In the evolving landscape of financial technology, automated money market platforms have emerged as a transformative force in cash management. With the modern finance sector characterized by rapid shifts and increasing complexity, these platforms present a compelling solution by integrating cutting-edge technology into the management of money market funds. The convergence of advanced technology and financial strategy is creating a new paradigm, promising to overcome traditional challenges associated with manual processes and fragmented infrastructure. Today, this evolution is impacting how investment managers and corporate treasurers manage, analyze, and optimize their financial operations.

The Core of Automated Money Market Platforms

At the heart of automated money market platforms lies a set of principles and components designed to streamline financial operations. These platforms offer direct and automated access to a range of tier-1 money market funds, significantly simplifying trade lifecycle processes and enhancing cost transparency. This marks a stark departure from conventional practices, where cumbersome manual procedures often hampered efficiency and clarity.

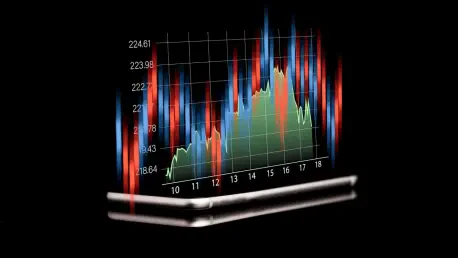

The technological revolution driving these platforms operates within the broader context of financial innovation. Over recent years, the shift toward digitization in banking and investments has laid the groundwork for such advancements. Automated platforms are transforming traditional cash management, providing enhanced capabilities that allow for real-time monitoring and strategic financial shifts in response to market conditions.

Key Features and Capabilities

Unified Interface for Enhanced Access

A standout feature of these automated platforms is their unified interface, which revolutionizes the user experience by providing comprehensive access to money market funds. This functionality is essential for facilitating direct, seamless transactions while ensuring transparency across all stages of the trade lifecycle. Furthermore, automation significantly reduces operational burdens, promoting a more transparent and efficient environment for both investment managers and corporates.

Efficiency gains aren’t limited to simplicity. By streamlining access and automating previously manual processes, businesses can allocate resources with greater precision, achieving a level of cost transparency that was previously unattainable. This marks a significant step forward in resolving long-standing pain points in the financial sector.

AI-Powered Risk Management Tools

Incorporating AI-driven risk management tools represents another leap forward for automated money market platforms. Tools like “Co-Pilot,” developed by MillTech, exemplify the integration of artificial intelligence in risk advisory. These tools offer sophisticated capabilities such as strategic simulation and interest rate differential analysis, enhancing decision-making processes within cash and risk management domains.

The use of AI in these tools provides actionable insights that support proactive financial strategies. By simulating varying market conditions and analyzing potential impacts, AI tools equip financial managers to navigate volatile environments effectively, optimizing returns while mitigating risks.

Innovations and Current Trends

Recent advancements in technology have propelled money market platforms into the spotlight, with innovations resetting expectations across the industry. The adoption of cloud-based solutions, blockchain technologies, and AI-driven analytics has revolutionized how financial data is handled and interpreted. These innovations are not just about efficiency but also about providing deeper insights into the evolving landscape and consumer behavior patterns.

Emerging trends indicate a growing demand for platforms with enhanced analytical capabilities and intuitive interfaces. Both consumer behaviors and industry standards are shifting towards technologies that offer greater agility and adaptability, reshaping the future of financial management.

Practical Deployment and Success Stories

The real-world applications of these platforms are vast, touching various sectors and industries. From corporate treasuries to large-scale investment firms, automated money market platforms are being implemented to enhance operational efficiency and financial strategy. The technology’s ability to maximize cash returns and streamline processes makes it an attractive option for diverse financial strategies.

Prominent case studies have highlighted successful implementations, showcasing how companies have leveraged these platforms to drive growth and improve resource allocation. Such success stories underline the platforms’ potential to transform traditional financial practices.

Overcoming Challenges and Constraints

Despite their promise, these platforms face several challenges ranging from technical to regulatory. The integration of advanced technologies requires addressing compatibility issues within existing infrastructure, and navigating complex regulatory landscapes adds another layer of complexity. Market dynamics and legacy systems also pose obstacles that must be adeptly managed for broader adoption to occur.

Efforts to overcome these challenges include partnerships with regulatory bodies and ongoing innovation in technology to ensure compliance and operational resilience. Continuous upgrades and adaptability are essential for these platforms to address evolving market needs.

Future Prospects and Innovations

Looking forward, the potential for breakthroughs in automated money market platforms appears boundless. Anticipated advancements in artificial intelligence, machine learning, and blockchain technology promise to enhance these platforms’ effectiveness and scalability. The industry’s trajectory hints at increasingly sophisticated tools that can anticipate market shifts and respond accordingly.

Future developments are expected to influence financial sectors beyond the immediate scope, potentially reshaping broader societal financial norms. The impact on global financial ecosystems could redefine how entities engage with market dynamics, fostering a new era of financial management.

Final Thoughts

In summation, automated money market platforms have redefined the landscape of cash management and financial analysis, introducing unprecedented efficiencies and insights. The review highlights the profound capabilities brought forth by these platforms, establishing a benchmark for technological integration into finance. Millennium transformations continue to pave the way for innovative and dynamic financial solutions, emphasizing the growing importance of technological adaptability in evolving markets. The evolution in financial management set forth by these platforms offers a promising horizon for future advancements and broader adoption.