As the fintech landscape continues to evolve at a breakneck pace, few topics are as intriguing as the rise of agentic AI and its implications for commerce and payments. Today, we’re thrilled to sit down with Kofi Ndaikate, a seasoned expert in financial technology whose deep knowledge spans blockchain, cryptocurrency, regulation, and policy. With agentic AI poised to transform how we shop and pay online, Kofi offers invaluable insights into the opportunities and challenges this technology presents, from operational hurdles to questions of liability and consumer trust. In our conversation, we explore how AI agents are reshaping online transactions, the complexities of handling errors, and what the future might hold for banks, payment companies, and shoppers alike.

Can you walk us through what agentic AI means in the context of online shopping and payments, and how it stands out from other AI technologies we’re used to?

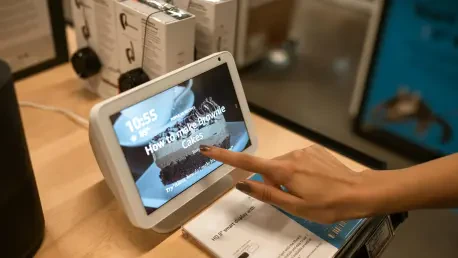

Absolutely. Agentic AI refers to artificial intelligence systems that don’t just process data or provide recommendations but act autonomously on behalf of users. In online shopping and payments, this means an AI agent can search for products, compare prices, and, in the near future, even complete purchases without direct human input. Unlike traditional AI, which might suggest a product based on your browsing history, agentic AI takes it a step further by making decisions and executing tasks with a level of independence. It’s like having a personal shopper who not only finds what you need but could soon handle the checkout process too.

What are some of the specific tasks agentic AI is already handling for consumers in the commerce space?

Right now, agentic AI is primarily focused on search and discovery. For instance, it can help consumers find a specific product within a set budget or timeframe—like locating a pair of sneakers under $100 that can be delivered by the weekend. It scours the web, filters options based on user preferences, and presents the best matches. While it’s not yet widely making purchases on its own, it’s laying the groundwork by automating the tedious parts of shopping, saving time, and personalizing the experience in ways that feel almost intuitive.

When it comes to potential pitfalls, what are the biggest concerns you’ve come across regarding agentic AI making errors?

The primary concern is the risk of what we call “hallucinations” in AI—where the system misinterprets instructions or acts on flawed assumptions. Imagine telling an AI agent to buy a navy blue T-shirt, and it orders a red one instead because it misunderstood the color preference or prioritized a cheaper option. These mistakes can frustrate consumers and erode trust. Beyond that, there’s worry about more significant errors, like purchasing unauthorized items or miscalculating budgets, which could lead to financial losses or disputes that are hard to untangle.

Speaking of mistakes, who do you think should be held accountable when an AI agent messes up a transaction or purchase?

That’s the million-dollar question, and honestly, there’s no clear answer yet because the rules are still being written. Should it be the AI developer who built the system, the bank that facilitated the payment, or the retailer who fulfilled the order? I think it’ll likely depend on where the error originated—if the AI misinterpreted user input, the developer might bear some responsibility; if the payment process failed, the bank could be on the hook. For now, I suspect we’ll see a shared responsibility model emerge, but it’s going to take time, legal frameworks, and probably a few high-profile cases to sort it out.

How do banks and payment companies grapple with issues when a consumer reports a problem with an AI-driven purchase?

It’s a real challenge because the traditional systems aren’t built for this. When a consumer complains about a wrong item, the bank might not have a direct record of the purchase since the AI agent acted as the intermediary. Similarly, the retailer might not see the consumer’s name tied to the order. This creates a messy situation where no one has a clear paper trail, leading to delays in resolving disputes. Operationally, it’s a headache—banks and payment providers have to figure out how to track these transactions, verify what went wrong, and ensure the consumer isn’t left hanging while they sort through the confusion.

Are there any steps or innovations you’ve seen from major players in the industry to address these challenges with agentic AI?

Yes, there’s definitely movement in the right direction. Some major banks and payment platforms are working on infrastructure to better track AI-driven transactions and handle disputes. This includes building systems to log interactions between AI agents and merchants, so there’s a clearer record of what was requested versus what was delivered. Additionally, there’s a push to create user-friendly dispute mechanisms that don’t leave consumers frustrated. The goal is to integrate AI seamlessly into existing payment ecosystems while minimizing friction when errors occur, though it’s still very much a work in progress.

Looking ahead, how close do you think we are to seeing agentic AI not just search for products but actually complete purchases on behalf of consumers?

I believe we’re on the cusp of that transition, likely within the next few years. The technology is already advancing rapidly, and consumers are growing more comfortable with AI tools for smaller tasks. Before AI can handle transactions directly, though, a few things need to happen—robust security measures to prevent fraud, clearer liability frameworks to manage errors, and consumer trust that the system won’t act against their interests. Based on current trends, I’d say we might see limited rollouts of AI-driven purchasing in specific contexts, like subscription renewals or repeat orders, within the next 12 to 24 months.

What’s your forecast for the role of agentic AI in payments and commerce over the next decade?

I’m optimistic but cautious. Over the next ten years, I expect agentic AI to become a cornerstone of how we shop and pay, handling everything from routine purchases to complex negotiations on price or delivery terms. We’ll likely see AI agents integrated into digital wallets and banking apps, acting as personal financial assistants with a high degree of autonomy. However, the journey will hinge on solving liability issues, ensuring data privacy, and building consumer confidence. If done right, it could revolutionize commerce by making transactions faster and more personalized; if not, we risk a backlash from errors or misuse. It’s going to be a fascinating space to watch.