Strategic Value for SaaS Platforms

Embedded finance stands out as a powerful mechanism for SaaS platforms to strengthen user loyalty while tapping into new revenue opportunities. By integrating financial services such as “buy now, pay later” options or working capital loans directly into their ecosystems, these platforms address critical user needs without requiring external navigation. This convenience fosters a stickier relationship, as customers are less likely to seek alternative solutions when their financial requirements are met in-app. Beyond retention, the financial products themselves generate income through transaction fees, interest, or shared revenue with banking partners. This dual benefit of enhanced engagement and diversified earnings can transform a SaaS company’s financial outlook, providing a buffer against market fluctuations and subscription churn. For businesses operating in niche sectors, this approach offers a unique way to deepen trust and utility among their user base.

Moreover, embedded finance serves as a competitive differentiator in an increasingly saturated SaaS landscape. Platforms that lack such integrations risk appearing outdated compared to rivals who offer a more comprehensive suite of services. Take, for instance, a point-of-sale system for small retailers; embedding loan options for inventory purchases or instant payroll for staff can make it indispensable to users. This added value not only attracts new customers but also cements the platform’s role as a central hub for business operations. Additionally, the data gathered from financial interactions provides SaaS companies with richer insights into user behavior, enabling more personalized offerings over time. While the upfront investment in embedding these services might be substantial, the long-term payoff in customer retention and revenue growth often justifies the effort. As more SaaS providers recognize this potential, embedded finance is fast becoming a benchmark for innovation and user-centric design.

The Driving Forces Behind Seamless Financial Integration

A confluence of technological advancements and industry shifts has paved the way for embedded finance to flourish within SaaS environments. Central to this is the proliferation of APIs and Banking-as-a-Service (BaaS) providers, which allow non-financial platforms to connect effortlessly with banking functionalities. These tools enable SaaS companies to offer services like account creation or card issuance without developing complex infrastructure from the ground up. Coupled with the widespread adoption of mobile and cloud technologies, user expectations have shifted toward accessing all services—financial or otherwise—through a unified digital interface. This demand for convenience drives SaaS platforms to embed financial tools, ensuring users can manage transactions or secure funding without disrupting their workflow. The technological backbone of embedded finance thus empowers platforms to meet modern user needs with unprecedented ease.

Another critical enabler is the rise of open banking regulations, which facilitate secure data sharing between financial institutions and third-party providers. This framework allows SaaS platforms to leverage detailed customer information for real-time financial decisions, such as underwriting loans or customizing insurance products. The ability to analyze user data within the platform creates opportunities for highly relevant offerings, enhancing the overall experience. Additionally, the frequent interactions that SaaS platforms have with their users—whether through daily operational tools or transactional systems—position them ideally to distribute embedded financial products. Industry insights suggest that platforms dominating customer relationships in specific niches can naturally extend into finance, capitalizing on existing trust and engagement. As these driving forces continue to mature, they are reshaping how SaaS companies approach value delivery, making embedded finance a cornerstone of digital strategy.

Navigating the Complexities and Potential of Embedded Finance

While embedded finance offers substantial benefits for SaaS platforms, it comes with a set of challenges that cannot be overlooked. Regulatory compliance stands as a primary hurdle, with requirements like Know Your Customer (KYC) and Anti-Money Laundering (AML) standards demanding rigorous attention. Data security is another pressing concern, as handling sensitive financial information increases the risk of breaches and erodes trust if not managed properly. SaaS companies must also contend with the technical intricacies of integrating financial services, which can strain resources, especially for smaller players without extensive expertise. Partnering with BaaS providers can alleviate some of these burdens by outsourcing compliance and backend operations, but it still requires careful coordination to ensure seamless user experiences. These complexities highlight the need for strategic planning and robust partnerships when venturing into embedded finance.

Despite these obstacles, the opportunities presented by embedded finance are too significant to ignore. Successfully implemented, it can redefine how users interact with SaaS platforms, turning them into indispensable tools for both operational and financial management. The potential to tap into underserved markets or address niche financial needs offers a pathway to growth that traditional SaaS models cannot match. For instance, providing instant access to credit for small businesses within a platform can unlock new customer segments and foster long-term loyalty. As BaaS solutions and regulatory frameworks evolve, the barriers to entry are likely to diminish, making it easier for more SaaS companies to adopt this model. Looking ahead, those who invest in overcoming initial challenges stand to gain a first-mover advantage, positioning themselves as leaders in a landscape where financial integration is becoming a standard expectation. The balance of risk and reward makes embedded finance a compelling frontier for SaaS innovation.