Central Asia’s Financial Battleground: Setting the Stage

Kazakhstan, a pivotal economic hub in Central Asia, is grappling with a staggering challenge: a shadow economy that undermines its financial stability and global reputation. With illicit activities ranging from money laundering to unauthorized cryptocurrency operations, the nation has launched an unprecedented crackdown, aiming to reduce the shadow economy to just 15% of GDP by year-end. This market analysis delves into the implications of Kazakhstan’s aggressive measures against financial crime, exploring how these efforts are reshaping the financial services sector, cryptocurrency markets, and broader economic transparency. The significance of this campaign lies not only in its domestic impact but also in its potential to influence regional markets and set a precedent for emerging economies facing similar threats.

Dissecting Market Trends in Kazakhstan’s Financial Landscape

Unregulated Crypto Platforms: A Market Under Siege

Kazakhstan’s cryptocurrency market has faced intense scrutiny as authorities shut down 130 unauthorized exchanges, seizing digital assets valued at $16.7 million (€14.4 million). These platforms, often linked to money laundering schemes involving drug trafficking and online fraud, operated across borders, impacting markets in Russia, Ukraine, and Moldova. The crackdown highlights a critical market trend: the vulnerability of unregulated digital asset spaces to criminal exploitation, which erodes investor confidence and stifles legitimate innovation. By enforcing strict licensing through the Astana Financial Services Authority (AFSA), with only 27 Digital Asset Service Providers (DASPs)—including 12 crypto exchanges—currently compliant, Kazakhstan is steering the market toward a regulated framework. This shift, while disruptive to illicit players, promises long-term stability but raises questions about balancing growth with stringent oversight in a rapidly evolving sector.

The ripple effects of these closures are reshaping market dynamics for digital assets in the region. Licensed platforms now face heightened demand to meet rigorous anti-money laundering (AML) and cybersecurity standards, potentially increasing operational costs. Meanwhile, investors and businesses must navigate a shrinking pool of service providers, which could limit access to crypto markets in the short term. Projections suggest that sustained enforcement will deter illicit activity, but market participants fear that overregulation might push legitimate operations underground or to less stringent jurisdictions, a trend worth monitoring over the next few years.

Cash Transactions: Persistent Challenges in a Digital Era

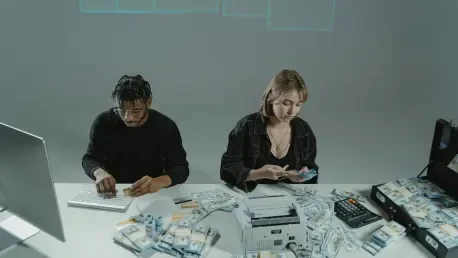

Despite Kazakhstan’s advanced digital payment infrastructure—where QR codes dominate even small transactions—cash remains a cornerstone of the shadow economy, posing a persistent challenge to market transparency. The Kazakh Agency for Financial Monitoring (AFM) uncovered 81 clandestine groups converting illicit funds into cash, with transactions surpassing €38.5 million, while cash withdrawals spiked to €21 billion this year. This trend underscores a paradox in the financial services market: digitalization has not fully displaced cash-based anonymity, which continues to facilitate illicit dealings. New measures, such as mandatory identification for cash deposits over 500,000 tenge (€802) and extended ATM video retention, aim to curb these vulnerabilities, but their impact on consumer behavior and banking operations remains uncertain.

Looking ahead, the potential integration of biometric verification systems, such as facial or fingerprint recognition, could redefine market norms by eliminating anonymous transactions. However, these innovations may strain smaller financial institutions lacking the resources to adopt advanced technologies, potentially widening the gap between major banks and regional players. Market forecasts indicate that while these controls could reduce illicit cash flows by a notable margin over the next two years, privacy concerns and implementation costs might slow adoption, creating a fragmented response across the sector.

Broader Financial Violations: Sector-Wide Ramifications

Beyond crypto and cash, Kazakhstan’s crackdown targets a spectrum of financial violations impacting diverse market segments. Authorities dismantled 18 illegal facilities producing tobacco and alcohol, intercepted €27 million in unlawfully exported petroleum products, and seized €19 million in banned vapes, alongside closing 62 underground gambling operations. These actions reveal a pervasive shadow economy infiltrating multiple industries, from consumer goods to energy, distorting fair competition and market pricing. Additionally, the deregistration of 3,600 shell companies involved in €450 million worth of fictitious transactions exposes systemic weaknesses in corporate governance, directly affecting investor trust and tax revenue streams.

The market implications of these enforcement efforts are multifaceted, influencing both domestic businesses and international stakeholders. Sectors like energy and retail face short-term disruptions as illegal operations are dismantled, potentially leading to supply chain adjustments and price volatility. Over the longer term, however, enhanced transparency could attract foreign investment by signaling a commitment to a cleaner business environment. Analysts predict that sustained efforts to eliminate shell entities and illicit trade will bolster market integrity, though cross-border collusion remains a hurdle that could temper progress unless regional cooperation strengthens.

Projecting Kazakhstan’s Financial Market Evolution

As Kazakhstan intensifies its regulatory grip, the financial market is poised for significant transformation driven by technology and policy alignment. Emerging trends point to the adoption of biometric systems and advanced monitoring tools as key mechanisms to eradicate transactional anonymity, fundamentally altering how financial services operate. Stricter licensing for digital platforms and harmonization with global AML standards are expected to fortify defenses against cross-border crime, positioning Kazakhstan as a potential leader in regional financial security. Projections indicate that investments in technology, coupled with partnerships among government, banks, and fintech entities, will be critical to outpacing adaptive criminal networks over the next several years.

Market challenges, however, loom large on the horizon. The rapid pace of regulatory change risks alienating smaller market players unable to comply with new standards, potentially consolidating power among larger institutions. Furthermore, the global nature of financial crime suggests that domestic measures alone may fall short without robust international frameworks. Forecasts for the coming years anticipate a gradual reduction in shadow economy activities, but the success of these initiatives hinges on balancing innovation with enforcement—a delicate equilibrium that will shape market confidence and economic growth in the region.

Reflecting on Kazakhstan’s Financial Reforms

Looking back, Kazakhstan’s comprehensive campaign against financial crime marked a pivotal moment for its market landscape, addressing deep-seated issues from unauthorized crypto exchanges to cash anonymity and widespread illicit operations. The closure of rogue platforms, alongside measures to curb anonymous transactions, tackled immediate threats to economic transparency, while actions against shell companies and illegal industries laid the groundwork for systemic change. These efforts underscored the intricate links between domestic policies and global criminal networks, revealing the scale of the challenge faced.

Moving forward, the strategic focus shifted toward actionable solutions and sustained progress. Strengthening international partnerships emerged as a critical step to combat cross-border crime, while continued investment in technological tools like biometric verification offered a path to long-term security. For market participants, adapting to regulatory shifts through compliance and innovation became essential to thriving in this evolving environment. Kazakhstan’s journey provided valuable lessons for other emerging markets, highlighting that resilience and collaboration were key to transforming financial systems for the better.