Imagine a world where financial institutions, regardless of their size or location, can launch sophisticated investment services in just a matter of weeks, catering to a global clientele with diverse needs and expectations. This is no longer a distant vision but a reality shaped by cutting-edge technology in the WealthTech sector. The multi-tenant investment platform, developed through a collaboration between Velexa and CSB Investors Group, stands as a transformative force, enabling broker-dealers, private banks, and wealth managers to operate seamlessly across multiple jurisdictions. This review dives deep into the platform’s capabilities, exploring how it addresses modern financial challenges with scalability, compliance, and user-centric design.

Core Features and Innovations

Scalability for Rapid Market Entry

The standout feature of this platform lies in its ability to facilitate swift deployment for financial institutions eager to expand their offerings. By leveraging a shared infrastructure, it significantly cuts down the time-to-market for new investment services, allowing firms to respond promptly to market demands. This scalability is particularly beneficial for entities managing varied client bases, from retail investors to high-net-worth individuals.

Beyond speed, the architecture supports growth without compromising performance. Whether a brokerage firm in the UK or a private bank in Mauritius, the system adapts to handle increased transaction volumes and user diversity. This ensures that institutions can focus on strategic goals rather than infrastructure limitations, marking a significant shift in operational agility.

Regulatory Adherence with Tailored Solutions

Operating across regions like the UK, Malta, Mauritius, and the Cook Islands demands strict compliance with local regulations, a challenge this platform meets head-on. Its design incorporates jurisdiction-specific frameworks, ensuring that each institution operates within legal boundaries while maintaining service quality. This adaptability is crucial for global scalability.

Customization extends beyond compliance to user interaction, enabling firms to offer localized experiences. For instance, client interfaces can reflect regional preferences or regulatory disclosures, fostering trust and engagement. Such attention to detail positions the platform as a reliable solution for institutions navigating complex international markets.

Integration and User-Centric Design

A key strength of this technology is its seamless integration with existing digital banking ecosystems, streamlining operations for financial entities. This connectivity reduces friction in adopting new systems, allowing for a smoother transition and enhanced efficiency in service delivery. It bridges traditional banking with modern investment tools effectively.

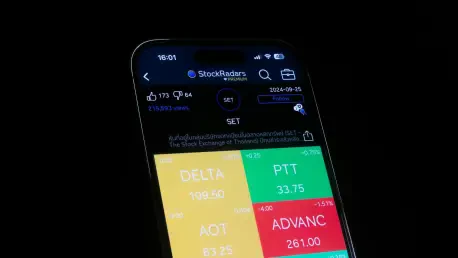

Equally impressive are the custom-branded mobile and web applications that prioritize user experience. Clients encounter a consistent, personalized interface, whether accessing equities, ETFs, or mutual funds, which boosts satisfaction and retention. This focus on end-user interaction underscores the platform’s commitment to client-centric innovation in a competitive landscape.

Performance Across Diverse Markets

The real-world impact of this platform shines through its deployment in four distinct jurisdictions, supporting three brokerage firms and a private bank. Its ability to serve varied client types, including professional traders and retail investors, demonstrates versatility in meeting specific investment needs. The technology has proven its worth in handling complex portfolios across borders.

Notable outcomes include heightened operational efficiency for participating institutions. By centralizing infrastructure, firms report faster processing times and broader access to financial products, enriching their service catalogs. This has translated into tangible benefits, such as expanded market reach and improved client trust in the offered solutions.

Feedback from industry leaders highlights the platform’s role in modernizing investment services. The capacity to maintain regulatory alignment while delivering a uniform client experience has been praised as a game-changer. Such endorsements reflect the technology’s effectiveness in addressing both business and client expectations on a global scale.

Industry Trends Fueling Adoption

The rise of multi-tenant solutions aligns with a broader demand for advanced, technology-driven tools in finance. Investors today expect intuitive platforms that offer accessibility and transparency, pushing firms to adopt systems that can keep pace with evolving preferences. This platform emerges as a direct response to such market pressures.

Regulatory compliance remains a driving force behind its development, as institutions grapple with stringent and often divergent regional requirements. Coupled with the push for global reach, these trends emphasize the need for adaptable, scalable technologies that can bridge gaps in service delivery across continents.

Additionally, the shift toward client-centric digital experiences shapes the platform’s design philosophy. By prioritizing user interfaces and integration, it caters to a generation of investors who value convenience alongside robust investment options. This alignment with industry currents ensures relevance in a rapidly changing sector.

Challenges in Implementation

Despite its strengths, operating a multi-tenant platform is not without hurdles, particularly in managing intricate regulatory landscapes. Ensuring compliance across multiple regions requires constant updates and vigilance, posing a resource-intensive challenge for developers and users alike. This complexity can strain operational focus if not addressed proactively.

Technical obstacles also arise in integrating with disparate digital ecosystems, where compatibility issues may disrupt seamless functionality. Data security within a shared infrastructure further complicates matters, as protecting sensitive information across borders demands rigorous safeguards. These issues highlight the need for ongoing refinement in deployment strategies.

Efforts to mitigate these challenges are evident through continuous innovation and strategic partnerships. By investing in robust cybersecurity measures and enhancing integration protocols, the collaboration behind this platform aims to minimize risks. Such proactive steps are essential to maintaining trust and reliability in a competitive market.

Future Potential and Expansion

Looking ahead, the platform shows immense promise for further growth, with recent expansions into markets like Brazil signaling ambitious plans. This move reflects a commitment to broadening global access, potentially tapping into emerging economies with growing investor bases. The trajectory suggests a widening impact on wealth management.

Possible enhancements include the integration of AI-driven tools to offer predictive analytics or personalized investment advice, enriching user engagement. Expanding product offerings to include alternative assets could also attract a broader clientele. These developments hint at a dynamic evolution in service capabilities over the coming years.

The long-term influence of such technologies on the financial sector appears transformative, fostering greater accessibility to investment opportunities worldwide. By setting a benchmark for scalable, compliant solutions, this platform could inspire similar innovations, reshaping how wealth is managed in an increasingly interconnected global economy.

Final Thoughts and Next Steps

Reflecting on this technological advancement, the partnership between Velexa and CSB Investors Group delivered a robust solution that bridged innovation with practical application. The platform’s success in supporting diverse institutions across multiple regions underscored its strength in addressing critical industry needs. It stood as a testament to the power of collaborative tech development in finance.

Moving forward, stakeholders should prioritize enhancing data security protocols to safeguard shared infrastructures against emerging threats. Exploring deeper AI integration could also unlock new levels of personalization for clients, setting a higher standard for user experience. These steps would ensure sustained relevance in a fast-evolving market.

Additionally, expanding educational initiatives for financial institutions on leveraging multi-tenant systems could accelerate adoption. By fostering a deeper understanding of the technology’s benefits and operational nuances, the industry can better prepare for widespread implementation. Such efforts would cement the platform’s role as a catalyst for modernizing wealth management on a global scale.