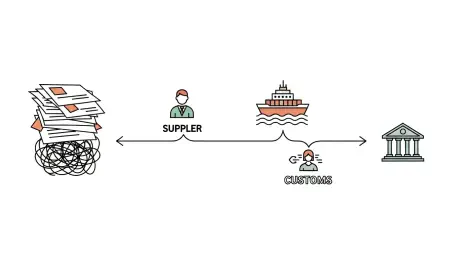

Global trade continues to be heavily reliant on antiquated paper-based processes, a reality that locks away an estimated $2.5 trillion in capital that could otherwise be fueling economic growth, according to a 2024 report from the Asian Development Bank. For years, couriers have shuttled bills of lading between ports, email chains have stalled letters of credit, and suppliers have endured weeks-long waits for cash. While blockchain technology was once heralded as the definitive solution to these inefficiencies, many early pilot programs failed to gain traction. However, a select few platforms have quietly moved beyond the proof-of-concept stage, delivering tangible results in live production environments. As businesses look to unlock liquidity, slash the risk of fraud, and satisfy regulatory requirements in 2026, the critical question is no longer if blockchain can help, but which platform is best equipped for the task. This analysis compares three live contenders, providing the evidence needed to make an informed decision.

1. A Framework for an Honest Comparison

To provide a clear and objective assessment, each platform was scored against seven critical supply-chain-finance factors that directly impact cash flow and risk management. The evaluation prioritized the two most pressing concerns for any Chief Financial Officer: liquidity enablement and risk control, with each category carrying a twenty percent weight in the total score. The framework also assigned significant importance to compliance automation and system integration, at fifteen percent each, recognizing that a platform is only as effective as its ability to seamlessly fit within existing legal and technical infrastructures. Finally, the remaining criteria of scalability, cost efficiency, and market traction each contributed ten percent, reflecting their role in supporting long-term growth and adoption. To ensure the integrity of the comparison, every metric was substantiated with hard data, including verified cycle-time reductions, total financed volume, and active member counts. This information was rigorously cross-referenced with independent sources such as bank case studies, reports from the International Chamber of Commerce, and industry analysis. Any claims lacking third-party validation were discounted, resulting in a weighted, evidence-based overview of where each platform excels and where it currently falls short.

2. Polymesh for Regulated Asset Tokenization

For a supplier holding a multi-million-dollar invoice but needing immediate working capital, Polymesh offers a unique solution by enabling the receivable to be fractionalized into digital tokens. These tokens are governed by compliance rules embedded directly at the protocol layer, rather than through custom smart contracts. This foundational design allows for issuance in minutes at a fraction of the cost associated with legacy securitization. Once an issuer’s digital wallet completes the necessary customer due diligence, the tokens can be listed to a pre-vetted pool of investors on the same day, with settlement occurring within hours. This process entirely eliminates the delays caused by physical couriers and manual reconciliation. The backbone of this system is identity verification. Every digital key that interacts with a regulated asset on Polymesh must be tied to a verified legal entity, and each transaction is automatically checked against KYC/AML rules built into the protocol. This means issuers and funding banks can reuse a single verified identity across multiple assets and financing programs, drastically shortening onboarding times and reducing recurring external KYC fees. This built-in transparency provides regulators with an immediate, auditable answer to ownership questions while assuring investors that the asset cannot be moved between anonymous wallets. By lowering the minimum investment size, a diverse group of participants—from regional banks to family offices—can purchase slices of the same invoice, creating a more competitive market that sharpens discount rates. While still in the early stages of supply-chain finance adoption, Polymesh’s compliance-first architecture is well-aligned with regulatory sandboxes like Europe’s DLT Pilot Regime, making it a forward-looking choice for businesses planning to securitize receivables or bundle inventory notes into regulated funds.

3. Komgo for Commodity Letters of Credit

The world of commodity finance remains notoriously dependent on paper. A single shipment of crude oil can generate over thirty original documents and involve more than two dozen distinct parties, a cumbersome process that can lock up essential working capital for over a week. Komgo directly addresses this inefficiency by migrating every critical file—from the initial letter of credit application to the final inspection report and KYC package—onto a single, shared, permissioned ledger. This gives banks, inspectors, and traders the ability to access and update information in real time, eliminating delays. The results are substantial and measurable. Early production data demonstrated that the platform reduced the turnaround time for letters of credit by an astounding 99.58%, from ten days to approximately one hour. For a typical $200 million copper trade, reclaiming nine days of transit time frees up nearly half a million dollars in cash. Risk is mitigated in tandem with cycle time. The platform’s use of structured data makes it impossible for the same cargo to be pledged as collateral to two different banks, as any duplicate financing attempt is flagged instantly. Furthermore, komgo’s Optimus module allows members to securely reuse a counterparty’s KYC documentation, a feature that streamlines compliance and has been praised by major financial institutions. With pragmatic integration that allows shareholder banks to feed data directly into their core trade-finance systems and corporates to connect via existing treasury workstations, the platform has achieved significant scale. Backed by fifteen global banks and commodity majors, komgo has established itself as the leading network for businesses reliant on letters of credit in the energy, metals, and agricultural sectors.

4. dltledgers for Agile SME Supply Chains

Mid-tier manufacturers and agricultural exporters often face the longest waits for financing as paper documents slowly make their way from the factory floor to corporate headquarters. The dltledgers platform transforms this fragmented paper trail into a unified digital thread. Built on Hyperledger Fabric, it notarizes every milestone in a trade journey, from the initial purchase order to the final customs release. As each step is confirmed on the ledger, a smart contract automatically alerts the funding bank, enabling the release of cash within hours instead of weeks. The platform’s ability to operate at scale has been proven, having processed $3.3 billion across hundreds of cross-border trades in its first eighteen months. This efficiency translates into direct savings for users, with agribusinesses reporting financing costs that are fifteen to twenty percent lower, a direct result of banks having access to tamper-proof shipment data in real time. This enhanced transparency also serves as a powerful tool for risk reduction. Every bill of lading, inspection certificate, or IoT sensor ping is cryptographically hashed to the ledger, which means any attempt to introduce a forged document is identified immediately. This real-time visibility has been described as a “game-changer” by financial partners, who have reported halving their document-handling time. Onboarding is designed to be lightweight and accessible; suppliers can join through a cloud portal, connect their existing ERP systems via APIs, and begin transacting without the need for dedicated hardware or significant upfront fees. This pay-as-you-go model makes it an ideal solution for multi-country supply chains with partners of varying technological readiness, particularly those operating in emerging markets.

5. How Evolving Digital Trade Laws Are Changing the Game

Recent legal advancements are providing the regulatory certainty needed to accelerate the shift from paper-based to fully digital trade finance. The United Kingdom’s Electronic Trade Documents Act, which took effect in late 2023, granted an electronic bill of lading the same legal standing as its paper equivalent. Similarly, the European Union’s DLT Pilot Regime has created a regulatory sandbox for the trading and settlement of tokenized securities, including invoice-backed notes. These initiatives, along with early adoption of electronic transferable records by hubs like Singapore and Bahrain, signal a global trend toward paperless trade. This legal clarity is paramount because it transforms on-chain data from mere proofs of existence into legally enforceable rights. Once a court recognizes a digital bill of lading as a document of title, banks can confidently raise their advance rates and insurers can underwrite larger policies, injecting more liquidity into the system while trimming risk premiums. With the legal hurdles being cleared, the next major challenge is interoperability. Industry bodies are now focused on drafting common data models and standards to ensure that a transaction executed on one platform, like a letter of credit on komgo, can seamlessly trigger a payment on another, such as dltledgers. While full network-to-network handshakes are still in development, the legal and standards tailwinds of recent years have effectively removed the last major excuses for clinging to paper. This new regulatory climate makes it an opportune time for businesses to launch blockchain-finance pilots and gain a competitive edge in an increasingly digital world.

6. Key Questions to Guide Your Next Steps

The detailed comparison of these platforms underscored that a successful implementation depended less on the technology itself and more on strategic planning and clear objectives. Before committing to a platform, organizations found that asking a series of foundational questions was crucial for aligning the pilot with tangible business outcomes and securing internal buy-in. A well-defined strategy, built by answering these questions, prevented scope creep and ensured that the initial project delivered a measurable win that could justify future expansion. The critical questions to address are:

- Which single bottleneck will be addressed first? Focus on one clear pain point, such as slow letters of credit or duplicate-invoice fraud, to prove value before moving to a second phase.

- Who must be live on day one? A network’s value is derived from its participants. Secure a commitment from at least one anchor buyer or funding bank before signing any contracts.

- How will data flow from the ERP to the chain? Map out the specific data fields that will be automated during the pilot. Manual uploads are acceptable for a proof of concept but will erase the return on investment at scale.

- Is the compliance team comfortable with the process? Demonstrate how KYC, sanctions screening, and audit trails are managed on-chain to get early sign-off from the risk team and prevent last-minute roadblocks.

- What metric will unlock expansion? Choose a specific number—such as days of cash-conversion saved, basis points cut from a spread, or the percentage of documents digitized—and track it relentlessly to publicize the success of the initiative.