In the fast-paced 2026 digital asset market, a clear trend has emerged where investor capital is increasingly flowing toward projects that can substantiate their vision with demonstrable, near-term execution rather than relying on purely speculative narratives. This shift places a premium on

In a decisive move to align with the rapidly evolving expectations of consumers in the digital age, Kootenay Savings Credit Union (KSCU) has announced a landmark strategic partnership with the global financial solutions provider VeriPark. This collaboration signifies a substantial, forward-thinking

As the brutal force of winter storm Fern descended upon the United States, an unprecedented signal rippled not through the power grid, but through the digital world of cryptocurrency, compelling the nation's largest Bitcoin miners to power down. This was not a system failure but a deliberate,

In a significant move that signals a deeper industry-wide shift toward integrated technology, Edelman Financial Engines, one of the nation's largest independent wealth planning and advisory firms, has finalized a strategic partnership with wealthtech provider Orion. This collaboration places

In a high-stakes confrontation between two of the Philippines' most powerful regulatory bodies, the Philippine Amusement and Gaming Corporation (PAGCOR) is formally challenging a directive from the nation's central bank that has sent shockwaves through the booming online gaming industry. The agency

The cryptocurrency industry is rife with speculation about the potential launch of a native token for Base, the Layer-2 blockchain network incubated by Coinbase. While many envision a token following the conventional playbook of governance rights and ecosystem incentives, a far more audacious

A profound economic and technological transition is reshaping the commercial landscape of the Bronx, where the rapid adoption of digital payment systems by small businesses is colliding with the borough's deeply entrenched digital divide. This shift, fueled by evolving consumer expectations and the

Once considered the last bastion of relationship-driven, voice-brokered execution, the fixed income market is now undergoing a seismic digital transformation that is fundamentally reshaping its structure and operational dynamics. The conversation has shifted from whether electronification will take

The rapid ascendance of stablecoins as the internet's native currency has quietly introduced a fundamental vulnerability into the financial lives of every user: radical, permanent transparency. Confidential Compliant Stablecoins represent a significant advancement in the digital finance sector and

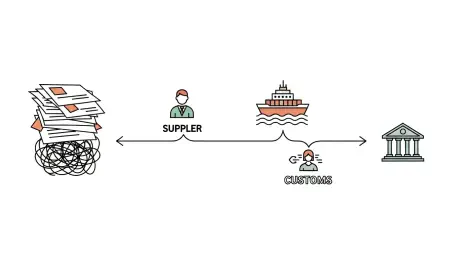

Global trade continues to be heavily reliant on antiquated paper-based processes, a reality that locks away an estimated $2.5 trillion in capital that could otherwise be fueling economic growth, according to a 2024 report from the Asian Development Bank. For years, couriers have shuttled bills of

ITCurated uses cookies to personalize your experience on our website. By continuing to use this site, you agree to our Cookie Policy