Setting the Stage for AI Transformation Imagine a world where a bank customer in London can seamlessly interact with a support agent in Tokyo, overcoming language barriers instantly, while transactions are safeguarded by intelligent systems detecting fraud in real-time. This is no longer a distant

Dive into the fast-paced world of cryptocurrency with Kofi Ndaikate, a seasoned expert in Fintech, blockchain, and cryptocurrency markets. With a deep understanding of regulatory landscapes and market trends, Kofi offers unparalleled insights into the future of digital assets like Solana. In this

In an era where digital transformation is reshaping the foundations of global finance, the emergence of cryptocurrencies as potential reserve assets has sparked intense debate among industry leaders and institutional investors. One asset, XRP, stands out due to its unique design and growing

In an era where digital transformation dictates the pace of industries, the banking sector faces unprecedented challenges with cybersecurity threats growing more sophisticated and operational demands intensifying by the day. Financial institutions, especially mid-market banks, grapple with the dual

In a world where digital transactions have become the lifeblood of commerce, the battle against fraud has reached unprecedented heights, demanding innovative solutions to protect businesses and consumers alike from increasingly sophisticated threats. As industries such as finance, retail, and

In an era where financial systems are racing to keep pace with technological innovation, a staggering $303 billion stablecoin market signals a seismic shift in global payments, highlighting the urgency for traditional institutions to adapt. Nine of the world’s most influential banks, including

In the ever-evolving landscape of financial markets, a fascinating and unexpected connection has emerged between Ethereum (ETH), a leading force in the cryptocurrency realm, and the Russell 2000, a stock index that tracks the performance of small-cap companies across the United States. This

Imagine a platform where the collective wisdom of thousands can predict the outcome of a major political election or a significant economic shift with uncanny accuracy, all while allowing participants to profit from their foresight. This is the reality of Polymarket, a decentralized prediction

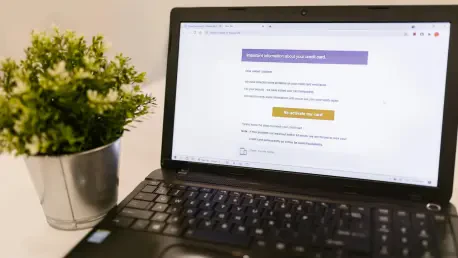

In an era where digital banking has become the cornerstone of financial interactions, the alarming rise in mobile-based cyber threats poses a significant challenge to both consumers and institutions, with recent data revealing a surge in device compromise incidents. As smartphones increasingly

In the rapidly evolving landscape of digital entertainment and blockchain technology, a major shift is underway that could redefine how millions engage with fantasy sports. Sorare, a prominent platform boasting a user base of over 5 million, has announced a groundbreaking migration to the Solana

ITCurated uses cookies to personalize your experience on our website. By continuing to use this site, you agree to our Cookie Policy