In the rapidly evolving landscape of financial services software, Alfa Financial Software Holdings PLC has emerged as a standout performer in the first half of 2025, captivating industry observers with a remarkable display of growth and strategic foresight. The company’s pivot to a Software-as-a-Service (SaaS) model has proven to be a transformative force, driving not only robust financial results but also positioning Alfa as a leader in a market increasingly dominated by cloud-based solutions. With revenue soaring and innovative platforms gaining traction, Alfa’s journey reflects broader trends of digitalization and scalability that define the modern software industry. This article explores the key facets of Alfa’s # performance, from financial milestones to technological innovation, shedding light on how this transition is reshaping the company’s future while delivering value to shareholders and customers alike in a competitive arena.

Financial Milestones in # 2025

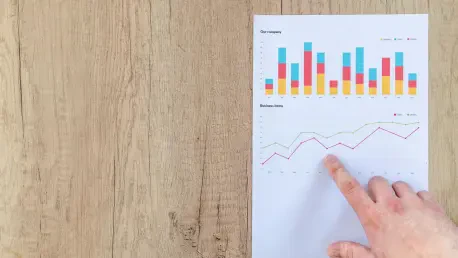

Alfa Financial Software’s financial achievements in the first half of 2025 paint a picture of a company thriving amidst economic complexities, with total revenue reaching an impressive £62.5 million, marking a substantial 22% increase compared to the prior year at constant currency. This growth is underpinned by a 17% rise in subscription revenue, a testament to the successful adoption of recurring revenue streams, alongside a staggering 72% surge in software engineering revenue. Beyond top-line growth, the operating margin expanded to 35%, up from 31% in the previous period, propelling operating profit to £21.6 million—a 33% year-over-year increase. These metrics underscore a disciplined approach to scaling operations while maintaining profitability, reflecting Alfa’s ability to navigate market challenges with finesse and build a resilient financial foundation for future expansion in the competitive software sector.

Delving deeper into the financial narrative, Alfa’s cash generation capabilities stand out as a critical strength, enabling a 12% increase in subscription Total Contract Value (TCV) during # 2025. This achievement highlights a stable revenue base that reduces reliance on unpredictable, one-off project sales, aligning with the predictable cash flows inherent in the SaaS model. The improved financial health is not just a number on a balance sheet; it signifies the company’s readiness to reinvest in growth initiatives while weathering potential macroeconomic headwinds. Such stability positions Alfa favorably among peers, offering a glimpse into a business model that prioritizes long-term sustainability over short-term gains, and sets the stage for consistent performance as market dynamics continue to evolve in the financial services software space.

Driving Growth Through SaaS Transition

At the core of Alfa Financial Software’s success in # 2025 lies its strategic shift to a SaaS model, evidenced by a significant 17% growth in Annual Recurring Revenue (ARR) to £41.6 million. This transition is more than a mere change in revenue structure; it represents a fundamental move toward predictability and scalability, with 23 cloud customers now integrated—16 already live and 7 in the implementation phase. The upgrade of nine customers to Alfa Systems 6, the company’s next-generation SaaS platform, further illustrates tangible progress in converting legacy clients to recurring revenue streams. This shift not only enhances financial stability but also aligns Alfa with the expectations of a market increasingly favoring subscription-based solutions over traditional licensing models, marking a pivotal step in future-proofing the business.

Beyond the numbers, the SaaS transition reflects Alfa’s commitment to meeting modern customer needs with a model that offers higher gross margins and reduced dependency on sporadic sales cycles. The focus on recurring revenue fosters a deeper relationship with clients, as ongoing subscriptions necessitate continuous value delivery through updates and support. This approach has bolstered Alfa’s cloud customer base, creating a ripple effect of trust and reliability that strengthens market positioning. As the company continues to refine its SaaS offerings, the emphasis on scalability ensures that growth can be achieved without proportional increases in operational costs, setting a benchmark for efficiency in the financial services software industry and highlighting the transformative power of this strategic pivot during # 2025.

Innovation and Competitive Edge

Alfa Financial Software is not merely adapting to industry trends but actively shaping them through innovative solutions tailored for the financial services sector, with Alfa Systems 6 leading the charge in # 2025. Designed to meet the growing demand for cloud-native platforms, this next-generation SaaS offering integrates AI-driven analytics, sustainability features, and modular “Everything-as-a-Service” (XaaS) capabilities to address contemporary customer challenges. With the financial services software market poised for significant expansion, Alfa’s focus on advanced asset lifecycle management provides a distinct advantage over less specialized competitors. This strategic alignment with digitalization trends positions the company to capture a substantial share of an industry hungry for interoperable and forward-thinking technology solutions.

Further cementing its market relevance, Alfa’s commitment to innovation extends to addressing broader societal and operational needs, such as sustainability and data-driven decision-making, which are increasingly prioritized by clients. Alfa Systems 6 stands out by offering tools that enhance efficiency while supporting environmental goals, a dual focus that resonates with the evolving expectations of financial institutions. This differentiation is critical in a competitive landscape where larger players often dominate through scale rather than niche expertise. By carving out a specialized role in asset lifecycle management, Alfa not only meets current demands but also anticipates future shifts, ensuring relevance and resilience as the industry continues to transform through digital and cloud-based advancements in 2025 and beyond.

Shareholder Returns and Strategic Balance

Alfa Financial Software’s financial discipline in # 2025 extends beyond growth metrics to a clear dedication to shareholder value, exemplified by the declaration of a special dividend of 5 pence per share. This payout, supported by robust cash flows and a sustainable revenue base from SaaS subscriptions, signals confidence in the company’s long-term stability and its ability to reward investors even while funding significant growth initiatives. The balance between reinvestment—evidenced by £19.4 million allocated to software development—and returning capital to shareholders highlights a prudent approach to capital allocation. For income-focused investors, this blend of growth potential and tangible returns positions Alfa as an attractive option in the high-margin software sector, promising both stability and upside.

Moreover, the potential for consistent or even increased dividends in the coming periods adds another layer of appeal, as Alfa’s SaaS-driven recurring revenue model continues to mature. This financial strategy mitigates the risks associated with heavy upfront investments by ensuring a steady cash inflow, allowing the company to navigate competitive pressures without compromising on investor returns. The special dividend serves as a marker of Alfa’s maturity as a software entity, capable of delivering value across multiple dimensions. As the company solidifies its foothold in the cloud-native market, the interplay of disciplined cost management and strategic payouts reflects a nuanced understanding of market expectations, making Alfa a compelling case study in balancing growth with shareholder priorities during # 2025.

Navigating Challenges and Future Outlook

While Alfa Financial Software’s # 2025 performance is overwhelmingly positive, the journey through its SaaS transition is not without hurdles, particularly the sustained investment required to maintain momentum. The £19.4 million directed toward software development, though necessary for innovation, could pose short-term profitability challenges if growth targets are not met as anticipated. Additionally, competition from larger players in the financial services software space presents risks to pricing power and market share. However, Alfa’s specialized focus on asset lifecycle management and proven success in converting legacy clients to SaaS offerings provide a buffer against these pressures, offering a degree of insulation that broader competitors may lack in this niche segment.

Looking ahead, the path forward for Alfa involves careful navigation of these challenges while capitalizing on the structural advantages of the SaaS model, as seen in # 2025. Strategic investments must be paired with rigorous cost oversight to ensure that profitability remains intact during expansion phases. For stakeholders, the focus should be on monitoring how Alfa leverages its innovative platforms like Alfa Systems 6 to capture market opportunities, while maintaining the agility to respond to competitive dynamics. The groundwork laid in this period—through robust financials, customer growth, and shareholder returns—suggests a promising trajectory, provided execution remains sharp and market conditions supportive in the evolving landscape of financial services software.