In an era where environmental concerns dominate global discourse, the fintech industry faces a staggering challenge: over 6 billion plastic payment cards are produced annually, contributing significantly to non-biodegradable waste, which underscores the urgent need for alternatives that align with

In the ever-evolving landscape of cryptocurrency, where countless projects compete for attention, a select few stand out as true game-changers with the potential to redefine the market and push boundaries. As the blockchain industry matures, the focus has shifted from speculative hype to tangible

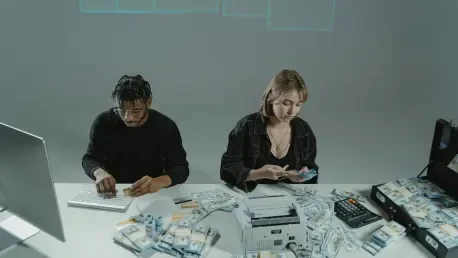

Central Asia's Financial Battleground: Setting the Stage Kazakhstan, a pivotal economic hub in Central Asia, is grappling with a staggering challenge: a shadow economy that undermines its financial stability and global reputation. With illicit activities ranging from money laundering to

In a world where small and medium-sized enterprises (SMEs) often grapple with the complexities and costs of international trade, a groundbreaking collaboration has emerged to address these challenges head-on. A leading global B2B cross-border trade payment platform has joined forces with a

Picture a trading platform where technology doesn’t just crunch numbers but builds bridges between investors across the globe, creating a unique space for collaboration and growth. That’s the reality eToro is crafting in 2025, as millions of users turn to social investing to navigate complex

Diving into the Future of Dining Transactions In an era where convenience reigns supreme, the hospitality industry stands at a pivotal crossroads with over 156,000 restaurant locations globally already leveraging digital tools for efficiency, and Boston-based Toast, a titan in restaurant software

What happens when the world of cryptocurrency, once a Wild West of digital innovation, starts demanding the ironclad security of traditional finance? The stakes skyrocket, and players like Ripple are stepping up to meet the challenge head-on with bold moves. In a landscape where institutional trust

Unraveling a Cybercrime Crisis in Global Finance In a world where digital transactions dominate, the recent German-led sting operation, dubbed "Operation Chargeback," has unveiled a staggering online fraud network impacting 4.3 million victims across 193 countries. Announced on November 5 at

What does it take to transform the financial landscape for millions in emerging markets? In South Africa, TymeBank has been a game-changer, serving over 11 million customers with innovative digital banking solutions. As this fintech powerhouse prepares for a significant leadership shift with

I'm thrilled to sit down with Kofi Ndaikate, a renowned expert in the fintech space with deep knowledge of blockchain and cryptocurrency trends. With a finger on the pulse of emerging technologies and market dynamics, Kofi has a unique perspective on how innovations like Internet Computer (ICP) are

ITCurated uses cookies to personalize your experience on our website. By continuing to use this site, you agree to our Cookie Policy