In the fast-paced world of digital finance, where transactions cross borders in an instant, the frameworks designed to prevent illicit activities serve as the bedrock of trust and stability, and a failure in this critical infrastructure can lead to severe regulatory consequences. This reality was starkly highlighted as Luxembourg’s financial regulator, the Commission de Surveillance du Secteur Financier (CSSF), imposed a significant €185,000 fine on Rakuten Europe Bank. The penalty, representing approximately one percent of the bank’s 2022 annual turnover, was not for an isolated incident but for what the regulator described as significant and persistent weaknesses in its anti-money laundering (AML) controls. The decision followed a comprehensive on-site inspection conducted in 2023, which unearthed a troubling history of systemic and long-standing compliance failures that had gone unaddressed for years, painting a picture of a financial institution struggling to meet its most fundamental regulatory obligations.

Systemic Flaws in a Critical Defense System

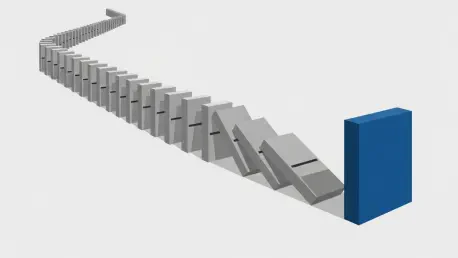

At the heart of the CSSF’s findings was the critical inadequacy of the bank’s transaction monitoring system, a cornerstone of any modern AML program designed to detect and flag suspicious financial behavior. The investigation revealed that the system was operating on an unsupported version of its software, a significant vulnerability in itself. Compounding this issue, the monitoring scenarios programmed into the system were outdated and lacked the necessary complexity to identify sophisticated money laundering techniques. This technological neglect was severely exacerbated by a critical loss of institutional knowledge following the departure of key personnel in both the IT and compliance departments. Without the requisite expertise to manage and update the platform, the system was left improperly configured. This cascade of failures resulted in a substantial and unmanageable backlog in the processing of transaction alerts, effectively neutralizing the bank’s first line of defense against financial crime and leaving it dangerously exposed to illicit fund flows.

A Pattern of Negligence and Non-Compliance

The deficiencies identified by the regulator extended far beyond technical shortcomings, pointing to a broader culture of negligence in the bank’s reporting duties and due diligence processes. Rakuten Europe Bank was found to have repeatedly failed in its legal obligation to report suspicious activities in a timely manner, submitting numerous reports to Luxembourg’s Financial Intelligence Unit weeks after the mandated deadlines had passed. In one particularly alarming instance, the bank completely failed to file a report on a customer who had previously been subjected to terrorism-related asset freezes in France, a severe lapse that occurred despite the presence of clear and undeniable indicators of risk. Furthermore, the CSSF identified profound weaknesses in the bank’s simplified due diligence procedures. The customer risk assessments were deemed inadequate, specifically for failing to properly consider and weigh the risk factors associated with the country of residence of beneficial owners, a fundamental aspect of understanding a customer’s risk profile and potential for involvement in illicit finance.

The Inevitable Consequence of Prolonged Inaction

A central and damning theme of the regulator’s report was that these critical failures were not recent developments but rather the culmination of a multi-year pattern of unaddressed non-compliance. The CSSF explicitly noted that another European supervisory authority had already identified and communicated similar shortcomings to Rakuten Europe Bank back in 2019 and 2020. Despite these early warnings, the bank failed to implement complete and adequate corrective measures in the intervening years, allowing the identified weaknesses to fester and grow more severe. The regulator observed that meaningful remedial actions to overhaul the deficient systems and procedures only commenced during and after its 2023 on-site inspection, suggesting that external regulatory pressure was the sole catalyst for change. In response to the findings, a spokesperson for Rakuten confirmed that the bank accepts both the findings and the sanction, publicly acknowledging its failures and committing to implementing all necessary measures to finally achieve full compliance with its AML obligations.

A Costly Reckoning and a Path to Remediation

The enforcement action by the CSSF represented more than just a financial penalty; it marked a definitive and public reckoning for Rakuten Europe Bank’s prolonged regulatory inaction. The bank’s acceptance of the fine and its commitment to overhaul its compliance framework signaled the start of a difficult but necessary journey to rebuild its internal controls and, more importantly, restore the trust of regulators. The incident served as a powerful cautionary tale for the wider financial industry, particularly within the rapidly evolving fintech sector, underscoring that growth and innovation cannot come at the expense of fundamental compliance obligations. The path forward for the bank involved not only a significant investment in technology and personnel but also a fundamental shift in its corporate culture towards one that prioritizes proactive risk management. This process, initiated under the direct scrutiny of financial supervisors, was a costly lesson in the non-negotiable importance of maintaining a robust and effective defense against the persistent threat of financial crime.