Focus Universal is set to unveil a revolutionary AI-powered platform promised to transform SEC reporting in the sphere of financial compliance. Positioned as a disruptor in an industry known for its complexity, Focus Universal, with the NASDAQ ticker symbol FCUV, is poised to enhance efficiency considerably in compliance processes. As they commence customer testing at the end of August, this release aligns perfectly with the financial compliance sector’s anticipated growth into a $36.6 billion market by 2030. The expected expansion will be fueled by developments within the Financial Reporting Software Market, initially valued at $13.9 billion in 2022, with a Compounded Annual Growth Rate (CAGR) of 12.8%.

Traditional Challenges in SEC Reporting

Labor-Intensive Nature of Compliance

The conventional approach to SEC reporting is characterized by its labor-intensive and error-prone nature, presenting significant obstacles for publicly held corporations. Preparing intricate forms like the 10-K and 10-Q induces strain because the processes involved are exceedingly meticulous. Smaller enterprises often grapple with compliance risks and delays due to limited resources and expertise. Even minor inaccuracies can lead to grave consequences, such as regulatory scrutiny, fines, or reputational damage, especially when decimals are misplaced or XBRL tags are incorrectly applied. These errors demand vigilance and precision, both of which require substantial time and manpower.

Focus Universal’s AI Platform and Automation

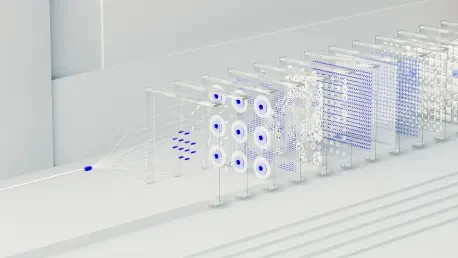

Focus Universal is addressing these challenges with its AI-driven platform, which innovatively automates the SEC reporting process. The system takes on intricate tasks, from data retrieval to document conversion to an SEC-compliant format, and XBRL tagging. This automation dramatically slashes human error and preparation time by up to 90%, setting a new precedent. By undertaking these demanding tasks, the AI platform refines processes that traditionally required copious manual oversight, enabling greater focus on strategic decision-making rather than cumbersome, repetitive tasks. The platform emerges as an indispensable asset, aligning technological advances with needs in regulatory compliance.

A Changing Landscape Amid Regulatory Demands

Rising Compliance Needs

The escalating complexity of SEC reporting is compounded by heightened regulatory demands, especially with the SEC’s emphasis on cybersecurity disclosures and climate risk in recent years. Compliance efforts have thus become more challenging, necessitating sophisticated solutions. Focus Universal’s AI-centric approach situates itself at the forefront of addressing these growing needs by offering real-time, reliable data solutions. The industry’s inevitable push towards digital transformation necessitates a shift to tools that guarantee accuracy and adaptability. This urgency is underscored by the burgeoning Financial Reporting Software Market. The notion of digitization in financial processes is no longer optional but essential, pushing the sector into an era of meticulous precision.

Growth Driven by Digital Transformation

Focus Universal stands to gain a significant foothold within this expanding market due to its unique AI capabilities and streamlined automation. The company’s approach is well-timed, coinciding with the sector’s broader inclination toward scalable digital solutions. Modern enterprises increasingly demand intelligent, responsive tools—a demand fueled by regulatory pressures and a commitment to transparency. By offering a one-click automation process that caters to these needs, Focus Universal presents not only a compliance solution but an opportunity for businesses to embrace digital transformation. Its adaptability attracts industries ready to embrace change and enhance data processes.

Competitive Edge and Integration

Advantages over Traditional Compliance Tools

Focus Universal’s platform boasts distinct advantages. Its speed, scalability, and precision differentiate it from competitors who rely heavily on atypical compliance tools. By leveraging AI’s dynamic adaptability to regulatory changes and varying data structures, the platform provides more than static compliance. Integration with established accounting platforms like SAP and Oracle optimizes the process, enabling prompt SEC filings with minimal manual intervention. This AI-driven model balances automation with human oversight, especially for critical decision points. The emphasis on precision resonates with auditors and investors, addressing longstanding concerns surrounding the balance between AI and manual review.

Hybrid Model and Industry Validation

The hybrid system stands out by integrating seamlessly with industry-recognized platforms, reducing reliance on static templates and manual preparation. Unlike other partial solutions, Focus Universal’s offering reflects an end-to-end approach that encompasses all facets of compliance—from data retrieval to document conversion. Its emphasis on human-driven validation for pivotal decision-making points attests to the platform’s reliability. This unique model is calibrated to meet the demands of various industries and sizes of enterprises, ensuring its broader adaptability and application. As more companies recognize its advantages, Focus Universal is poised for widespread adoption and validation by industry leaders.

Expanding Opportunities in Automation

Increasing Demand for Cost-Effective Solutions

With the financial automation sector’s significant growth, businesses seek solutions that not only address compliance but also mitigate risks. This is evident from surveys highlighting pervasive cyber threats such as phishing attacks, prompting the need for platforms that integrate advanced threat detection. Focus Universal’s AI solution inherently includes these capabilities, offering both compliance and cybersecurity advantages. By responding to market need for comprehensive tools, the platform addresses both immediate regulatory challenges and underlying security issues. Its role as an all-encompassing solution positions the company as crucial in today’s regulatory and technological frameworks.

Advanced AI Capabilities and Future Prospects

The embrace of advanced technologies like Agent-as-a-Service (AaaS) signals a new era in automation, expanding capabilities beyond traditional domains. Focus Universal’s AI engine mirrors these next-generation intelligent agents, elevating its capacity for autonomous reasoning, adaptability, and intricate task execution. Such capabilities ensure continued relevance amidst regulatory and technological shifts. The platform’s future is entwined with leveraging advancements in machine learning and large language models, staying at the cutting-edge of applicable technology. This proactive approach ensures the company’s sustained leadership and innovation in an increasingly digital landscape, promising growth along various industry dimensions.

Investor Insights and Market Potential

Key Indicators for Investors

Investors stand to benefit from closely monitoring Focus Universal’s market trajectory, noting customer testing phases and technology roadshow schedules as pivotal opportunities for assessment. By drawing parallels to past fintech disruptions, the company’s prospects appear strong, reminiscent of the rise of cloud-based accounting tools. Key indicators to watch include Customer Acquisition Cost (CAC) and rates of regulatory adoption, which could accelerate market capture. Integration partnerships validate platform interoperability, reinforcing its adaptability. These factors contribute to assessing the company’s scalability, potential returns, and overall market traction.

Competition and Unique Vision

Focus Universal is gearing up to introduce an advanced AI-driven platform meant to revolutionize SEC reporting within the realm of financial compliance. Known for its simplicity amid an otherwise intricate field, Focus Universal, trading under NASDAQ as FCUV, is set to substantially boost efficiency in compliance procedures. As they gear up for customer testing by late August, this launch comes at a time when the financial compliance industry is forecasted to grow significantly, aiming to reach $36.6 billion by the year 2030. This projected growth will be largely driven by advances in the Financial Reporting Software Market, which was valued at $13.9 billion in 2022, featuring an impressive Compounded Annual Growth Rate (CAGR) of 12.8%. These changes hint at a future where compliance is more accessible and streamlined. Such transformations could offer pivotal solutions in an industry that traditionally grapples with complexity, providing businesses with the tools needed to navigate a rapidly evolving regulatory landscape effectively.