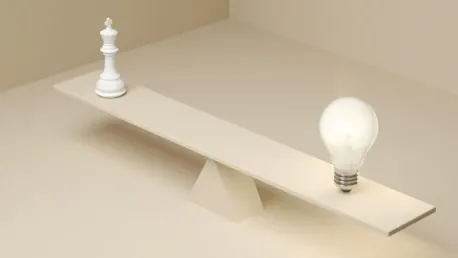

The fintech industry is a burgeoning sector that offers boundless innovation opportunities while simultaneously bringing forth significant regulatory challenges. Fintech companies must strike a delicate balance between pushing the boundaries of financial technology and adhering to stringent regulatory frameworks to ensure sustainable growth and consumer trust. This article explores various strategies and perspectives on how fintech firms can achieve this balance effectively.

Understanding Regulatory Bodies and Their Roles

In the global fintech landscape, regulatory compliance is both crucial and intricate, governed by significant bodies such as the Financial Conduct Authority (FCA) in the UK, the Office of the Comptroller of the Currency (OCC) in the US, and the European Banking Authority (EBA) in the EU. These agencies strive to protect consumers, ensure market integrity, and maintain financial stability, making it essential for fintech firms to understand their roles and the specific regulations they enforce as the first step in navigating the complex compliance maze.

Fintech companies need to be well-acquainted with these regulatory bodies to meet legal requirements effectively. For instance, the FCA’s focus is on promoting competition and ensuring consumer protection, while the OCC emphasizes the safety and soundness of national banks. The EBA, on the other hand, aims to create a single rulebook for bank regulation across the EU. Fintech firms operating internationally must be prepared to comply with varying demands from multiple regulators, which can be a significant but vital challenge to address.

Collaborating with these regulatory bodies is not just a compliance exercise but also an opportunity to influence policy. Regular dialogue with regulators, participation in industry forums, and public consultations on regulatory changes can help fintech firms stay ahead of the curve and even shape the regulatory landscape in ways that support innovation. Such proactive engagement allows fintech companies to advocate for regulations that are conducive to their innovative efforts while ensuring consumer protection and financial stability.

Historical Evolution and Current Trends in Fintech Regulations

The regulatory framework governing fintech has evolved significantly over the years, with landmark changes shaping its current state. Starting from the 1990s, when the term “fintech” was first coined, the sector saw transformative changes with the introduction of Bitcoin in 2008, which intensified discussions around cryptocurrency regulations. The 2010s brought in stringent data protection laws like the General Data Protection Regulation (GDPR) in Europe, which set new standards for data privacy and profoundly impacted how fintech companies handle user data.

Current trends reflect an increasing collaboration between fintech companies and traditional banks. Many financial institutions are now partnering with fintech firms to leverage their innovative capabilities while maintaining regulatory compliance. Data privacy has also become a focal point, driven by consumer demand for higher transparency and protection. Regulations around data protection are becoming more stringent, pushing fintech companies to adopt robust data management practices.

The emergence of regulatory sandboxes is another significant trend. These frameworks allow fintech companies to test new products in a controlled environment without immediately facing the full brunt of regulatory requirements. Sandboxes encourage innovation while providing regulators with the oversight needed to ensure consumer safety. They offer a practical approach for fintech companies to refine their offerings before a full-scale launch while aligning with regulatory standards. This evolving regulatory environment underscores the need for fintech firms to stay agile and informed, continuously adapting their strategies and operations to comply with global regulatory demands.

Compliance Challenges in Fintech

One of the most pressing challenges fintech companies face is ensuring data privacy and protection. Robust data protection measures are essential, as data breaches can lead to severe legal repercussions and loss of consumer trust. Companies must regularly update their privacy policies, invest in staff training, and employ advanced technologies to safeguard sensitive information. In an era where data breaches are increasingly common and costly, maintaining stringent data privacy protocols is not just a regulatory requirement but a business imperative.

Cybersecurity threats are another significant concern for fintech firms. Regular security assessments, the development of comprehensive incident response plans, and investments in state-of-the-art security technologies are critical to mitigating these risks. Given the increasing sophistication of cyber-attacks, staying one step ahead is a constant challenge and necessity for fintech companies. Protecting customer data and financial information from cyber threats requires a proactive and multifaceted approach to cybersecurity.

Third-party risk management is equally important. Fintech firms often rely on third-party vendors for various services, which introduces additional risks. Conducting thorough due diligence, establishing clear service level agreements, and continuously monitoring vendor performance are essential steps to managing these risks effectively. A lapse in a third party’s compliance can directly impact the fintech firm, making stringent oversight and continuous evaluation crucial. Addressing these multi-faceted challenges is vital for fintech companies to maintain their reputation, earn consumer trust, and ensure long-term success.

Integrating Compliance into Product Development

Fintech companies can achieve a balance between innovation and compliance by integrating regulatory considerations into the product development process from the outset. Involving compliance experts in the early stages of product development ensures that new products meet regulatory standards from the very beginning, thus avoiding costly adjustments later. This proactive approach can save time and resources in the long run and can foster a culture of compliance within the organization, making it a fundamental aspect of the product development lifecycle.

Regular training on compliance for product teams is also crucial. When product developers understand the regulatory landscape, they are better equipped to design solutions that comply with laws and regulations. Feedback mechanisms between product and compliance teams can further enhance this process, allowing for continuous improvements. This ongoing dialogue ensures that compliance becomes an integral part of the innovation, rather than an afterthought addressed post-development.

Successful fintech firms like Affirm and Gusto exemplify the benefits of this approach. By integrating compliance early in the development process, conducting regular audits, and proactively collaborating with regulators, these companies have managed to innovate while maintaining regulatory adherence. Their success stories highlight that compliance need not be a barrier to innovation but rather an enabler that drives responsible and sustainable growth.

Advanced Compliance Technologies

Technology offers a myriad of solutions to help fintech firms manage compliance effectively. Data integration technologies ensure seamless and accurate data flow from multiple sources, facilitating compliance reporting and risk management. Automated reporting tools can greatly reduce the effort and errors associated with manual reporting processes, allowing compliance teams to focus on higher-value tasks. These technological solutions help fintech firms stay nimble and responsive in a dynamic regulatory environment.

Real-time monitoring tools are also invaluable for quickly identifying suspicious activities and ensuring ongoing compliance. These technologies enable fintech firms to respond swiftly to potential issues, minimizing risks, and maintaining regulatory standards. By incorporating advanced analytics and AI-driven insights, firms can enhance their ability to detect anomalies and ensure compliance on a continuous basis.

Automation and solid data governance frameworks play a crucial role in enhancing compliance. Automation streamlines workflows, reduces human error, and improves cost efficiency, while robust data governance ensures the secure management of sensitive information, supported by regular audits and continuous staff training. These technologies collectively empower fintech firms to not only meet current regulatory requirements but to also scale efficiently as regulations evolve and new challenges emerge.

Global Perspectives on Fintech Regulations

The fintech industry is thriving, offering limitless opportunities for innovation. However, this rapid growth brings with it considerable regulatory challenges. Fintech companies are tasked with finding the sweet spot between pushing the envelope of financial technology and complying with strict regulatory standards. Achieving this balance is crucial for long-term growth and maintaining consumer trust.

This article delves into a variety of strategies and viewpoints on how fintech firms can effectively manage this equilibrium. Regulatory compliance isn’t just a legal hurdle; it’s essential for protecting consumers and building credibility in the marketplace. On the other hand, innovation drives the industry forward, enabling new solutions that can transform financial services.

To successfully navigate both realms, fintech companies can adopt several approaches. Collaboration with regulatory bodies can help firms understand and influence new regulations. Investing in compliance technology can streamline processes and ensure adherence to laws. Additionally, maintaining transparency with consumers about data usage and security measures can build trust and loyalty.

By focusing on these strategies, fintech companies can continue to innovate while upholding the regulatory requirements necessary for sustaining their growth and reputation. This balanced approach not only fosters innovation but also ensures that consumer interests are safeguarded, creating a robust and trustworthy fintech environment.